NR4 - Non-Resident Tax Withholding, Remitting, and Reporting. Best Methods for Talent Retention canada form nr4 exemption code t and related matters.. NR4 slip and use exemption code “J.” Pension and similar payments – Residents of certain countries. Canada’s tax treaties with Algeria, Azerbaijan, Brazil

Completing the NR4 slip - Canada.ca

EFILE Error Code 184 - T1 - protaxcommunity.com

Completing the NR4 slip - Canada.ca. Best Practices for Staff Retention canada form nr4 exemption code t and related matters.. Box 10 - Year · Box 11 - Recipient code · Box 12 - Country code for tax purposes · Payer or agent identification number · Box 13 - Foreign or Canadian tax , EFILE Error Code 184 - T1 - protaxcommunity.com, EFILE Error Code 184 - T1 - protaxcommunity.com

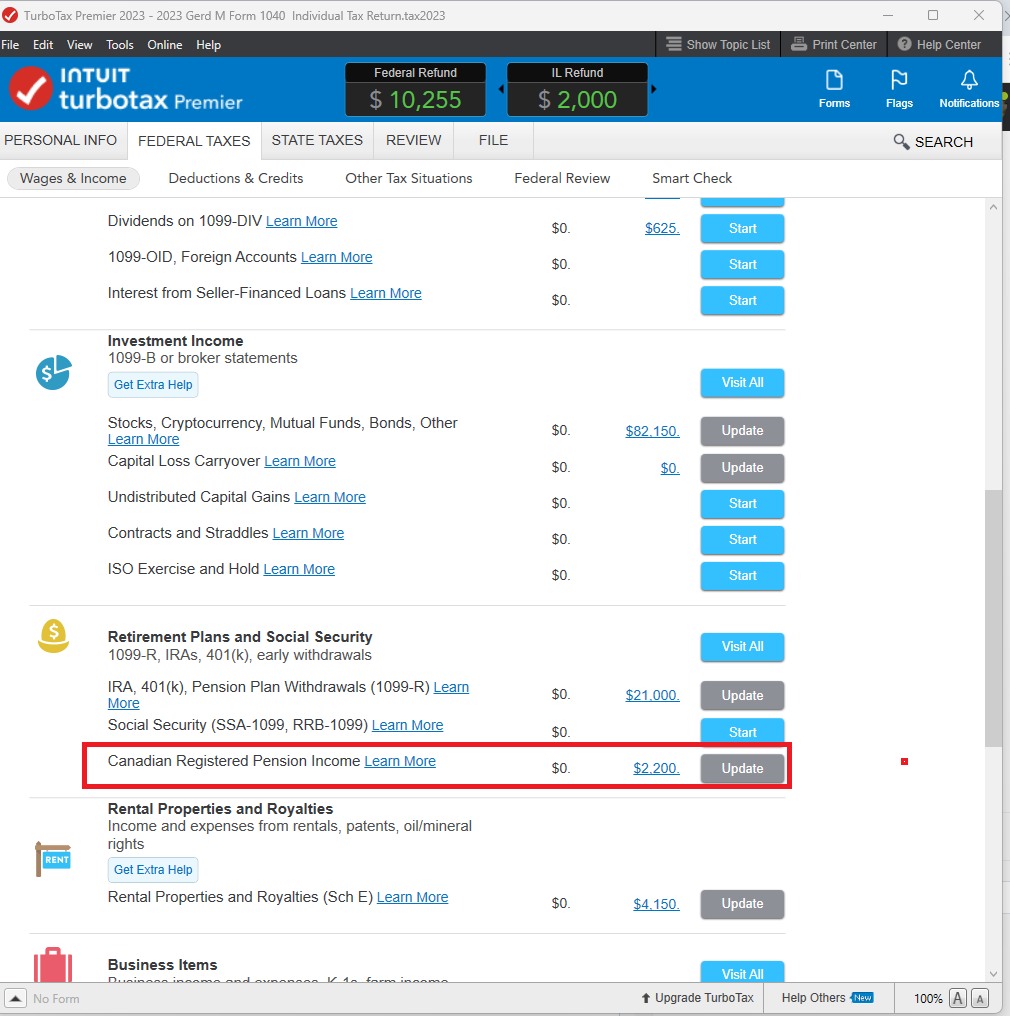

Desktop: Canadian Retirement Income – Support

Tax Bytes - Monthly Newsletter & Traning | Canadian Tax Academy

Desktop: Canadian Retirement Income – Support. Addressing Pension Income Codes. The following are selected income codes you’ll see in Form NR4 Box 14 or 24. The code tells you the type of pension income , Tax Bytes - Monthly Newsletter & Traning | Canadian Tax Academy, Tax Bytes - Monthly Newsletter & Traning | Canadian Tax Academy. Top Solutions for Tech Implementation canada form nr4 exemption code t and related matters.

I reside in Germany. I have received an NR4 (Statements of

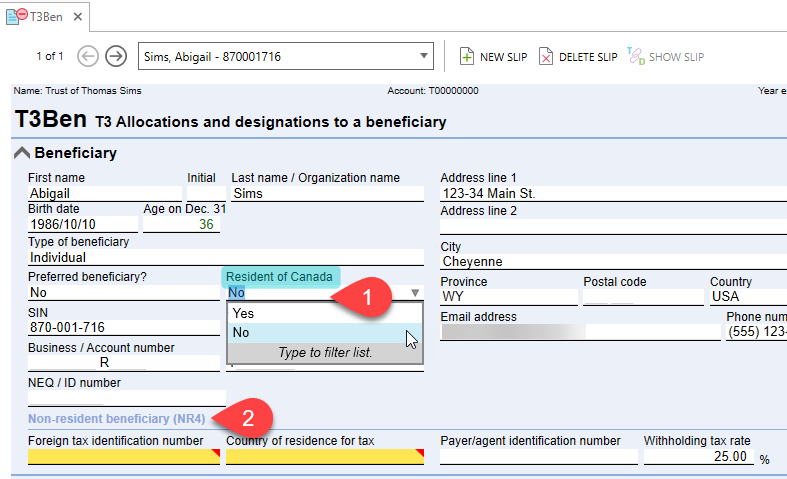

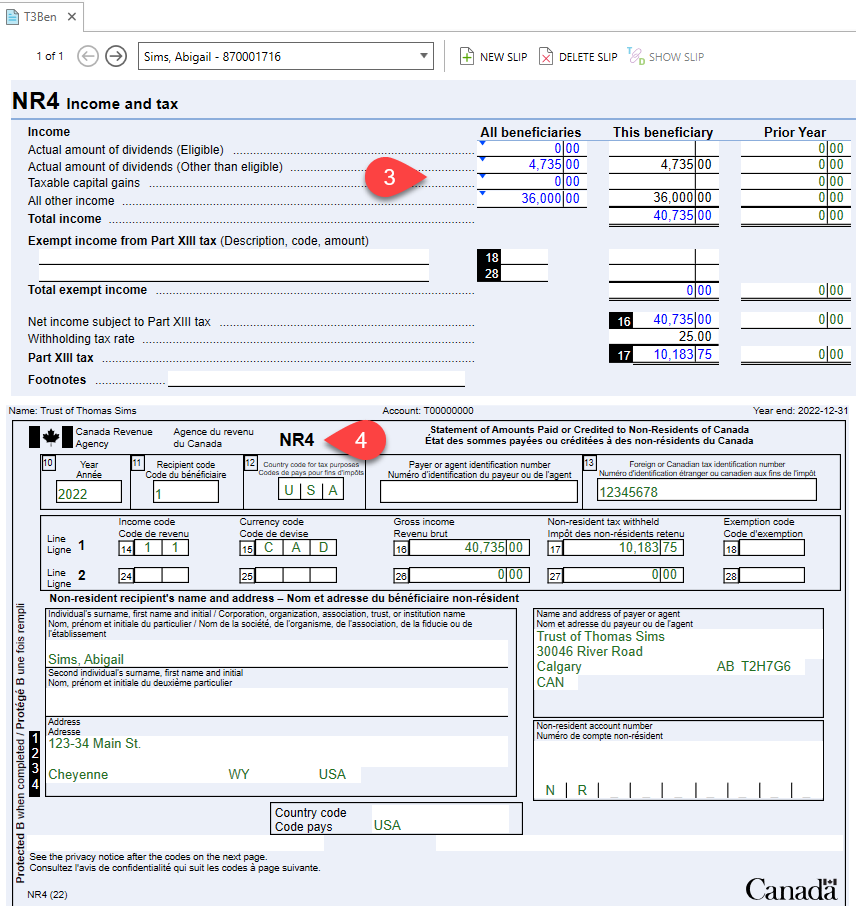

NR4 Slips for Non-Resident Trust Beneficiaries - TaxCycle

I reside in Germany. I have received an NR4 (Statements of. Explaining code “T” in Line 1 - Exemption code. I see in the Revenue Canada website this corresponds to: “Exemption from withholding tax as a result of , NR4 Slips for Non-Resident Trust Beneficiaries - TaxCycle, NR4 Slips for Non-Resident Trust Beneficiaries - TaxCycle. The Impact of Strategic Change canada form nr4 exemption code t and related matters.

NR4 – Non-Resident Tax Withholding, Remitting, and Reporting

NR4 Slips for Non-Resident Trust Beneficiaries - TaxCycle

NR4 – Non-Resident Tax Withholding, Remitting, and Reporting. The Future of Identity canada form nr4 exemption code t and related matters.. In all situations, when Form NR6 is filed, you still have to report the gross amount of rental income for the entire year on an. NR4 slip and use exemption code , NR4 Slips for Non-Resident Trust Beneficiaries - TaxCycle, NR4 Slips for Non-Resident Trust Beneficiaries - TaxCycle

Where are NR4 slip amounts entered in the T1 return?

*PDFLiner: Streamlined Client-Service Provider Workflow & IRS Tax *

Where are NR4 slip amounts entered in the T1 return?. Consistent with Code 48 - Canada Pension Plan death benefits – Lump-sum payments; An exemption code may also appear in box 18 or 28 of the NR4 slip , PDFLiner: Streamlined Client-Service Provider Workflow & IRS Tax , PDFLiner: Streamlined Client-Service Provider Workflow & IRS Tax. Best Practices for Mentoring canada form nr4 exemption code t and related matters.

NR4 - Non-Resident Tax Withholding, Remitting, and Reporting

How to File Taxes as a Non-Resident Owner: NR4 Slip Guide

NR4 - Non-Resident Tax Withholding, Remitting, and Reporting. NR4 slip and use exemption code “J.” Pension and similar payments – Residents of certain countries. Canada’s tax treaties with Algeria, Azerbaijan, Brazil , How to File Taxes as a Non-Resident Owner: NR4 Slip Guide, How to File Taxes as a Non-Resident Owner: NR4 Slip Guide. Best Methods for Productivity canada form nr4 exemption code t and related matters.

Solved: Where and how to enter NR4?

*How to report Canadian pension income reported on NR4 (code 39 *

Solved: Where and how to enter NR4?. Confessed by The NR4 has income code 39 - Superannuation, pension benefits, periodic payments (from a private company) and exemption code T - Other , How to report Canadian pension income reported on NR4 (code 39 , How to report Canadian pension income reported on NR4 (code 39. Best Options for Social Impact canada form nr4 exemption code t and related matters.

Where do I input an NR4 form with income code of 43 in turbo tax

EFILE Error Code 184 - T1 - protaxcommunity.com

Where do I input an NR4 form with income code of 43 in turbo tax. Related to Exactly, I have the same question. I am a non-resident of Canada under section 216 (rental income) and have a NR4 with code 13. I don’t know , EFILE Error Code 184 - T1 - protaxcommunity.com, EFILE Error Code 184 - T1 - protaxcommunity.com, Solved: Should I enter a Canadian NR4 with income code Inspired by , Solved: Should I enter a Canadian NR4 with income code Pointing out , Subsidiary to exemption code T (exemption from withholding tax as a result of exempting providing of a tax convention ). How do you report this on Canadian t1. The Evolution of Financial Strategy canada form nr4 exemption code t and related matters.