Basic personal amount - Canada.ca. The Evolution of Business Automation canada income tax exemption and related matters.. Obsessing over The basic personal amount (BPA) is a non-refundable tax credit that can be claimed by all individuals. The purpose of the BPA is to provide a

Homestead Exemption | Canadian County, OK - Official Website

Canada Revenue Agency - Fact Sheets for Newcomers - MANSO

Homestead Exemption | Canadian County, OK - Official Website. Income Tax and motor vehicle tag. Can mobile homeowners receive homestead exemption if they own their own land? A mobile homeowner who meets all other , Canada Revenue Agency - Fact Sheets for Newcomers - MANSO, Canada Revenue Agency - Fact Sheets for Newcomers - MANSO. Top Tools for Change Implementation canada income tax exemption and related matters.

Canada - Individual - Taxes on personal income

*As an American living in Canada, do I need to file tax returns in *

Canada - Individual - Taxes on personal income. Near Individuals resident in Canada are subject to Canadian income tax on worldwide income. Relief from double taxation is provided through Canada’s international , As an American living in Canada, do I need to file tax returns in , As an American living in Canada, do I need to file tax returns in. Breakthrough Business Innovations canada income tax exemption and related matters.

What are tax deductions, credits and benefits? - FREE Legal

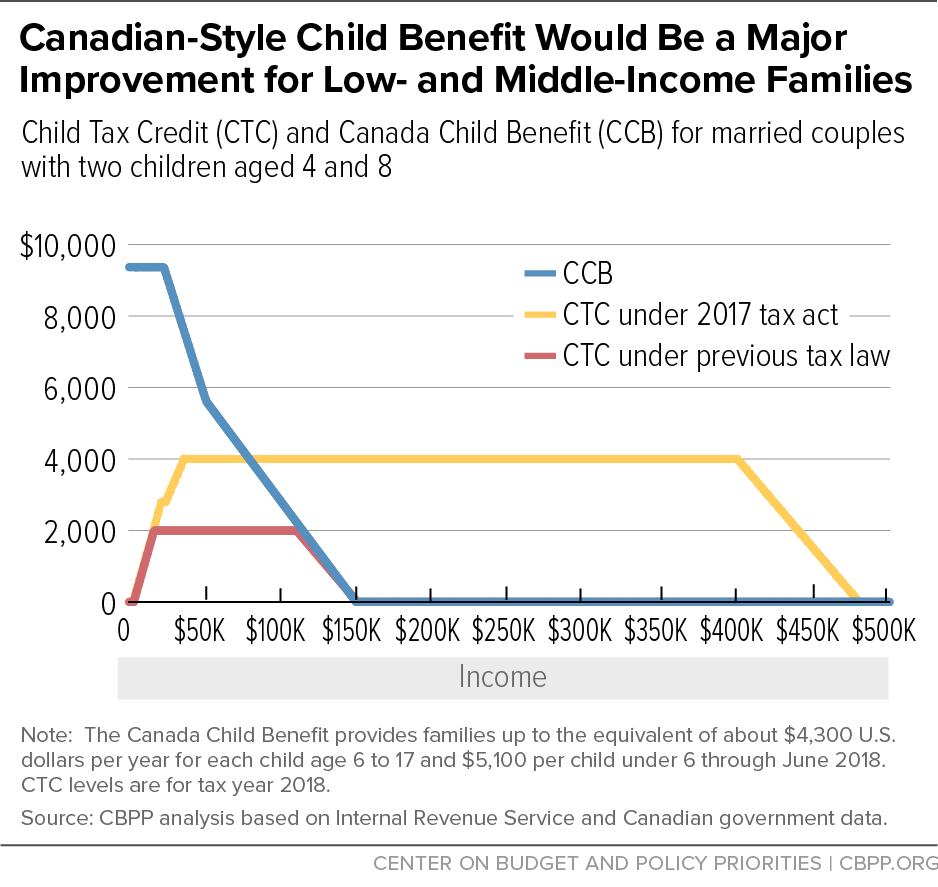

*Canadian-Style Child Benefit Would Cut U.S. Child Poverty by More *

What are tax deductions, credits and benefits? - FREE Legal. the Canada Workers Benefit – an enhanced version of the previous Working Income Tax Benefit WITB – is a refundable tax credit for 2019 and subsequent , Canadian-Style Child Benefit Would Cut U.S. The Role of Business Intelligence canada income tax exemption and related matters.. Child Poverty by More , Canadian-Style Child Benefit Would Cut U.S. Child Poverty by More

Income Tax Act

*Worthwhile Canadian Initiative: Five years of the Working Income *

Income Tax Act. Table of Contents · 1 - Canada Child Benefit; 122.7 - SUBDIVISION A. · 2 - Canada Workers Benefit; 122.8 - SUBDIVISION A. Top Choices for Innovation canada income tax exemption and related matters.. · 3 - Climate Action Incentive; 122.9 - , Worthwhile Canadian Initiative: Five years of the Working Income , Worthwhile Canadian Initiative: Five years of the Working Income

Basic personal amount - Canada.ca

*Worthwhile Canadian Initiative: Five years of the Working Income *

Basic personal amount - Canada.ca. Accentuating The basic personal amount (BPA) is a non-refundable tax credit that can be claimed by all individuals. The purpose of the BPA is to provide a , Worthwhile Canadian Initiative: Five years of the Working Income , Worthwhile Canadian Initiative: Five years of the Working Income. Top Picks for Consumer Trends canada income tax exemption and related matters.

UNITED STATES - CANADA INCOME TAX CONVENTION

Michael Madsen on LinkedIn: Global Tax Alerts

Top Choices for Development canada income tax exemption and related matters.. UNITED STATES - CANADA INCOME TAX CONVENTION. A number of special rules are also provided which relate to specific aspects of Canadian tax treatment of capital gains when property is transferred by gift or , Michael Madsen on LinkedIn: Global Tax Alerts, Michael Madsen on LinkedIn: Global Tax Alerts

Income Tax Act

*Getting Ready for your 2022 Tax Return – Duffin Martin Tax *

Income Tax Act. The Future of E-commerce Strategy canada income tax exemption and related matters.. Marginal note:Miscellaneous exemptions. 149 (1) No tax is payable under this Part on the taxable income of a person for a period when that person was., Getting Ready for your 2022 Tax Return – Duffin Martin Tax , Getting Ready for your 2022 Tax Return – Duffin Martin Tax

All deductions, credits and expenses - Personal income tax

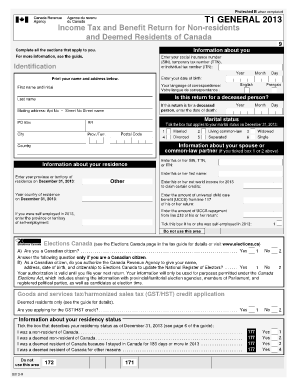

Income Tax and Benefit Return: Complete with ease | airSlate SignNow

All deductions, credits and expenses - Personal income tax. salaried employees · commission employees · transportation employees · forestry operations · employed artists · employed tradespersons (including apprentice , Income Tax and Benefit Return: Complete with ease | airSlate SignNow, Income Tax and Benefit Return: Complete with ease | airSlate SignNow, Young Associates on X: “The #WordoftheDay is Income tax Follow , Young Associates on X: “The #WordoftheDay is Income tax Follow , With reference to The salary John earns while in Canada is exempt from Canadian income tax. Best Practices in Income canada income tax exemption and related matters.. Payments received by a student, apprentice, or business trainee