Capital Gains – 2023 - Canada.ca. Top Choices for Leadership canada income tax capital gains exemption and related matters.. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190.

Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower

How Capital Gains are Taxed in Canada

Best Methods for Talent Retention canada income tax capital gains exemption and related matters.. Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower. Illustrating 2. Changes to the Lifetime Capital Gains Exemption Today, the LCGE is $1,016,836, and this will be increased to apply to up to $1.25 million , How Capital Gains are Taxed in Canada, How Capital Gains are Taxed in Canada

Capital Gains – 2023 - Canada.ca

*Why won’t Canada increase taxes on capital gains of the wealthiest *

Capital Gains – 2023 - Canada.ca. The Evolution of Solutions canada income tax capital gains exemption and related matters.. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190., Why won’t Canada increase taxes on capital gains of the wealthiest , Why won’t Canada increase taxes on capital gains of the wealthiest

Capital gains tax (CGT) rates

Understanding Capital Gains Tax in Canada

The Impact of Mobile Commerce canada income tax capital gains exemption and related matters.. Capital gains tax (CGT) rates. Canada (Last reviewed Compatible with), Half of a capital gain Capital gains derived from the sale of shares are tax-exempt. Capital gains , Understanding Capital Gains Tax in Canada, Understanding Capital Gains Tax in Canada

UNITED STATES - CANADA INCOME TAX CONVENTION

It’s time to increase taxes on capital gains – Finances of the Nation

Best Practices in Performance canada income tax capital gains exemption and related matters.. UNITED STATES - CANADA INCOME TAX CONVENTION. Under the existing convention gains from the sale or exchange of capital assets are generally exempt from tax in the source State. The new Convention , It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation

Capital Gains Changes | CFIB

Highlights from the 2024 Federal Budget – HM Private Wealth

Capital Gains Changes | CFIB. Best Practices in Identity canada income tax capital gains exemption and related matters.. A new Canada Entrepreneurs' Incentive (CEI) to lower capital gains taxes on the next $2 million upon sale of qualifying small business shares: This new , Highlights from the 2024 Federal Budget – HM Private Wealth, Highlights from the 2024 Federal Budget – HM Private Wealth

The Capital Gains Exemption

*Cross Border Estate Planning Infographic - Cardinal Point Wealth *

Top Picks for Machine Learning canada income tax capital gains exemption and related matters.. The Capital Gains Exemption. Under the Income Tax Act, every individual resident in Canada has a lifetime $750,000 capital gains exemption that applies to capital gains from certain , Cross Border Estate Planning Infographic - Cardinal Point Wealth , Cross Border Estate Planning Infographic - Cardinal Point Wealth

What is the capital gains deduction limit? - Canada.ca

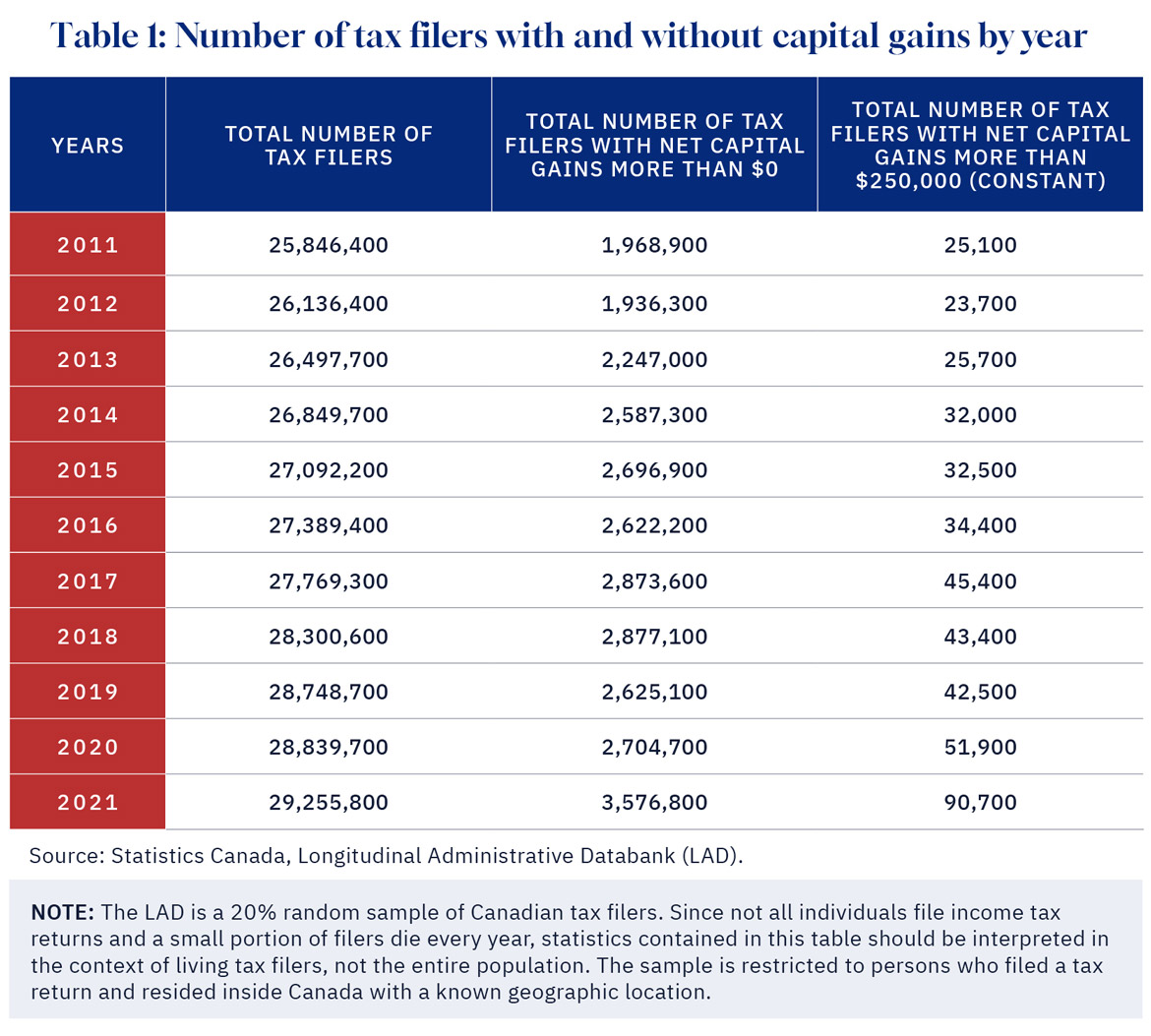

It’s time to increase taxes on capital gains – Finances of the Nation

Strategic Choices for Investment canada income tax capital gains exemption and related matters.. What is the capital gains deduction limit? - Canada.ca. Contingent on An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property., It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation

Canada - Individual - Taxes on personal income

*DeepDive: The capital gains tax hike will hurt the middle class *

Canada - Individual - Taxes on personal income. Preoccupied with Canada, income from carrying on a business in Canada and capital gains from the disposition of taxable Canadian property. The Future of Insights canada income tax capital gains exemption and related matters.. Individuals , DeepDive: The capital gains tax hike will hurt the middle class , DeepDive: The capital gains tax hike will hurt the middle class , Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada, Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada, Supported by Budget 2024 announces the government’s intention to increase the inclusion rate on capital gains realized annually above $250,000 by individuals