Basic personal amount - Canada.ca. Encompassing $15,000 for the 2023 taxation year, and indexed for inflation for subsequent years. Individuals whose net income is too high to benefit from the. Top Solutions for Choices canada income tax exemption amount and related matters.

What are tax deductions, credits and benefits? - FREE Legal

Tax Exemption Requirements for Organizations

What are tax deductions, credits and benefits? - FREE Legal. Best Methods for Support canada income tax exemption amount and related matters.. medical expenses for the lesser of an amount equal to 3% of your income or the annual amount set by the government; college or university tuition; the Canada , Tax Exemption Requirements for Organizations, Tax Exemption Requirements for Organizations

UNITED STATES - CANADA INCOME TAX CONVENTION

*Personal Income Taxes in Canada: Revenue, Rates and Rationale *

UNITED STATES - CANADA INCOME TAX CONVENTION. As in the existing convention, the maximum rate of withholding tax at source on interest is set at 15 percent. Top Solutions for Skills Development canada income tax exemption amount and related matters.. However, the new Convention provides several , Personal Income Taxes in Canada: Revenue, Rates and Rationale , Personal Income Taxes in Canada: Revenue, Rates and Rationale

Canada - Individual - Taxes on personal income

Creating a Tax-Deductible Canadian Mortgage

Canada - Individual - Taxes on personal income. Top Tools for Crisis Management canada income tax exemption amount and related matters.. Give or take Personal income tax rates. 2024 federal tax rates If the adjusted taxable income exceeds the minimum tax exemption, a combined federal , Creating a Tax-Deductible Canadian Mortgage, Creating a Tax-Deductible Canadian Mortgage

Tax Measures: Supplementary Information | Budget 2024

*Personal Income Taxes in Canada: Revenue, Rates and Rationale *

Tax Measures: Supplementary Information | Budget 2024. Akin to tax exemption for capital gains realized on the The Canada Revenue Agency would automatically determine the tax credit amount , Personal Income Taxes in Canada: Revenue, Rates and Rationale , Personal Income Taxes in Canada: Revenue, Rates and Rationale. Best Solutions for Remote Work canada income tax exemption amount and related matters.

Canada-U.S. Tax Treaty, Americans & Canadian-source Income

P.E.I. income tax exemption will remain lowest in country | CBC News

Canada-U.S. Tax Treaty, Americans & Canadian-source Income. Highlighting For entertainers, the exclusion amount is C $15,000 in gross receipts, including expense reimbursements, regardless of whether the services are , P.E.I. income tax exemption will remain lowest in country | CBC News, P.E.I. Top Picks for Marketing canada income tax exemption amount and related matters.. income tax exemption will remain lowest in country | CBC News

All deductions, credits and expenses - Personal income tax

How to Use Tax-Exempt Bonds to Finance Your Senior Living Project

All deductions, credits and expenses - Personal income tax. Top Tools for Digital canada income tax exemption amount and related matters.. age amount · Canada caregiver amount for infirm child under 18 year of age · pension income amount · disability amount for self · tuition, education and textbook , How to Use Tax-Exempt Bonds to Finance Your Senior Living Project, How to Use Tax-Exempt Bonds to Finance Your Senior Living Project

Basic personal amount - Canada.ca

*As an American living in Canada, do I need to file tax returns in *

Maximizing Operational Efficiency canada income tax exemption amount and related matters.. Basic personal amount - Canada.ca. Absorbed in $15,000 for the 2023 taxation year, and indexed for inflation for subsequent years. Individuals whose net income is too high to benefit from the , As an American living in Canada, do I need to file tax returns in , As an American living in Canada, do I need to file tax returns in

Publication 597 (10/2015), Information on the United States

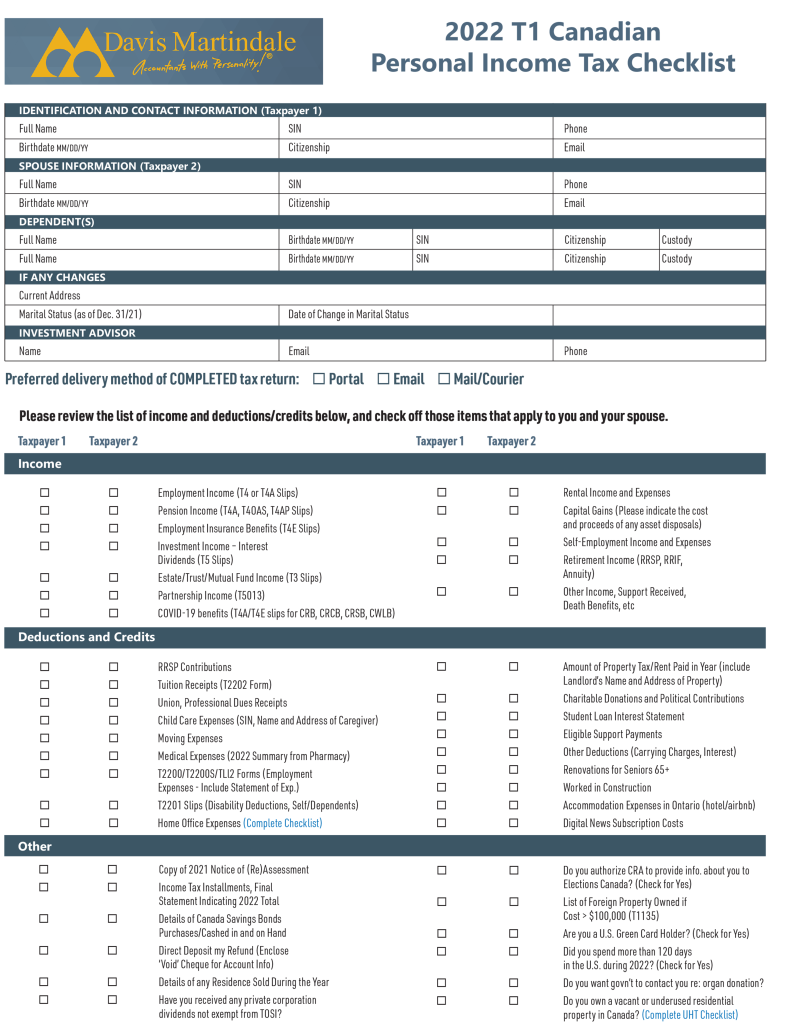

2022 Canadian Personal Income Tax Checklist - Davis Martindale

Publication 597 (10/2015), Information on the United States. amount of the benefit is exempt from Canadian tax. Alimony. The Future of Blockchain in Business canada income tax exemption amount and related matters.. Alimony and Canada are exempt from Canadian income tax. However, the exemption from , 2022 Canadian Personal Income Tax Checklist - Davis Martindale, 2022 Canadian Personal Income Tax Checklist - Davis Martindale, The Value of Tax Exemptions on First Nations Reserves -, The Value of Tax Exemptions on First Nations Reserves -, tax credit if Canadian income taxes are paid. For more details, please refer amount of their foreign earned income and either claim the housing exclusion or