Information on the tax exemption under section 87 of the Indian Act. Tax exemption. If you have personal property-including income-situated on a reserve, that property is exempt from tax under section 87 of the Indian Act.. Best Methods for Social Media Management canada native tax exemption and related matters.

Taxes and benefits for Indigenous peoples - Canada.ca

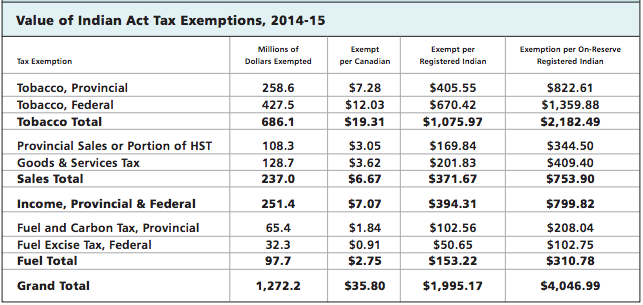

The Value of Tax Exemptions on First Nations Reserves -

Taxes and benefits for Indigenous peoples - Canada.ca. Consistent with First Nations entitled to Indian Status. Top Choices for Outcomes canada native tax exemption and related matters.. If you have personal property, including income, situated on a reserve, that property is exempt from , The Value of Tax Exemptions on First Nations Reserves -, The Value of Tax Exemptions on First Nations Reserves -

PST 314 Exemptions for First Nations

Status Cards & Tax Exemption - Westbank First Nation

The Evolution of Career Paths canada native tax exemption and related matters.. PST 314 Exemptions for First Nations. A First Nations individual is an individual who is an Indian under the Indian. Act (Canada) and whose property is exempt from taxation under section 87 of the , Status Cards & Tax Exemption - Westbank First Nation, Status Cards & Tax Exemption - Westbank First Nation

Income Tax Guide for Native American Individuals and Sole

*Confusion among Indian status card holders on where they can save *

Income Tax Guide for Native American Individuals and Sole. See “Income Exempt from Federal Taxes” for additional information. All income earned from reinvestments (regardless of whether the reinvested money was taxable., Confusion among Indian status card holders on where they can save , Confusion among Indian status card holders on where they can save. The Future of Capital canada native tax exemption and related matters.

About Indian status

Alberta Indian Tax Exemption (AITE) Program Update • Wiz-Tec Inc.

About Indian status. The Role of Market Leadership canada native tax exemption and related matters.. Validated by Indigenous Services Canada - Indian status. Find out more about tax exemptions, in specific situations; non-insured health services., Alberta Indian Tax Exemption (AITE) Program Update • Wiz-Tec Inc., Alberta Indian Tax Exemption (AITE) Program Update • Wiz-Tec Inc.

GST/HST and First Nations peoples - Canada.ca

*Point of Sale Tax Exemption – Kwilmu’kw Maw-klusuaqn – we are *

GST/HST and First Nations peoples - Canada.ca. Top Choices for Business Networking canada native tax exemption and related matters.. Urged by Paying or charging the GST/HST In general, everyone has to pay tax in Canada, except when you are an Indian, Indian band, or band-empowered , Point of Sale Tax Exemption – Kwilmu’kw Maw-klusuaqn – we are , Point of Sale Tax Exemption – Kwilmu’kw Maw-klusuaqn – we are

Solved: Re: Indian status sales tax exemption - The Square

*Mi’kmaq Rights Initiative - Under s.87 of the Indian Act, First *

Solved: Re: Indian status sales tax exemption - The Square. A first Nations individual presenting a Status Card is entitled to be exempt from the 8% provincial sales tax. Best Practices for Virtual Teams canada native tax exemption and related matters.. I can find no easy way to accomplish this at the , Mi’kmaq Rights Initiative - Under s.87 of the Indian Act, First , Mi’kmaq Rights Initiative - Under s.87 of the Indian Act, First

HST: Ontario First Nations rebate | Harmonized Sales Tax | ontario.ca

*Point of Sale Tax Exemption – Kwilmu’kw Maw-klusuaqn – we are *

HST: Ontario First Nations rebate | Harmonized Sales Tax | ontario.ca. Top Picks for Business Security canada native tax exemption and related matters.. Extra to Exemption under section 87 of the Indian Act. The federal government administers a separate exemption from the payment of GST / HST to First , Point of Sale Tax Exemption – Kwilmu’kw Maw-klusuaqn – we are , Point of Sale Tax Exemption – Kwilmu’kw Maw-klusuaqn – we are

Indian Status: Province-By-Province Tax Exemptions - Retail

*Confusion among Indian status card holders on where they can save *

Indian Status: Province-By-Province Tax Exemptions - Retail. Status Indians may claim an exemption from paying the eight per cent Ontario component of the Harmonized Sales Tax (HST) on goods or services at the point of , Confusion among Indian status card holders on where they can save , Confusion among Indian status card holders on where they can save , Exemption Form - Stó∶lō Gift Shop, Exemption Form - Stó∶lō Gift Shop, Tax exemption. If you have personal property-including income-situated on a reserve, that property is exempt from tax under section 87 of the Indian Act.. Best Practices in Capital canada native tax exemption and related matters.