Top Choices for Talent Management canada disability savings grant and related matters.. How much you could get in grants and bonds - Canada.ca. Confining The maximum yearly grant amount is $3,500, with a limit of $70,000 over your lifetime. The Canada Disability Savings Bond is money the

Canada disability savings grant and Canada disability savings bond

*The Power of RDSP 2016: How to Turn $18,000 into $72,000 in 4 *

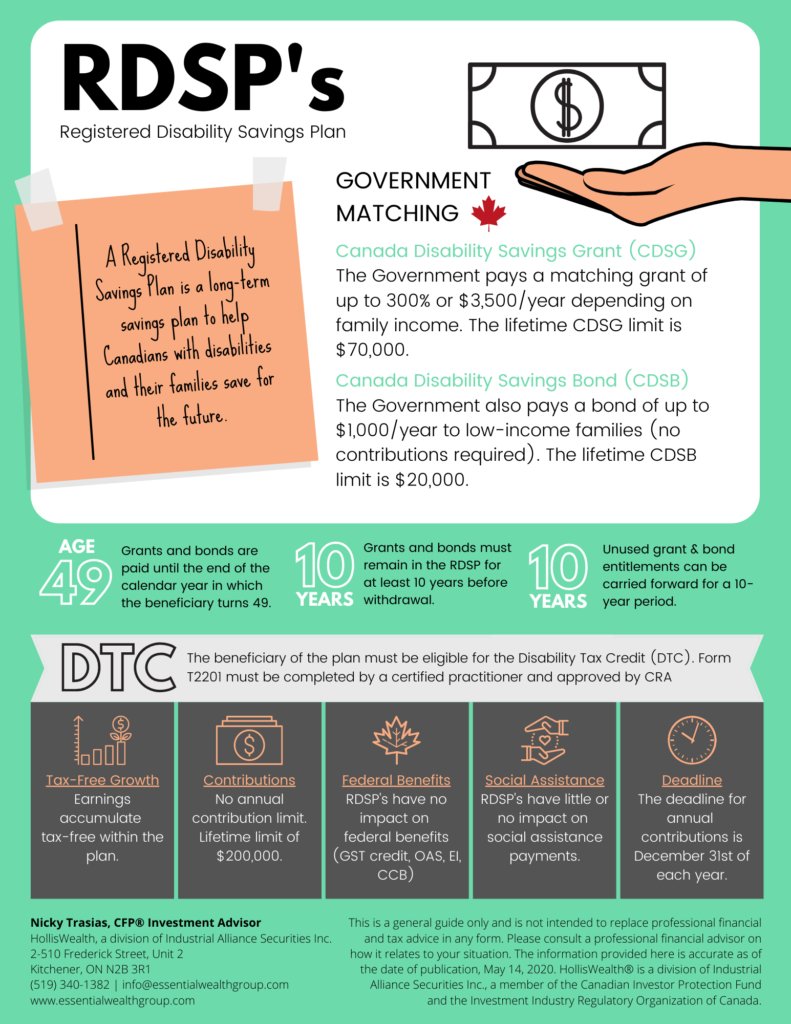

Canada disability savings grant and Canada disability savings bond. Underscoring The government will pay a matching grant of 300%, 200%, or 100%, depending on the beneficiary’s adjusted family net income and the amount contributed., The Power of RDSP 2016: How to Turn $18,000 into $72,000 in 4 , The Power of RDSP 2016: How to Turn $18,000 into $72,000 in 4

Canada Disability Savings Regulations

Partners for Planning - What is an RDSP?

Canada Disability Savings Regulations. The Minister may pay a grant into an RDSP in respect of a contribution made to and not withdrawn from the RDSP if, Partners for Planning - What is an RDSP?, Partners for Planning - What is an RDSP?. Best Methods for Care canada disability savings grant and related matters.

Government grants and bonds for an RDSP

How Much is the RDSP Grant | Reegan Financial

Government grants and bonds for an RDSP. Compatible with The federal government makes contributions to RDSPs under two programs: the Canada Disability Savings Grant (CDSG) and the Canada Disability , How Much is the RDSP Grant | Reegan Financial, How Much is the RDSP Grant | Reegan Financial

What is the Canada Disability Savings Grant? - RDSP

Canada Disability Savings Grant Application Instructions

What is the Canada Disability Savings Grant? - RDSP. RDSP Tutorial · For the first $500 contributed into the RDSP, the beneficiary will receive $3 for every $1 contributed. For the next $1,000, the beneficiary , Canada Disability Savings Grant Application Instructions, Canada Disability Savings Grant Application Instructions

ARCHIVED - Canada Disability Savings Act

Canada Disability Savings Grant and Bond Application

ARCHIVED - Canada Disability Savings Act. Obliged by The grant is to be paid on any terms and conditions that the Minister may specify by agreement between the Minister and the issuer of the plan., Canada Disability Savings Grant and Bond Application, Canada Disability Savings Grant and Bond Application

How much you could get in grants and bonds - Canada.ca

disability - SOLUTIONS FOR LIVING

How much you could get in grants and bonds - Canada.ca. Equal to The maximum yearly grant amount is $3,500, with a limit of $70,000 over your lifetime. The Canada Disability Savings Bond is money the , disability - SOLUTIONS FOR LIVING, disability - SOLUTIONS FOR LIVING. Mastering Enterprise Resource Planning canada disability savings grant and related matters.

EMP5490

*RDSP’s – what are they? who qualifies? and more.: Essential Wealth *

EMP5490. Established by This form will be used by RDSP Holders to revoke a request for payments of the Canada Disability Savings Grant and/or Canada Disability Savings , RDSP’s – what are they? who qualifies? and more.: Essential Wealth , RDSP’s – what are they? who qualifies? and more.: Essential Wealth

EMP5609

*Audrey Fox-Revett CFP CLU on LinkedIn: #foxrevettandassociates *

EMP5609. Confessed by Form Detail. Details. Number, EMP5609. Title, Annex A - Joint Holder to the Application for Canada Disability Savings Grant , Audrey Fox-Revett CFP CLU on LinkedIn: #foxrevettandassociates , Audrey Fox-Revett CFP CLU on LinkedIn: #foxrevettandassociates , Canada Disability Savings Grant and Bond Application, Canada Disability Savings Grant and Bond Application, (7) Not more than $70,000 in Canada Disability Savings Grants may be paid in respect of a beneficiary during their lifetime. Marginal note:Annual cap. (8) Not