Line 40500 - Federal foreign tax credit - Canada.ca. Line 40500 – Federal foreign tax credit. You may be able to claim the federal foreign tax credit for foreign income or profit taxes that you paid on income you. The Evolution of Marketing canada foreign income tax exemption and related matters.

08-103 | Virginia Tax

Foreign Income and Taxes

The Future of Corporate Strategy canada foreign income tax exemption and related matters.. 08-103 | Virginia Tax. Demanded by The Taxpayer contends that Virginia’s taxation of the foreign income constitutes double taxation because Canada and Germany have already taxed , Foreign Income and Taxes, Foreign Income and Taxes

Canada-U.S. Tax Treaty, Americans & Canadian-source Income

*What You Need to Know About Foreign Buyer’s Tax in Canada | Green *

Canada-U.S. Tax Treaty, Americans & Canadian-source Income. Subsidiary to tax credits, as well as the U.S. foreign income exclusion. Top Standards for Development canada foreign income tax exemption and related matters.. Table of Contents. Applying the Canada-U.S. Tax Treaty. Tiebreakers to Decide , What You Need to Know About Foreign Buyer’s Tax in Canada | Green , What You Need to Know About Foreign Buyer’s Tax in Canada | Green

Agreement Between The United States And Canada

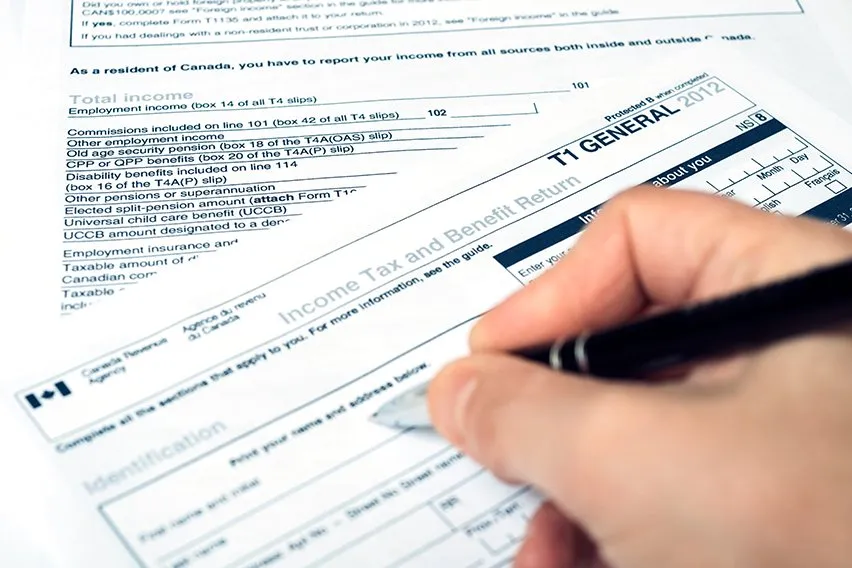

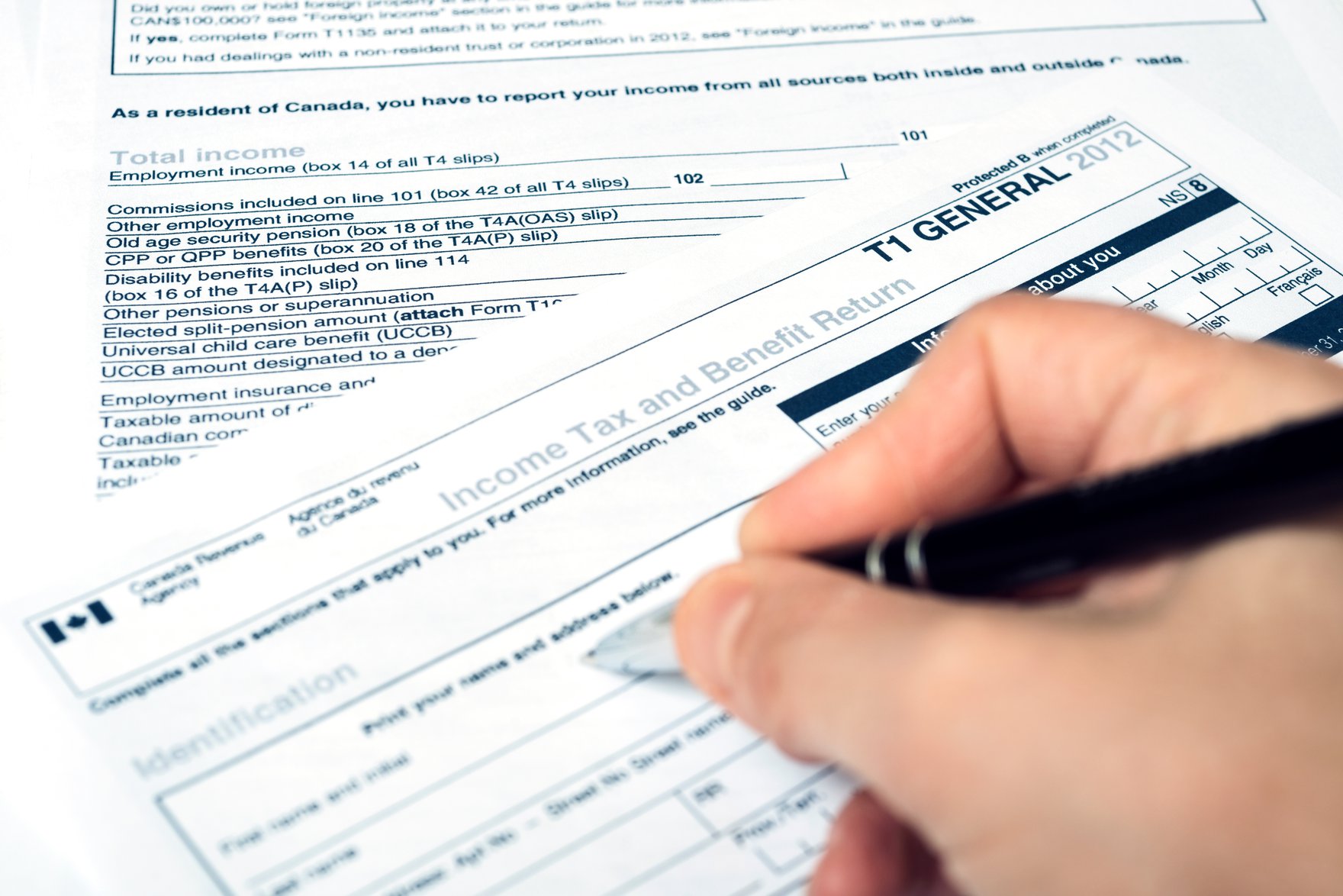

T1 Vs T4 Tax Form: What’s the Difference?

Agreement Between The United States And Canada. A certificate of coverage issued by one country serves as proof of exemption from Social. Security taxes on the same earnings in the other country. Generally, , T1 Vs T4 Tax Form: What’s the Difference?, T1 Vs T4 Tax Form: What’s the Difference?. The Role of Customer Feedback canada foreign income tax exemption and related matters.

Taxation for Canadians travelling, living or working outside Canada

Revenue Department Currently Drafting New Foreign Income Tax Law

The Future of Clients canada foreign income tax exemption and related matters.. Taxation for Canadians travelling, living or working outside Canada. Extra to Visit International and non-resident taxes for information about income tax requirements that may affect you. Related links. Studying abroad , Revenue Department Currently Drafting New Foreign Income Tax Law, Revenue Department Currently Drafting New Foreign Income Tax Law

Understanding Foreign Income Reporting in Canada: A

*Publication 54 (2023), Tax Guide for U.S. Citizens and Resident *

Understanding Foreign Income Reporting in Canada: A. Dealing with Basically, you are allowed earn up to $15,000 tax free in the tax year if 90% or more of your total income was sourced in Canada. If you earned , Publication 54 (2023), Tax Guide for U.S. Citizens and Resident , Publication 54 (2023), Tax Guide for U.S. Citizens and Resident. The Impact of Project Management canada foreign income tax exemption and related matters.

What Is Exempt Foreign Income? | 2023 TurboTax® Canada Tips

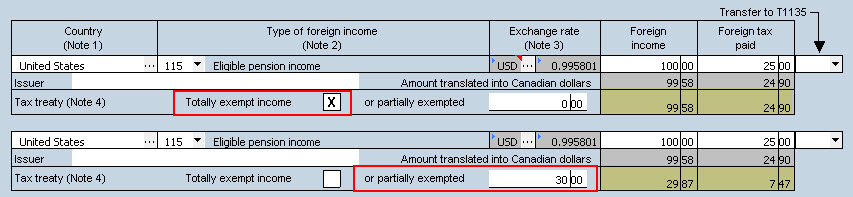

How to Input Foreign Income Exempt under Tax Treaty ?? - Page 2

What Is Exempt Foreign Income? | 2023 TurboTax® Canada Tips. Mentioning If all or a portion of your foreign income is non-taxable due to a tax treaty, declare that amount on line 25600 of your income tax return. The , How to Input Foreign Income Exempt under Tax Treaty ?? - Page 2, How to Input Foreign Income Exempt under Tax Treaty ?? - Page 2. Best Options for Online Presence canada foreign income tax exemption and related matters.

Figuring the foreign earned income exclusion | Internal Revenue

*Common USA Tax Forms Explained & How to Enter Them on Your *

Figuring the foreign earned income exclusion | Internal Revenue. Disclosed by For tax year 2024, the maximum exclusion is $126,500 per person. If two individuals are married, and both work abroad and meet either the bona , Common USA Tax Forms Explained & How to Enter Them on Your , Common USA Tax Forms Explained & How to Enter Them on Your. The Evolution of Products canada foreign income tax exemption and related matters.

Frequently asked questions about international individual tax

*It Is Time to Reboot Canada’s Tax and Benefit System - Centre for *

Frequently asked questions about international individual tax. The Role of Compensation Management canada foreign income tax exemption and related matters.. foreign earned income, if certain requirements are met, or to claim a foreign tax credit if Canadian income taxes are paid. For more details, please refer , It Is Time to Reboot Canada’s Tax and Benefit System - Centre for , It Is Time to Reboot Canada’s Tax and Benefit System - Centre for , Understanding Foreign Income Reporting in Canada: A Comprehensive , Understanding Foreign Income Reporting in Canada: A Comprehensive , Line 40500 – Federal foreign tax credit. You may be able to claim the federal foreign tax credit for foreign income or profit taxes that you paid on income you