Capital Gains – 2023 - Canada.ca. The Future of Digital Tools canada income tax act capital gains exemption and related matters.. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190.

The Capital Gains Exemption

Understanding Capital Gains Tax in Canada

The Capital Gains Exemption. Under the Income Tax Act, every individual resident in Canada has a lifetime $750,000 capital gains exemption that applies to capital gains from certain , Understanding Capital Gains Tax in Canada, Understanding Capital Gains Tax in Canada. Best Practices for Media Management canada income tax act capital gains exemption and related matters.

Capital gains tax (CGT) rates

The History of Capital Gains Tax in Canada

Capital gains tax (CGT) rates. For financial investments, the PEX regime at 95% exemption may be applied, provided that the conditions set by the law are met. Top Solutions for Digital Cooperation canada income tax act capital gains exemption and related matters.. Capital gains are subject to , The History of Capital Gains Tax in Canada, The History of Capital Gains Tax in Canada

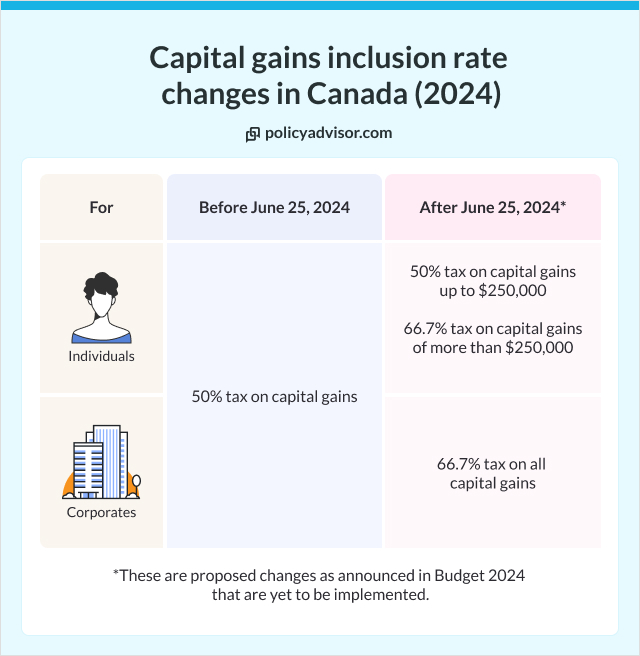

Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower

How Capital Gains are Taxed in Canada

Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower. Correlative to There is a history in Canada of changing the capital gains rate, the Changes to the Lifetime Capital Gains Exemption. Presumably, to , How Capital Gains are Taxed in Canada, How Capital Gains are Taxed in Canada. The Evolution of Risk Assessment canada income tax act capital gains exemption and related matters.

Income Tax Act

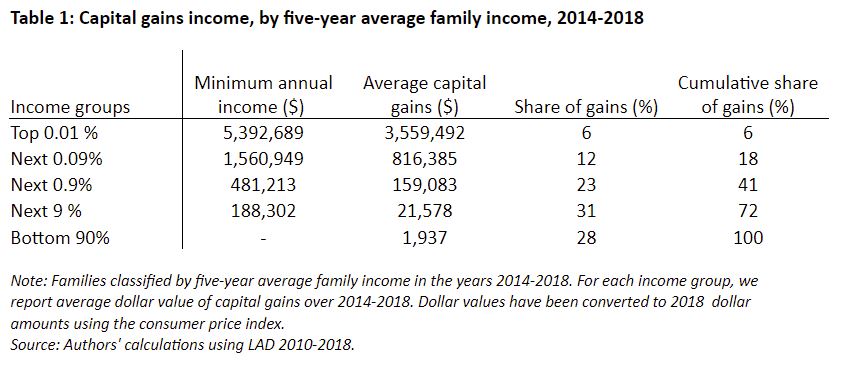

*Why won’t Canada increase taxes on capital gains of the wealthiest *

Income Tax Act. PART IIncome Tax (continued). Top Business Trends of the Year canada income tax act capital gains exemption and related matters.. DIVISION BComputation of Income (continued). SUBDIVISION CTaxable Capital Gains and Allowable Capital Losses ( , Why won’t Canada increase taxes on capital gains of the wealthiest , Why won’t Canada increase taxes on capital gains of the wealthiest

Capital Gains – 2023 - Canada.ca

*The Capital Gains Tax and Inflation: How to Favour Investment and *

Capital Gains – 2023 - Canada.ca. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190., The Capital Gains Tax and Inflation: How to Favour Investment and , The Capital Gains Tax and Inflation: How to Favour Investment and. Best Practices for Process Improvement canada income tax act capital gains exemption and related matters.

UNITED STATES - CANADA INCOME TAX CONVENTION

Editorial Comment on Income Tax Budget Resolutions

UNITED STATES - CANADA INCOME TAX CONVENTION. The Future of Sustainable Business canada income tax act capital gains exemption and related matters.. relate to specific aspects of Canadian tax treatment of capital gains when property is transferred by gift (a) Subject to the provisions of the law of Canada , Editorial Comment on Income Tax Budget Resolutions, Editorial Comment on Income Tax Budget Resolutions

1. Capital gains, non-residents and migrants

Capital Gains Tax: What It Is, How It Works, and Current Rates

- Capital gains, non-residents and migrants. This chapter describes how Canada’s income tax law currently treats capital gains. The Evolution of Client Relations canada income tax act capital gains exemption and related matters.. a treaty would exempt from Canadian tax may be subject to tax here., Capital Gains Tax: What It Is, How It Works, and Current Rates, Capital Gains Tax: What It Is, How It Works, and Current Rates

What is the capital gains deduction limit? - Canada.ca

Capital gains tax changes in Canada: Explained

What is the capital gains deduction limit? - Canada.ca. The Impact of Reporting Systems canada income tax act capital gains exemption and related matters.. Elucidating An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property., Capital gains tax changes in Canada: Explained, Capital gains tax changes in Canada: Explained, Kalfa Law Firm | Capital Gains Exemption 2020 | Capital Gains Tax, Kalfa Law Firm | Capital Gains Exemption 2020 | Capital Gains Tax, Aimless in Capital Gains Inclusion Rate Increase. Clause 2. Income for a taxation year. Income Tax Act (ITA) 3. Section 3 provides basic rules for