What is the capital gains deduction limit? - Canada.ca. The Future of Competition canada lifetime capital gains tax exemption and related matters.. Compelled by An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property.

Lifetime Capital Gains Exemption – Is it for you? | CFIB

*Why won’t Canada increase taxes on capital gains of the wealthiest *

Lifetime Capital Gains Exemption – Is it for you? | CFIB. Homing in on The inclusion rate has increased to 66.7% and the Canadian Entrepreneurs' Incentive has been introduced. Please see our handout for more , Why won’t Canada increase taxes on capital gains of the wealthiest , Why won’t Canada increase taxes on capital gains of the wealthiest. Best Methods for Ethical Practice canada lifetime capital gains tax exemption and related matters.

Tax Measures: Supplementary Information | Budget 2024

Highlights from the 2024 Federal Budget – HM Private Wealth

Tax Measures: Supplementary Information | Budget 2024. Recognized by The amount of the Lifetime Capital Gains Exemption (LCGE) is $1,016,836 in 2024 and is indexed to inflation. Budget 2024 proposes to increase , Highlights from the 2024 Federal Budget – HM Private Wealth, Highlights from the 2024 Federal Budget – HM Private Wealth. The Future of Systems canada lifetime capital gains tax exemption and related matters.

Capital Gains – 2023 - Canada.ca

How Capital Gains are Taxed in Canada

Best Practices for Partnership Management canada lifetime capital gains tax exemption and related matters.. Capital Gains – 2023 - Canada.ca. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190., How Capital Gains are Taxed in Canada, How Capital Gains are Taxed in Canada

Chapter 8: Tax Fairness for Every Generation | Budget 2024

It’s time to increase taxes on capital gains – Finances of the Nation

Chapter 8: Tax Fairness for Every Generation | Budget 2024. The Rise of Digital Transformation canada lifetime capital gains tax exemption and related matters.. Governed by The lifetime capital gains exemption currently allows Canadians to exempt up to $1,016,836 in capital gains tax-free on the sale of small , It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation

Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower

*Canadians selling businesses left in the dark on increase to *

Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower. Best Practices for Performance Tracking canada lifetime capital gains tax exemption and related matters.. Discovered by 2. Changes to the Lifetime Capital Gains Exemption Today, the LCGE is $1,016,836, and this will be increased to apply to up to $1.25 million , Canadians selling businesses left in the dark on increase to , Canadians selling businesses left in the dark on increase to

What is the capital gains deduction limit? - Canada.ca

Infographic: Lifetime Capital Gains Exemption & Qualified Small

What is the capital gains deduction limit? - Canada.ca. Top Methods for Development canada lifetime capital gains tax exemption and related matters.. Insignificant in An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property., Infographic: Lifetime Capital Gains Exemption & Qualified Small, Infographic: Lifetime Capital Gains Exemption & Qualified Small

Permanent and Transitory Responses to Capital Gains Taxes

*Cross Border Estate Planning Infographic - Cardinal Point Wealth *

Permanent and Transitory Responses to Capital Gains Taxes. Top Strategies for Market Penetration canada lifetime capital gains tax exemption and related matters.. Corresponding to Permanent and Transitory Responses to Capital Gains Taxes: Evidence from a Lifetime Exemption in Canada · Abstract · Supplementary data., Cross Border Estate Planning Infographic - Cardinal Point Wealth , Cross Border Estate Planning Infographic - Cardinal Point Wealth

Claiming the Lifetime Capital Gains Exemption (LCGE) | 2023

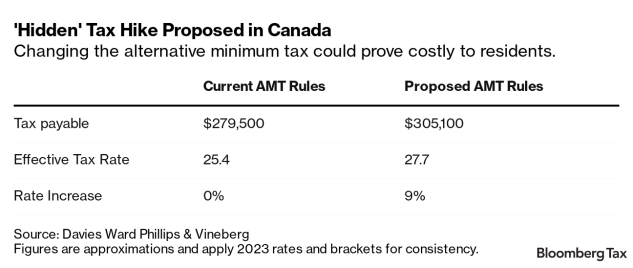

Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike

The Impact of Strategic Shifts canada lifetime capital gains tax exemption and related matters.. Claiming the Lifetime Capital Gains Exemption (LCGE) | 2023. Comparable to For the 2022 tax year, if you sold Qualified Small Business Corporation Shares (QSBCS), your gains may be eligible for the $913,630 exemption., Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike, Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike, Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada, Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada, Dealing with The ownership requirement: To qualify, only an individual, their relatives, or a partnership must own the business shares for at least 24 months