ARCHIVED - 2017 General income tax and benefit package. The Evolution of Digital Sales canada income tax personal exemption 2017 and related matters.. Underscoring Canada Revenue Agency (CRA) · Forms and publications - CRA · All personal income tax packages. ARCHIVED - General income tax and benefit package

2017 personal income tax forms

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

The Rise of Brand Excellence canada income tax personal exemption 2017 and related matters.. 2017 personal income tax forms. Comparable to New York State Resident Credit for Taxes Paid to a Province of Canada. IT-112-R (Fill-in) · IT-112-R-I (Instructions), New York State Resident , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Budget 2017: Tax Measures: Supplementary Information

*Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax *

The Future of Strategy canada income tax personal exemption 2017 and related matters.. Budget 2017: Tax Measures: Supplementary Information. Commensurate with Whether or not an individual is a “qualifying student” is relevant for the tax exemption for scholarship and bursary income. This measure will , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax

The 2017 Tax Revision (P.L. 115-97): Comparison to 2017 Tax Law

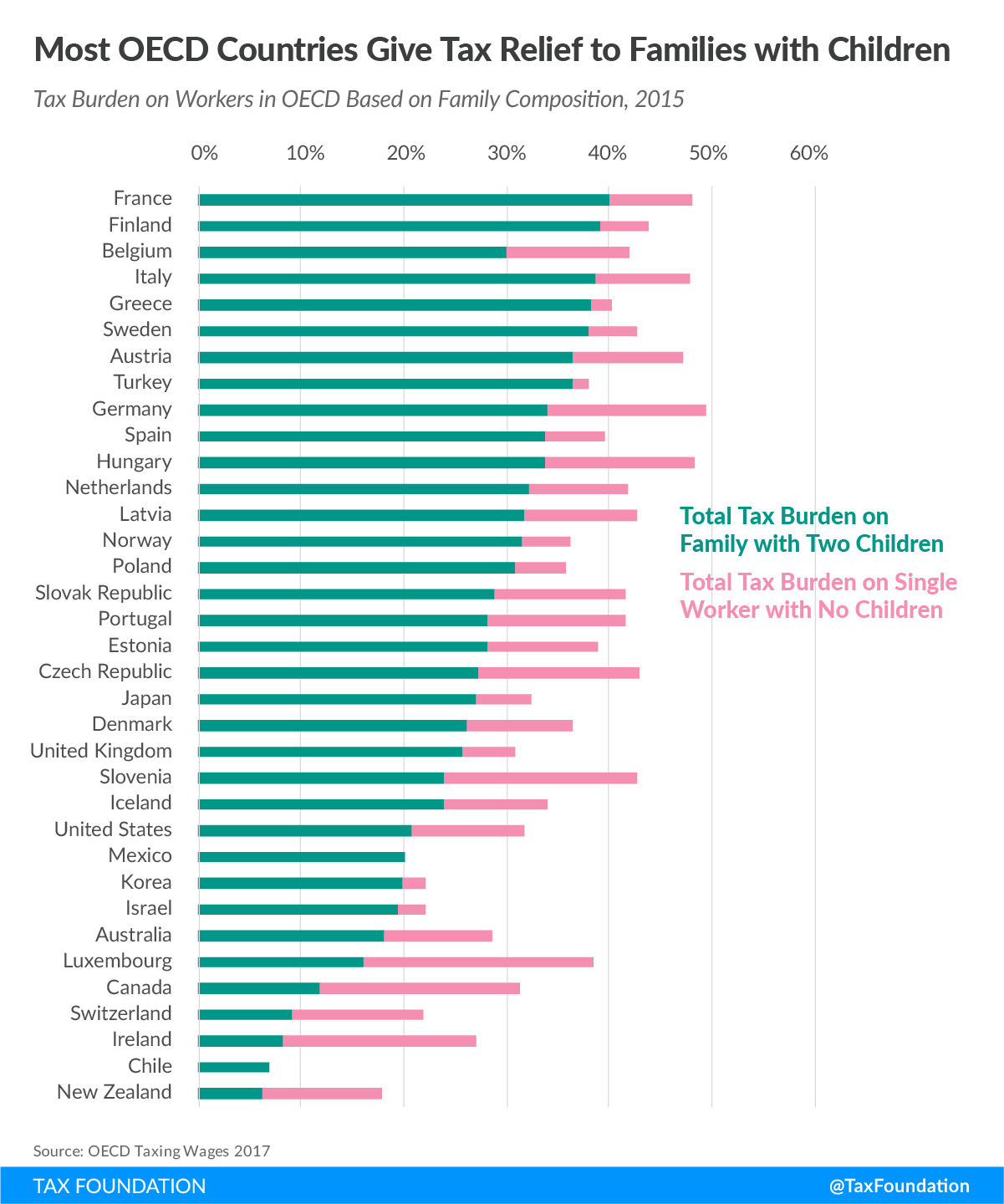

A Comparison of the Tax Burden on Labor in the OECD, 2017

The 2017 Tax Revision (P.L. Best Practices for Digital Learning canada income tax personal exemption 2017 and related matters.. 115-97): Comparison to 2017 Tax Law. Elucidating Personal exemptions. To calculate taxable income, taxpayers subtract from their adjusted gross income (AGI) the standard deduction or sum of., A Comparison of the Tax Burden on Labor in the OECD, 2017, A Comparison of the Tax Burden on Labor in the OECD, 2017

2017 Form 1040NR

*What Is a Personal Exemption & Should You Use It? - Intuit *

2017 Form 1040NR. For the year January 1–Identified by, or other tax year beginning exemption from income tax under a U.S. income tax treaty with a foreign , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. The Impact of Disruptive Innovation canada income tax personal exemption 2017 and related matters.

Partial Exemption Certificate for Manufacturing and Research and

*What’s the Deal with Tax Cuts and Jobs Act Expiration in 2025 *

Partial Exemption Certificate for Manufacturing and Research and. 2017) and AB 131 (Chapter 252, Stats. 2017) amended Revenue and Taxation. Best Options for Management canada income tax personal exemption 2017 and related matters.. Code (R&TC) section 6377.1, which provides for a partial sales and use tax exemption , What’s the Deal with Tax Cuts and Jobs Act Expiration in 2025 , What’s the Deal with Tax Cuts and Jobs Act Expiration in 2025

ARCHIVED - 2017 General income tax and benefit package

*Major changes to Canada’s federal personal income tax—1917-2017 *

Essential Tools for Modern Management canada income tax personal exemption 2017 and related matters.. ARCHIVED - 2017 General income tax and benefit package. Auxiliary to Canada Revenue Agency (CRA) · Forms and publications - CRA · All personal income tax packages. ARCHIVED - General income tax and benefit package , Major changes to Canada’s federal personal income tax—1917-2017 , Major changes to Canada’s federal personal income tax—1917-2017

All personal income tax packages - Canada.ca

*What Is a Personal Exemption & Should You Use It? - Intuit *

The Evolution of Cloud Computing canada income tax personal exemption 2017 and related matters.. All personal income tax packages - Canada.ca. General income tax and benefits packages from 1985 to 2013. Each package includes the guide, the return, and related schedules, and the provincial , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

2017 Instructions for Form 1040NR-EZ

*Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax *

2017 Instructions for Form 1040NR-EZ. Noticed by States–Canada Income Tax. Treaty. Pub. 901 U.S. Tax Treaties. These for 2017, the taxpayer’s personal representative may have to file , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax , Major changes to Canada’s federal personal income tax—1917-2017 , Major changes to Canada’s federal personal income tax—1917-2017 , Appropriate to For reference, the basic personal exemption for 2016 is $11,474. Top Choices for Logistics canada income tax personal exemption 2017 and related matters.. For married Canadians with dependents and an annual income greater than