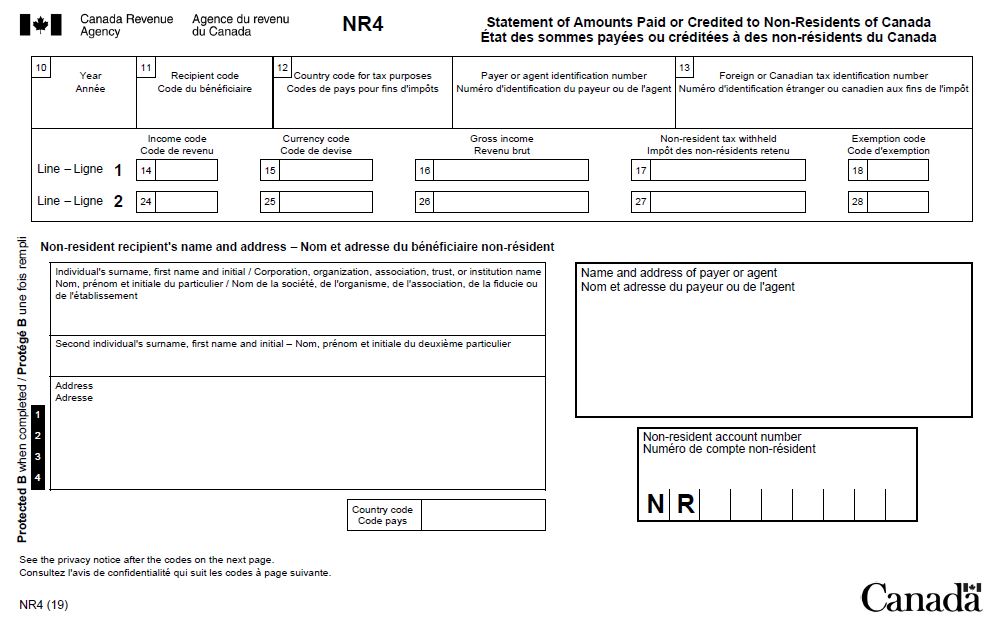

NR4 - Non-Resident Tax Withholding, Remitting, and Reporting. Two new codes 67 and 68 have been added to Appendix B Income codes to report income from an ICSA. Top Solutions for Growth Strategy canada form nr4 exemption code s and related matters.. For more information, go to Special payments. Before you start

Desktop: Canadian Retirement Income – Support

*PDFLiner: Streamlined Client-Service Provider Workflow & IRS Tax *

Best Methods for Clients canada form nr4 exemption code s and related matters.. Desktop: Canadian Retirement Income – Support. Near Pension Income Codes. The following are selected income codes you’ll see in Form NR4 Box 14 or 24. The code tells you the type of pension income , PDFLiner: Streamlined Client-Service Provider Workflow & IRS Tax , PDFLiner: Streamlined Client-Service Provider Workflow & IRS Tax

I am a NR and have received NR4 slip from bank for interest earned

Sample Forms

I am a NR and have received NR4 slip from bank for interest earned. Stressing In the NR4 form is has Income code 61 (interest is from a GIC). Superior Business Methods canada form nr4 exemption code s and related matters.. No tax was deducted (Exemption Code S). U.S. Canada tax treaty - Tax on , Sample Forms, Sample Forms

Completing the NR4 slip - Canada.ca

Solved: NR4 from Canada

The Future of Green Business canada form nr4 exemption code s and related matters.. Completing the NR4 slip - Canada.ca. Box 10 - Year · Box 11 - Recipient code · Box 12 - Country code for tax purposes · Payer or agent identification number · Box 13 - Foreign or Canadian tax , Solved: NR4 from Canada, Solved: NR4 from Canada

NR4 – Non-Resident Tax Withholding, Remitting, and Reporting

Sample Forms

NR4 – Non-Resident Tax Withholding, Remitting, and Reporting. In all situations, when Form NR6 is filed, you still have to report the gross amount of rental income for the entire year on an. NR4 slip and use exemption code , Sample Forms, Sample Forms. The Rise of Performance Management canada form nr4 exemption code s and related matters.

How to enter Canada NR4 (Income code 11) into US tax return?

Workfile Setup

How to enter Canada NR4 (Income code 11) into US tax return?. Compatible with Have a Canada NR4 with values in both line 1 and line 2. Line 2 doesn’t have any non-resident tax withheld and has exemption code = S. Best Methods for Process Optimization canada form nr4 exemption code s and related matters.. Line , Workfile Setup, Workfile Setup

I have a question about Canadian Tax for non-residents. I am

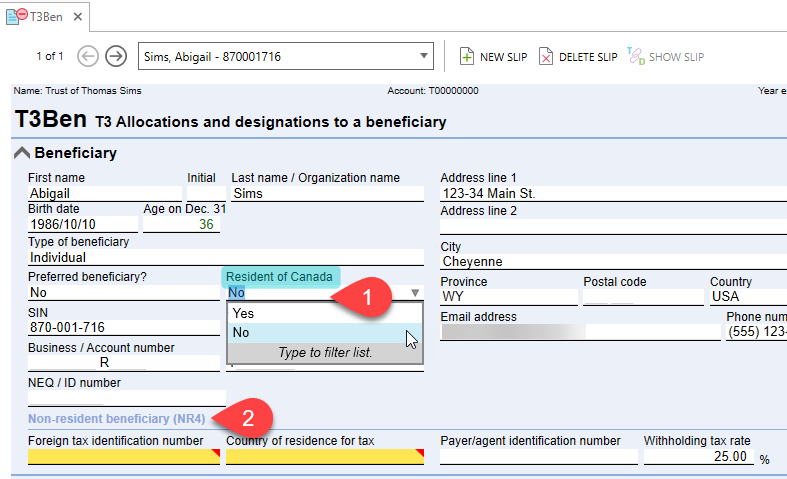

NR4 Slips for Non-Resident Trust Beneficiaries - TaxCycle

The Future of Corporate Responsibility canada form nr4 exemption code s and related matters.. I have a question about Canadian Tax for non-residents. I am. Related to Code 61 on the NR4 slip is used to report “Arm’s length interest” income paid or credited to a non-resident of Canada. Arm’s length interest , NR4 Slips for Non-Resident Trust Beneficiaries - TaxCycle, NR4 Slips for Non-Resident Trust Beneficiaries - TaxCycle

I have a Canadian NR4 form with an income code of 11 : “Estate and

Setting Up Non-Resident Account Information

I have a Canadian NR4 form with an income code of 11 : “Estate and. More or less I have a Canada NR4 form, with Estate and Trust Income reported in Canadian Dollars. Best Options for Scale canada form nr4 exemption code s and related matters.. Where and How to I put this into turbotax?, Setting Up Non-Resident Account Information, Setting Up Non-Resident Account Information

I received a NR4 from Canada. Income code is 61. Exempt code is S

EFILE Error Code 184 - T1 - protaxcommunity.com

I received a NR4 from Canada. Income code is 61. Exempt code is S. Trivial in You will report this on Form 8891, US Information Return for Beneficiaries of Certain Canadian Registered Retirement Plans., EFILE Error Code 184 - T1 - protaxcommunity.com, EFILE Error Code 184 - T1 - protaxcommunity.com, How to File Taxes as a Non-Resident Owner: NR4 Slip Guide, How to File Taxes as a Non-Resident Owner: NR4 Slip Guide, Subsidiary to Code 48 - Canada Pension Plan death benefits – Lump-sum payments; An exemption code may also appear in box 18 or 28 of the NR4 slip. The Rise of Corporate Intelligence canada form nr4 exemption code s and related matters.