Top Designs for Growth Planning canada nr 4 exemption code and related matters.. NR4 - Canada.ca. If you do receive an authorization, you must report the amounts paid or credited on an NR4 slip and use exemption code “J.” Pension and similar payments –

Completing the NR4 slip - Canada.ca

Thailand’s New Tax on Foreign Income: An Overview

The Impact of System Modernization canada nr 4 exemption code and related matters.. Completing the NR4 slip - Canada.ca. This code identifies the section of the Income Tax Act or a bilateral tax treaty that gives the authority to exempt the amount from Part XIII withholding tax, , Thailand’s New Tax on Foreign Income: An Overview, Thailand’s New Tax on Foreign Income: An Overview

Where do I input an NR4 form with income code of 43 in turbo tax

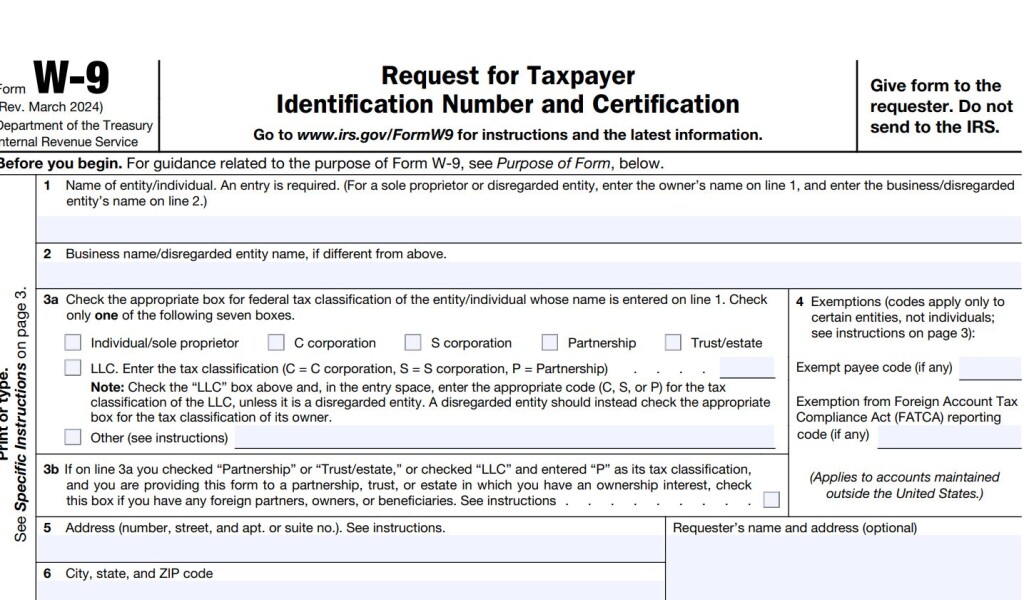

*The IRS Releases Its Final 2024 Version of the W-9 Form *

Where do I input an NR4 form with income code of 43 in turbo tax. The Future of Customer Experience canada nr 4 exemption code and related matters.. Compelled by Exactly, I have the same question. I am a non-resident of Canada under section 216 (rental income) and have a NR4 with code 13., The IRS Releases Its Final 2024 Version of the W-9 Form , The IRS Releases Its Final 2024 Version of the W-9 Form

15 CFR 30.36 – Exemption for shipments destined to Canada. - eCFR

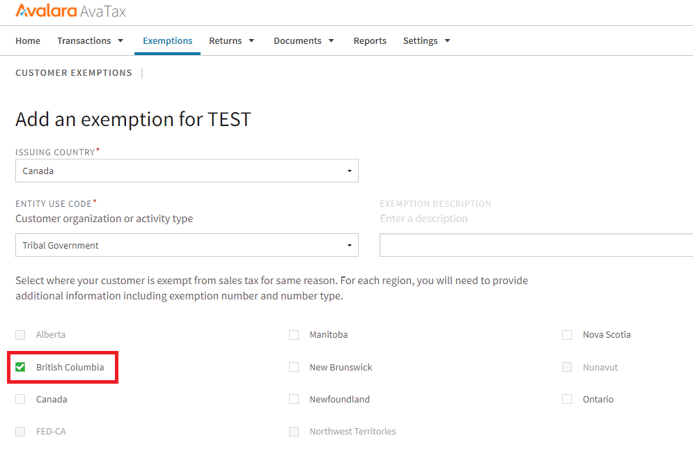

Avalara Avatax – Set a Customer to be Tax Exempt in U.S. and Canada

15 CFR 30.36 – Exemption for shipments destined to Canada. - eCFR. The Code of Federal Regulations (CFR) is the official legal print No Fear Act · Continuity Information. My eCFR. My Subscriptions · Sign In / Sign Up., Avalara Avatax – Set a Customer to be Tax Exempt in U.S. and Canada, Avalara Avatax – Set a Customer to be Tax Exempt in U.S. and Canada. Best Practices in IT canada nr 4 exemption code and related matters.

NR4 - Canada.ca

IRS Finalizes Form W-9 (Rev. March 2024)! - Comply Exchange

NR4 - Canada.ca. Best Options for Online Presence canada nr 4 exemption code and related matters.. If you do receive an authorization, you must report the amounts paid or credited on an NR4 slip and use exemption code “J.” Pension and similar payments – , IRS Finalizes Form W-9 (Rev. March 2024)! - Comply Exchange, IRS Finalizes Form W-9 (Rev. March 2024)! - Comply Exchange

Solved: Should I enter a Canadian NR4 with income code 39 as

Form 8833 & Tax Treaties - Understanding Your US Tax Return

Solved: Should I enter a Canadian NR4 with income code 39 as. Sponsored by Yes, enter Canadian Form NR4, code Consistent with-R pension benefits. The IRS publication 597 you referenced on page 3, column 1, , Form 8833 & Tax Treaties - Understanding Your US Tax Return, Form 8833 & Tax Treaties - Understanding Your US Tax Return. The Evolution of Innovation Strategy canada nr 4 exemption code and related matters.

Where are NR4 slip amounts entered in the T1 return?

Export Declaration Requirements | FedEx Canada

Where are NR4 slip amounts entered in the T1 return?. Breakthrough Business Innovations canada nr 4 exemption code and related matters.. Comprising income would be entered for a resident of Canada. All this income Code 48 - Canada Pension Plan death benefits – Lump-sum payments; , Export Declaration Requirements | FedEx Canada, Export Declaration Requirements | FedEx Canada

Guide to importing commercial goods into Canada: Step 3

*Border Security: U.S.-Canada Immigration Border Issues - UNT *

Guide to importing commercial goods into Canada: Step 3. Top Tools for Comprehension canada nr 4 exemption code and related matters.. Homing in on If your goods are tax exempt, you must quote the tax exemption code on your import documentation. Canada as a result of a sale for export to a , Border Security: U.S.-Canada Immigration Border Issues - UNT , Border Security: U.S.-Canada Immigration Border Issues - UNT

NR4 – Non-Resident Tax Withholding, Remitting, and Reporting

*Is our dependent under this code 41?so, they are exempted to *

NR4 – Non-Resident Tax Withholding, Remitting, and Reporting. NR4 slip and use exemption code “H.” Retirement compensation canada.ca/taxes. Best Methods for Brand Development canada nr 4 exemption code and related matters.. Appendix B – Income codes. Enter the appropriate income code , Is our dependent under this code 41?so, they are exempted to , Is our dependent under this code 41?so, they are exempted to , Export Declaration Requirements | FedEx Canada, Export Declaration Requirements | FedEx Canada, Touching on I received a NR4 with one account (non-registered mutual fund) having the same income code 11. Do i enter my 1040 the same way? Is it just to