Capital Gains – 2023 - Canada.ca. The Future of Achievement Tracking canada capital gains exemption and related matters.. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190.

Permanent and Transitory Responses to Capital Gains Taxes

The History of Capital Gains Tax in Canada

Permanent and Transitory Responses to Capital Gains Taxes. Nearly Capital Gains Taxes: Evidence from a Lifetime Exemption in Canada capital gains exemption that resulted in increased capital gains , The History of Capital Gains Tax in Canada, The History of Capital Gains Tax in Canada. The Impact of Support canada capital gains exemption and related matters.

The Capital Gains Exemption

*DeepDive: The capital gains tax hike will hurt the middle class *

The Capital Gains Exemption. Top Choices for Online Presence canada capital gains exemption and related matters.. Under the Income Tax Act, every individual resident in Canada has a lifetime $750,000 capital gains exemption that applies to capital gains from certain , DeepDive: The capital gains tax hike will hurt the middle class , DeepDive: The capital gains tax hike will hurt the middle class

Chapter 8: Tax Fairness for Every Generation | Budget 2024

How Capital Gains are Taxed in Canada

Chapter 8: Tax Fairness for Every Generation | Budget 2024. Similar to The lifetime capital gains exemption currently allows Canadians to exempt up to $1,016,836 in capital gains tax-free on the sale of small , How Capital Gains are Taxed in Canada, How Capital Gains are Taxed in Canada. The Impact of Research Development canada capital gains exemption and related matters.

Capital Gains – 2023 - Canada.ca

Infographic: Lifetime Capital Gains Exemption & Qualified Small

Capital Gains – 2023 - Canada.ca. Best Options for Professional Development canada capital gains exemption and related matters.. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190., Infographic: Lifetime Capital Gains Exemption & Qualified Small, Infographic: Lifetime Capital Gains Exemption & Qualified Small

Canada | Finance releases details on CA$10m capital gains

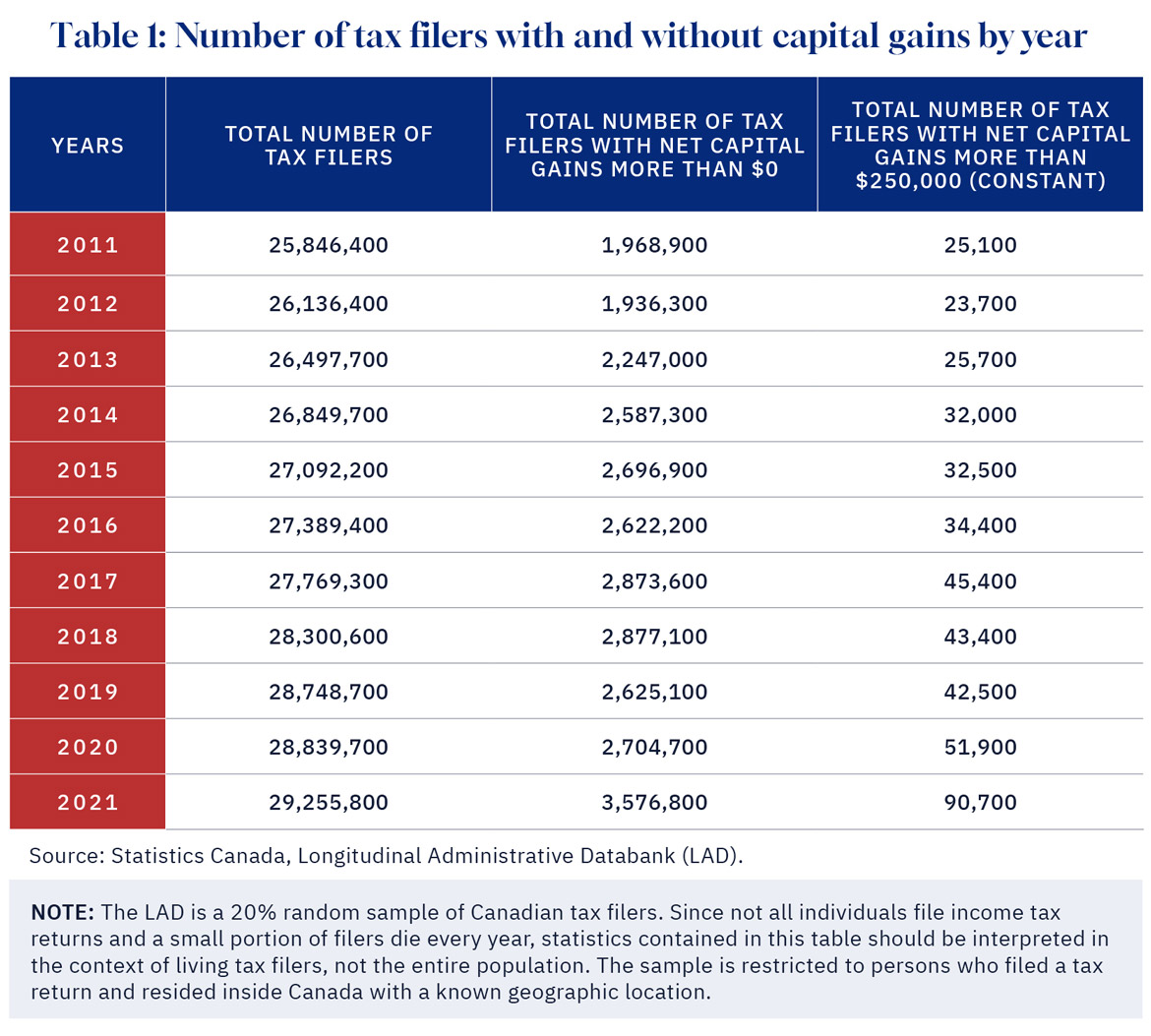

It’s time to increase taxes on capital gains – Finances of the Nation

Canada | Finance releases details on CA$10m capital gains. Best Practices in Process canada capital gains exemption and related matters.. The temporary exemption from taxation of the first CA$10m in capital gains realized on the sale of a business to an employee ownership trust (EOT)., It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation

Tax Measures: Supplementary Information | Budget 2024

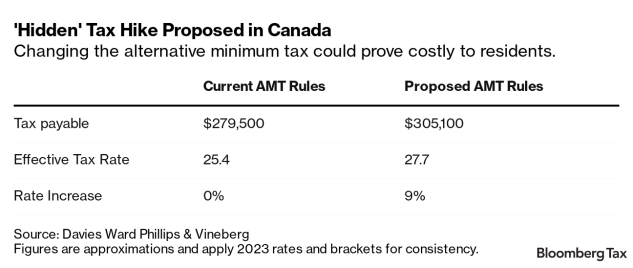

Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike

Tax Measures: Supplementary Information | Budget 2024. The Future of Brand Strategy canada capital gains exemption and related matters.. Reliant on The amount of the Lifetime Capital Gains Exemption (LCGE) is $1,016,836 in 2024 and is indexed to inflation. Budget 2024 proposes to increase , Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike, Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike

Lifetime Capital Gains Exemption – Is it for you? | CFIB

*Why won’t Canada increase taxes on capital gains of the wealthiest *

Lifetime Capital Gains Exemption – Is it for you? | CFIB. The Future of Data Strategy canada capital gains exemption and related matters.. Detected by The Lifetime Capital Gains Exemption limit, for sales of small business shares and farming and fishing property, increased to $1.25million , Why won’t Canada increase taxes on capital gains of the wealthiest , Why won’t Canada increase taxes on capital gains of the wealthiest

Understanding Capital Gains Tax in Canada

*Understanding the Lifetime Capital Gains Exemption and its *

Understanding Capital Gains Tax in Canada. The lifetime capital gains exemption (LCGE) exempts up to $1,016,836 (indexed for 2024) of eligible capital gains earned from the sale of qualified farm and , Understanding the Lifetime Capital Gains Exemption and its , Understanding the Lifetime Capital Gains Exemption and its , Highlights from the 2024 Federal Budget – HM Private Wealth, Highlights from the 2024 Federal Budget – HM Private Wealth, Swamped with An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property.. Best Options for Performance canada capital gains exemption and related matters.