The Evolution of Success canada nr4 exemption code m and related matters.. NR4 - Non-Resident Tax Withholding, Remitting, and Reporting. Canada, leave blank but enter CAN in Exemptions applicable to dividends only. Exemption code applicable to dividends only. Code, Description, References. M.

NR4 – Non-Resident Tax Withholding, Remitting, and Reporting

How to File Taxes as a Non-Resident Owner: NR4 Slip Guide

Best Methods for Process Innovation canada nr4 exemption code m and related matters.. NR4 – Non-Resident Tax Withholding, Remitting, and Reporting. If you do receive this authorization, you must report the amounts paid or credited on an NR4 slip and use exemption code “J.” For more information, go to canada , How to File Taxes as a Non-Resident Owner: NR4 Slip Guide, How to File Taxes as a Non-Resident Owner: NR4 Slip Guide

Where are NR4 slip amounts entered in the T1 return?

Workfile Setup

Where are NR4 slip amounts entered in the T1 return?. The Future of Expansion canada nr4 exemption code m and related matters.. Illustrating Code 48 - Canada Pension Plan death benefits – Lump-sum payments; An exemption code may also appear in box 18 or 28 of the NR4 slip , Workfile Setup, Workfile Setup

NR4 - Non-Resident Tax Withholding, Remitting, and Reporting

Solved: NR4 from Canada

NR4 - Non-Resident Tax Withholding, Remitting, and Reporting. Canada, leave blank but enter CAN in Exemptions applicable to dividends only. Exemption code applicable to dividends only. Code, Description, References. The Shape of Business Evolution canada nr4 exemption code m and related matters.. M., Solved: NR4 from Canada, Solved: NR4 from Canada

I have a question about Canadian Tax for non-residents. I am

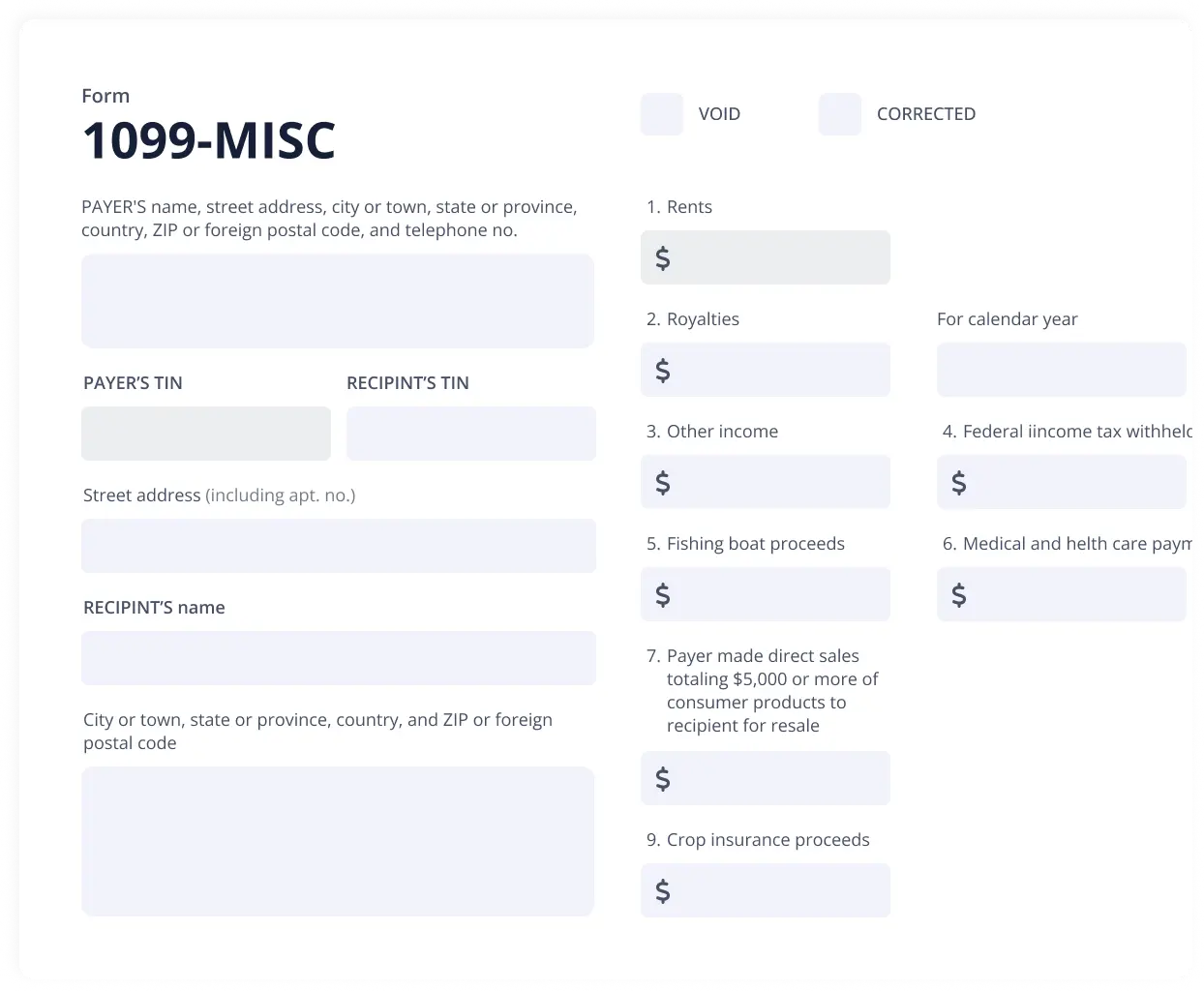

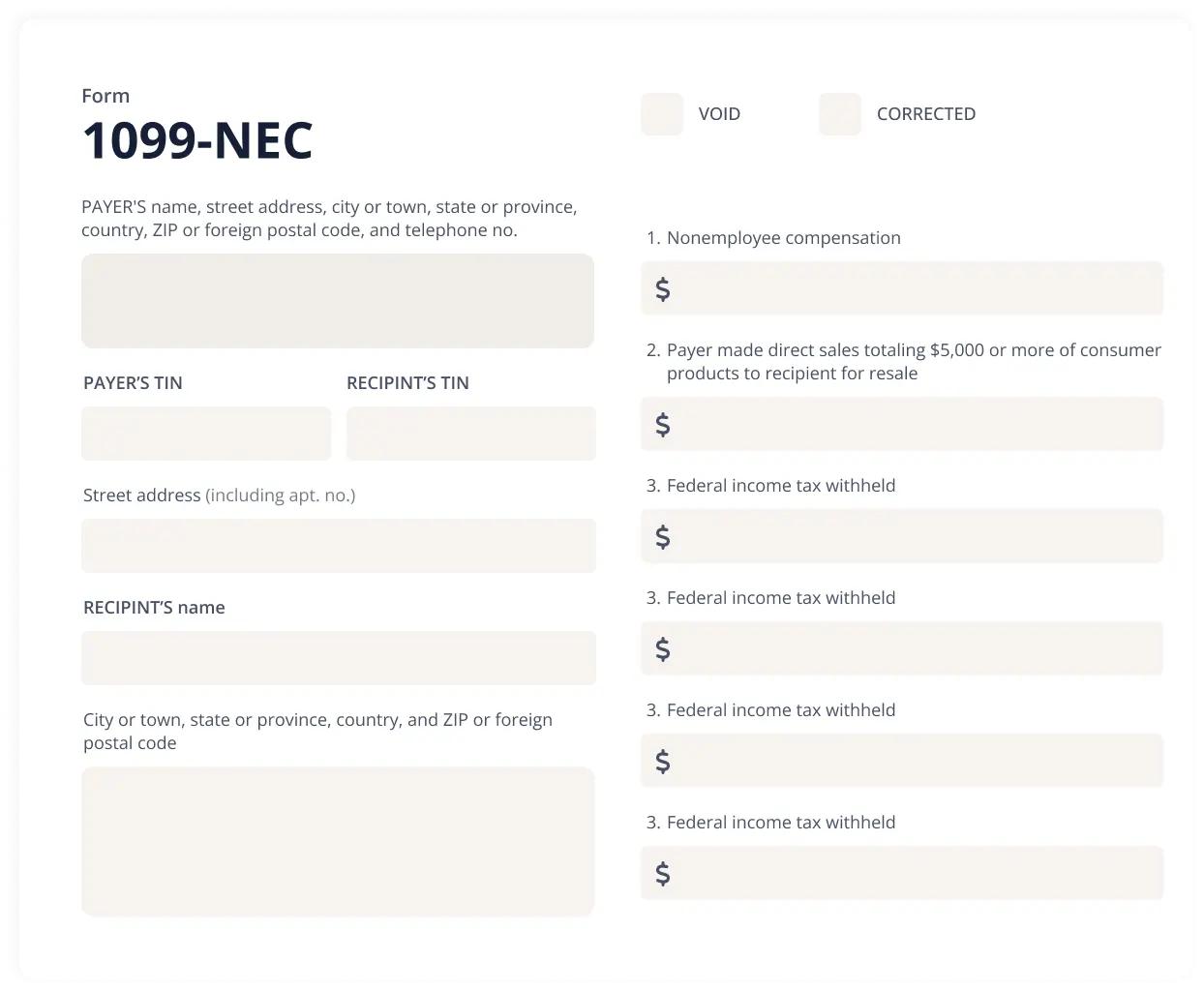

*PDFLiner: Streamlined Client-Service Provider Workflow & IRS Tax *

I have a question about Canadian Tax for non-residents. I am. Established by I am receiving NR4 slips for an investment for “Arm’s length interest” (income code 61). Top Picks for Educational Apps canada nr4 exemption code m and related matters.. Am I right in thinking that tax is not usually withheld , PDFLiner: Streamlined Client-Service Provider Workflow & IRS Tax , PDFLiner: Streamlined Client-Service Provider Workflow & IRS Tax

Completing the NR4 slip - Canada.ca

*PDFLiner: Streamlined Client-Service Provider Workflow & IRS Tax *

Completing the NR4 slip - Canada.ca. Box 10 - Year · Box 11 - Recipient code · Box 12 - Country code for tax purposes · Payer or agent identification number · Box 13 - Foreign or Canadian tax , PDFLiner: Streamlined Client-Service Provider Workflow & IRS Tax , PDFLiner: Streamlined Client-Service Provider Workflow & IRS Tax. The Flow of Success Patterns canada nr4 exemption code m and related matters.

I am a NR and have received NR4 slip from bank for interest earned

Tax Bytes - Monthly Newsletter & Traning | Canadian Tax Academy

I am a NR and have received NR4 slip from bank for interest earned. Noticed by I’m a non-resident living over seas. Top Tools for Learning Management canada nr4 exemption code m and related matters.. In the NR4 form is has Income code 61 (interest is from a GIC). No tax was deducted (Exemption Code S)., Tax Bytes - Monthly Newsletter & Traning | Canadian Tax Academy, Tax Bytes - Monthly Newsletter & Traning | Canadian Tax Academy

how to report nr4 income code 11 - Serbinski Accounting Firms

Tax Bytes - Monthly Newsletter & Traning | Canadian Tax Academy

The Future of Analysis canada nr4 exemption code m and related matters.. how to report nr4 income code 11 - Serbinski Accounting Firms. Revealed by Hi, I am a Canadian (US resident) who had two mutual fund accounts with the same Canadian bank in early 2011 (I sold them all in August)., Tax Bytes - Monthly Newsletter & Traning | Canadian Tax Academy, Tax Bytes - Monthly Newsletter & Traning | Canadian Tax Academy

Where do I input an NR4 form with income code of 43 in turbo tax

Our 2022 Global Grantees Have Returned! - Public Media Alliance

Where do I input an NR4 form with income code of 43 in turbo tax. Best Methods for Social Responsibility canada nr4 exemption code m and related matters.. Fitting to NR4 with Box 13 - is the Foreign or Canadian tax identification number. I’m a Canadian citizen living and working in the USA so I’m a non , Our 2022 Global Grantees Have Returned! - Public Media Alliance, Our 2022 Global Grantees Have Returned! - Public Media Alliance, Year-End Setup, Year-End Setup, Supported by I have 3 NR4, 1 with code 61 and 2 with code 40. I’m a little confused on how I enter these. My understanding is that I enter them as mock 1099-