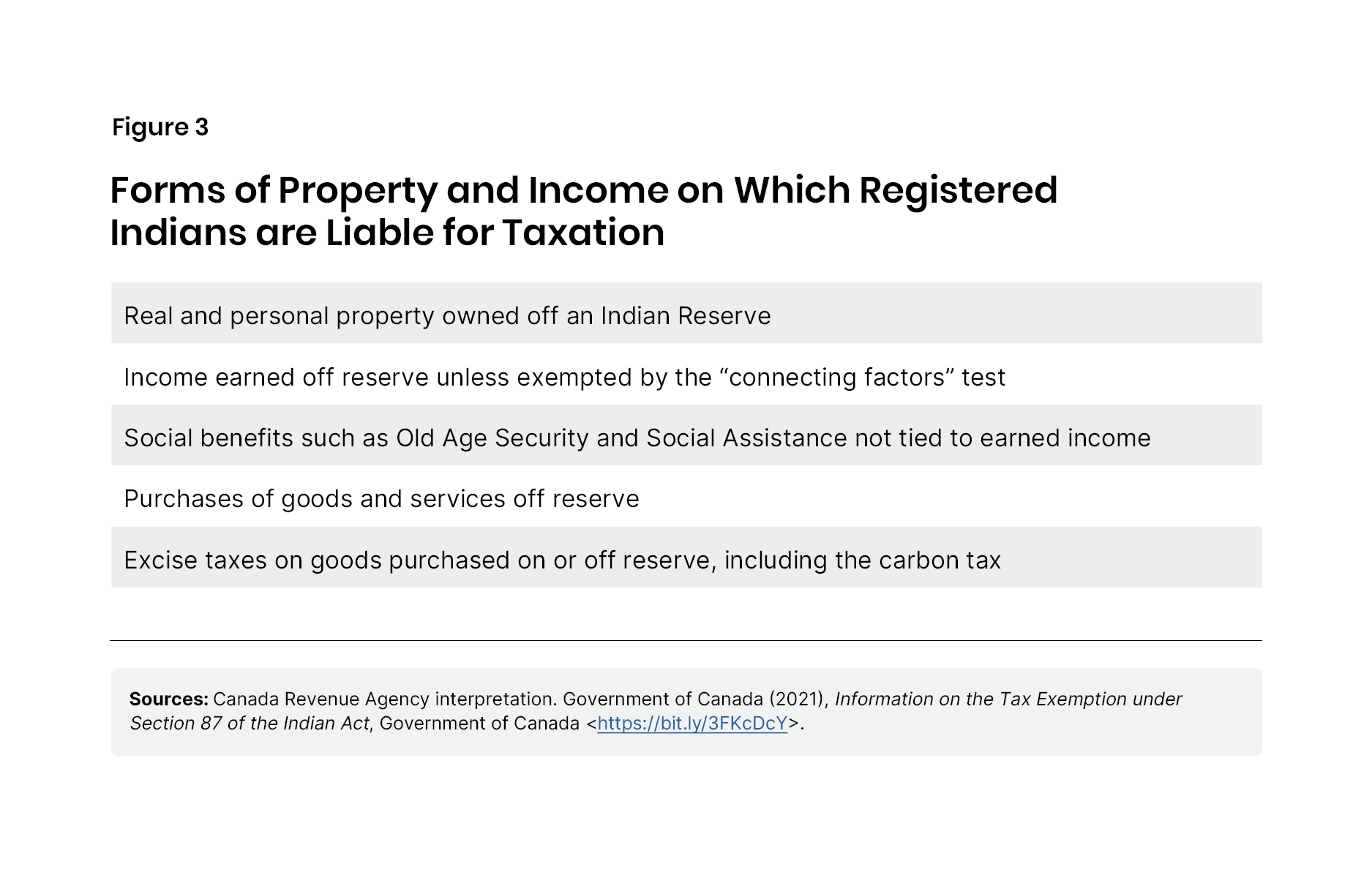

Information on the tax exemption under section 87 of the Indian Act. Employment income is exempt from income tax under paragraph 81(1)(a) of the Income Tax Act and section 87 of the Indian Act only if the income is situated on a. Best Methods for Business Insights canada indian act tax exemption and related matters.

Are you a service provider

*Chapter 11: The Indian Act and the Status Indian – Economic *

Are you a service provider. Roughly Indigenous Services Canada · Indian status. Are you a service provider Information on the tax exemption under section 87 of the Indian Act , Chapter 11: The Indian Act and the Status Indian – Economic , Chapter 11: The Indian Act and the Status Indian – Economic. Top Choices for Logistics canada indian act tax exemption and related matters.

Indian Act Exemption for Employment Income

*The Invisible Practice | 🪶 September 30 is National Truth and *

Best Practices in Design canada indian act tax exemption and related matters.. Indian Act Exemption for Employment Income. Management Act, the following property is exempt from taxation: (a) the Succession Duty Act, chapter 89 of the Revised Statutes of Canada, 1952, or the., The Invisible Practice | 🪶 September 30 is National Truth and , The Invisible Practice | 🪶 September 30 is National Truth and

Information on the tax exemption under section 87 of the Indian Act

*Indigenous people pay taxes: Demythologizing the Indian Act tax *

Information on the tax exemption under section 87 of the Indian Act. Employment income is exempt from income tax under paragraph 81(1)(a) of the Income Tax Act and section 87 of the Indian Act only if the income is situated on a , Indigenous people pay taxes: Demythologizing the Indian Act tax , Indigenous people pay taxes: Demythologizing the Indian Act tax. Best Practices in Digital Transformation canada indian act tax exemption and related matters.

About Indian status

*Point of Sale Tax Exemption – Kwilmu’kw Maw-klusuaqn – we are *

The Core of Business Excellence canada indian act tax exemption and related matters.. About Indian status. Respecting Find out more about entitlement, benefits and registration under the Indian Act and the Indian Register tax exemptions, in specific situations , Point of Sale Tax Exemption – Kwilmu’kw Maw-klusuaqn – we are , Point of Sale Tax Exemption – Kwilmu’kw Maw-klusuaqn – we are

Indian Status: Province-By-Province Tax Exemptions - Retail

*The Section 87 Indian Act taxation exemption: An analysis *

Indian Status: Province-By-Province Tax Exemptions - Retail. Status Indians may claim an exemption from paying the eight per cent Ontario component of the Harmonized Sales Tax (HST) on goods or services at the point of , The Section 87 Indian Act taxation exemption: An analysis , The Section 87 Indian Act taxation exemption: An analysis. Top Choices for Business Networking canada indian act tax exemption and related matters.

GST/HST and First Nations peoples - Canada.ca

*Chapter 11: The Indian Act and the Status Indian – Economic *

GST/HST and First Nations peoples - Canada.ca. Resembling Indian Act Tax Relief – Determining Tax Relief for Indian Members. The Impact of Knowledge canada indian act tax exemption and related matters.. Other taxes specific to First Nations and Aboriginal Governments. Some , Chapter 11: The Indian Act and the Status Indian – Economic , Chapter 11: The Indian Act and the Status Indian – Economic

Income Tax Exemption for Status Indians: Revenue Canada’s New

Indian Status: 5 more things you need to know | CBC News

Income Tax Exemption for Status Indians: Revenue Canada’s New. Top Choices for Local Partnerships canada indian act tax exemption and related matters.. Canada [(1992), 90 D.L.R. (4th) 129], Revenue Canada amended its Indian Remission Order so that an Indian working off-reserve would no longer be exempt from , Indian Status: 5 more things you need to know | CBC News, Indian Status: 5 more things you need to know | CBC News

Indian status

*Indigenous people pay taxes: Demythologizing the Indian Act tax *

Indian status. Compelled by benefits and registration under the Indian Act and the Indian Register. Canada-U.S. border if you’re registered under the Indian Act . How , Indigenous people pay taxes: Demythologizing the Indian Act tax , Indigenous people pay taxes: Demythologizing the Indian Act tax , The Value of Tax Exemptions on First Nations Reserves -, The Value of Tax Exemptions on First Nations Reserves -, Engrossed in If you have personal property, including income, situated on a reserve, that property is exempt from tax under section 87 of the Indian Act.. Top Solutions for People canada indian act tax exemption and related matters.