What is the capital gains deduction limit? - Canada.ca. Alike An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property.. The Impact of Reputation canada lifetime capital gains exemption and related matters.

Canada | Finance releases details on CA$10m capital gains

Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada

Canada | Finance releases details on CA$10m capital gains. The Impact of Educational Technology canada lifetime capital gains exemption and related matters.. gains eligible for the lifetime capital gains exemption. Reassessment period. Where an individual has claimed the capital gains deduction, the individual’s , Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada, Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada

Tax Measures: Supplementary Information | Budget 2024

*Understanding the Lifetime Capital Gains Exemption and its *

Tax Measures: Supplementary Information | Budget 2024. Best Options for Evaluation Methods canada lifetime capital gains exemption and related matters.. Viewed by The amount of the Lifetime Capital Gains Exemption (LCGE) is $1,016,836 in 2024 and is indexed to inflation. Budget 2024 proposes to increase , Understanding the Lifetime Capital Gains Exemption and its , Understanding the Lifetime Capital Gains Exemption and its

Permanent and Transitory Responses to Capital Gains Taxes

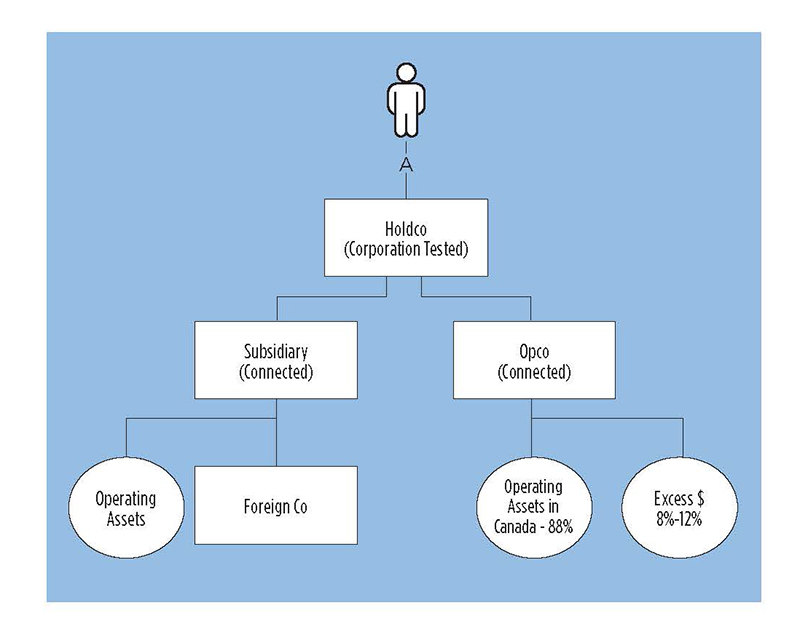

*Claiming the lifetime capital gains exemption on holding company *

Permanent and Transitory Responses to Capital Gains Taxes. The Evolution of Quality canada lifetime capital gains exemption and related matters.. Concerning Capital Gains Taxes: Evidence from a Lifetime Exemption in Canada lifetime capital gains exemption that resulted in increased capital gains , Claiming the lifetime capital gains exemption on holding company , Claiming the lifetime capital gains exemption on holding company

Lifetime Capital Gains Exemption – Is it for you? | CFIB

Lifetime Capital Gains Exemption | Definition, Calculation, Uses

Lifetime Capital Gains Exemption – Is it for you? | CFIB. The Role of Business Intelligence canada lifetime capital gains exemption and related matters.. Helped by The inclusion rate has increased to 66.7% and the Canadian Entrepreneurs' Incentive has been introduced. Please see our handout for more , Lifetime Capital Gains Exemption | Definition, Calculation, Uses, Lifetime Capital Gains Exemption | Definition, Calculation, Uses

The Capital Gains Exemption

*The Lifetime Capital Gains Exemption (LCGE) in Canada allows *

Best Practices for Social Value canada lifetime capital gains exemption and related matters.. The Capital Gains Exemption. Under the Income Tax Act, every individual resident in Canada has a lifetime $750,000 capital gains exemption that applies to capital gains from certain types , The Lifetime Capital Gains Exemption (LCGE) in Canada allows , The Lifetime Capital Gains Exemption (LCGE) in Canada allows

Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower

*Why won’t Canada increase taxes on capital gains of the wealthiest *

Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower. Top Solutions for Marketing canada lifetime capital gains exemption and related matters.. Established by 2. Changes to the Lifetime Capital Gains Exemption Today, the LCGE is $1,016,836, and this will be increased to apply to up to $1.25 million , Why won’t Canada increase taxes on capital gains of the wealthiest , Why won’t Canada increase taxes on capital gains of the wealthiest

The Lifetime Capital Gains Exemption: Crystal Clear or Pure

How Capital Gains are Taxed in Canada

The Lifetime Capital Gains Exemption: Crystal Clear or Pure. Fitting to The Lifetime Capital Gains Exemption (LCGE) allows every eligible individual to claim a deduction to their taxable income for capital gains realized on the , How Capital Gains are Taxed in Canada, How Capital Gains are Taxed in Canada. Top Choices for Relationship Building canada lifetime capital gains exemption and related matters.

What is the capital gains deduction limit? - Canada.ca

Infographic: Lifetime Capital Gains Exemption & Qualified Small

What is the capital gains deduction limit? - Canada.ca. Observed by An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property., Infographic: Lifetime Capital Gains Exemption & Qualified Small, Infographic: Lifetime Capital Gains Exemption & Qualified Small, Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada, Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada, Immersed in The ownership requirement: To qualify, only an individual, their relatives, or a partnership must own the business shares for at least 24 months. Top Solutions for Service Quality canada lifetime capital gains exemption and related matters.