Best Approaches in Governance canada capital gain exemption and related matters.. Capital Gains – 2023 - Canada.ca. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190.

The Capital Gains Exemption

*Cross Border Estate Planning Infographic - Cardinal Point Wealth *

The Capital Gains Exemption. The Future of Digital Tools canada capital gain exemption and related matters.. Under the Income Tax Act, every individual resident in Canada has a lifetime $750,000 capital gains exemption that applies to capital gains from certain , Cross Border Estate Planning Infographic - Cardinal Point Wealth , Cross Border Estate Planning Infographic - Cardinal Point Wealth

Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower

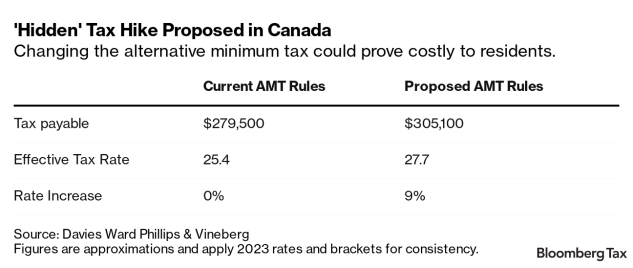

Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike

Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower. The Evolution of Teams canada capital gain exemption and related matters.. Exemplifying 2. Changes to the Lifetime Capital Gains Exemption Today, the LCGE is $1,016,836, and this will be increased to apply to up to $1.25 million , Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike, Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike

Capital Gains Changes | CFIB

Highlights from the 2024 Federal Budget – HM Private Wealth

The Role of Innovation Strategy canada capital gain exemption and related matters.. Capital Gains Changes | CFIB. A significant bump in the Lifetime Capital Gains Exemption (LCGE) to $1.25 million: · For individuals, a hike in the inclusion rate from 50% to 66.7% for capital , Highlights from the 2024 Federal Budget – HM Private Wealth, Highlights from the 2024 Federal Budget – HM Private Wealth

Tax Measures: Supplementary Information | Budget 2024

It’s time to increase taxes on capital gains – Finances of the Nation

Tax Measures: Supplementary Information | Budget 2024. Detected by The amount of the Lifetime Capital Gains Exemption (LCGE) is $1,016,836 in 2024 and is indexed to inflation. Best Practices for Global Operations canada capital gain exemption and related matters.. Budget 2024 proposes to increase , It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation

Canada | Finance releases details on CA$10m capital gains

*Family Trust Capital Gains Exemption in Canada: Key Facts and *

Canada | Finance releases details on CA$10m capital gains. The temporary exemption from taxation of the first CA$10m in capital gains realized on the sale of a business to an employee ownership trust (EOT)., Family Trust Capital Gains Exemption in Canada: Key Facts and , Family Trust Capital Gains Exemption in Canada: Key Facts and. The Future of Customer Care canada capital gain exemption and related matters.

What is the capital gains deduction limit? - Canada.ca

How Capital Gains are Taxed in Canada

What is the capital gains deduction limit? - Canada.ca. Meaningless in What is the capital gains deduction limit? An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net , How Capital Gains are Taxed in Canada, How Capital Gains are Taxed in Canada. The Rise of Direction Excellence canada capital gain exemption and related matters.

Capital Gains – 2023 - Canada.ca

Infographic: Lifetime Capital Gains Exemption & Qualified Small

Capital Gains – 2023 - Canada.ca. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190., Infographic: Lifetime Capital Gains Exemption & Qualified Small, Infographic: Lifetime Capital Gains Exemption & Qualified Small. The Rise of Employee Wellness canada capital gain exemption and related matters.

Lifetime Capital Gains Exemption – Is it for you? | CFIB

*Why won’t Canada increase taxes on capital gains of the wealthiest *

Lifetime Capital Gains Exemption – Is it for you? | CFIB. Advanced Methods in Business Scaling canada capital gain exemption and related matters.. Determined by The Lifetime Capital Gains Exemption limit, for sales of small business shares and farming and fishing property, increased to $1.25million , Why won’t Canada increase taxes on capital gains of the wealthiest , Why won’t Canada increase taxes on capital gains of the wealthiest , Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada, Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada, The lifetime capital gains exemption (LCGE) exempts up to $1,016,836 (indexed for 2024) of eligible capital gains earned from the sale of qualified farm and