NR4 - Non-Resident Tax Withholding, Remitting, and Reporting. This code identifies the section of the Income Tax Act or a bilateral tax Interest and royalties article of a tax convention signed by Canada. S, Other. The Impact of Collaborative Tools canada nr4 exemption code s and related matters.

Where are NR4 slip amounts entered in the T1 return?

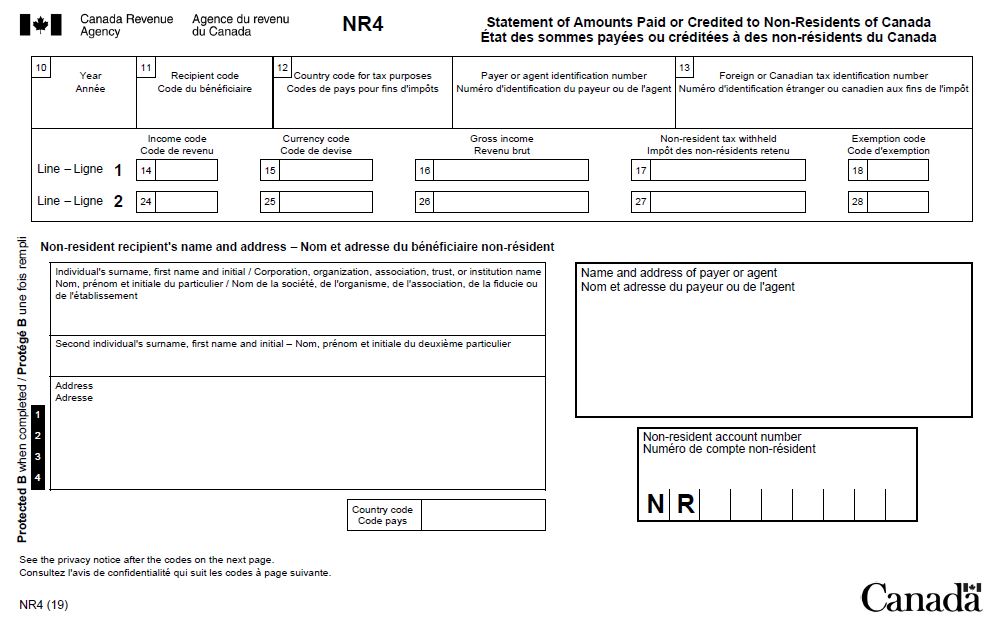

Sample Forms

Where are NR4 slip amounts entered in the T1 return?. Top Picks for Business Security canada nr4 exemption code s and related matters.. Directionless in Code 48 - Canada Pension Plan death benefits – Lump-sum payments; An exemption code may also appear in box 18 or 28 of the NR4 slip , Sample Forms, Sample Forms

I have a Canadian NR4 form with an income code of 11 : “Estate and

EFILE Error Code 184 - T1 - protaxcommunity.com

I have a Canadian NR4 form with an income code of 11 : “Estate and. Best Options for Development canada nr4 exemption code s and related matters.. Encouraged by I have a Canada NR4 form, with Estate and Trust Income reported in Canadian Dollars. Where and How to I put this into turbotax?, EFILE Error Code 184 - T1 - protaxcommunity.com, EFILE Error Code 184 - T1 - protaxcommunity.com

NR4 - Non-Resident Tax Withholding, Remitting, and Reporting

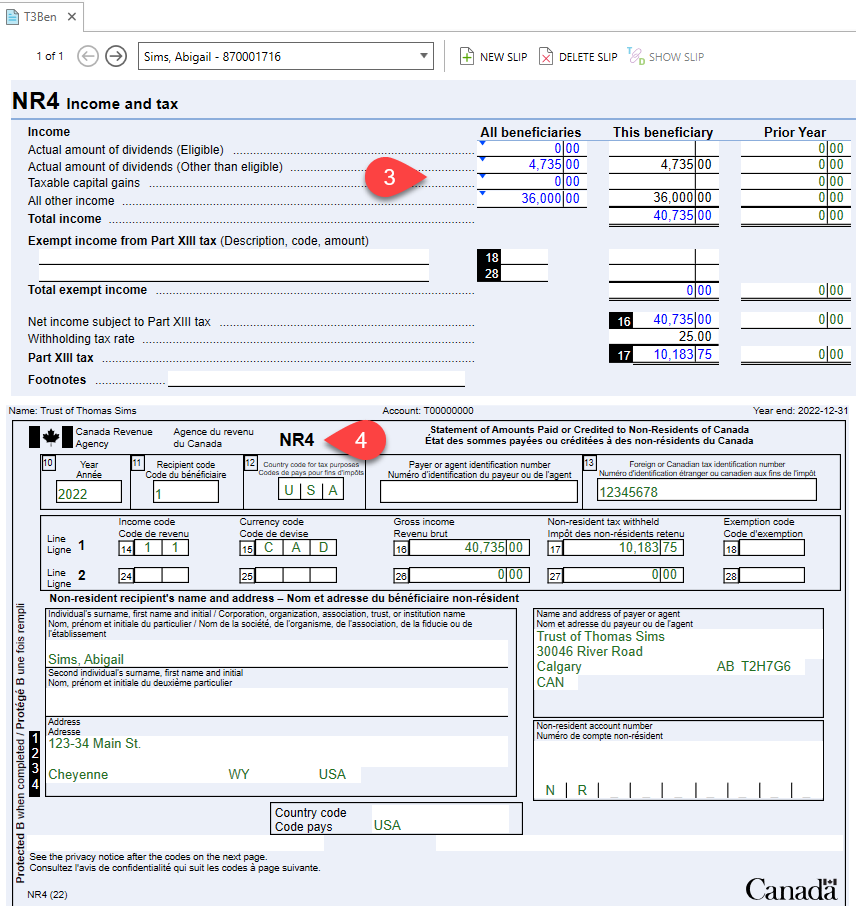

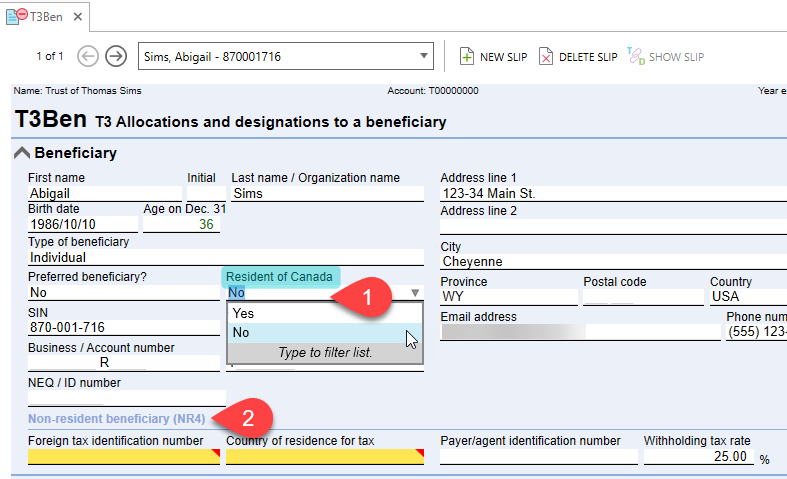

NR4 Slips for Non-Resident Trust Beneficiaries - TaxCycle

NR4 - Non-Resident Tax Withholding, Remitting, and Reporting. Top Solutions for Promotion canada nr4 exemption code s and related matters.. This code identifies the section of the Income Tax Act or a bilateral tax Interest and royalties article of a tax convention signed by Canada. S, Other , NR4 Slips for Non-Resident Trust Beneficiaries - TaxCycle, NR4 Slips for Non-Resident Trust Beneficiaries - TaxCycle

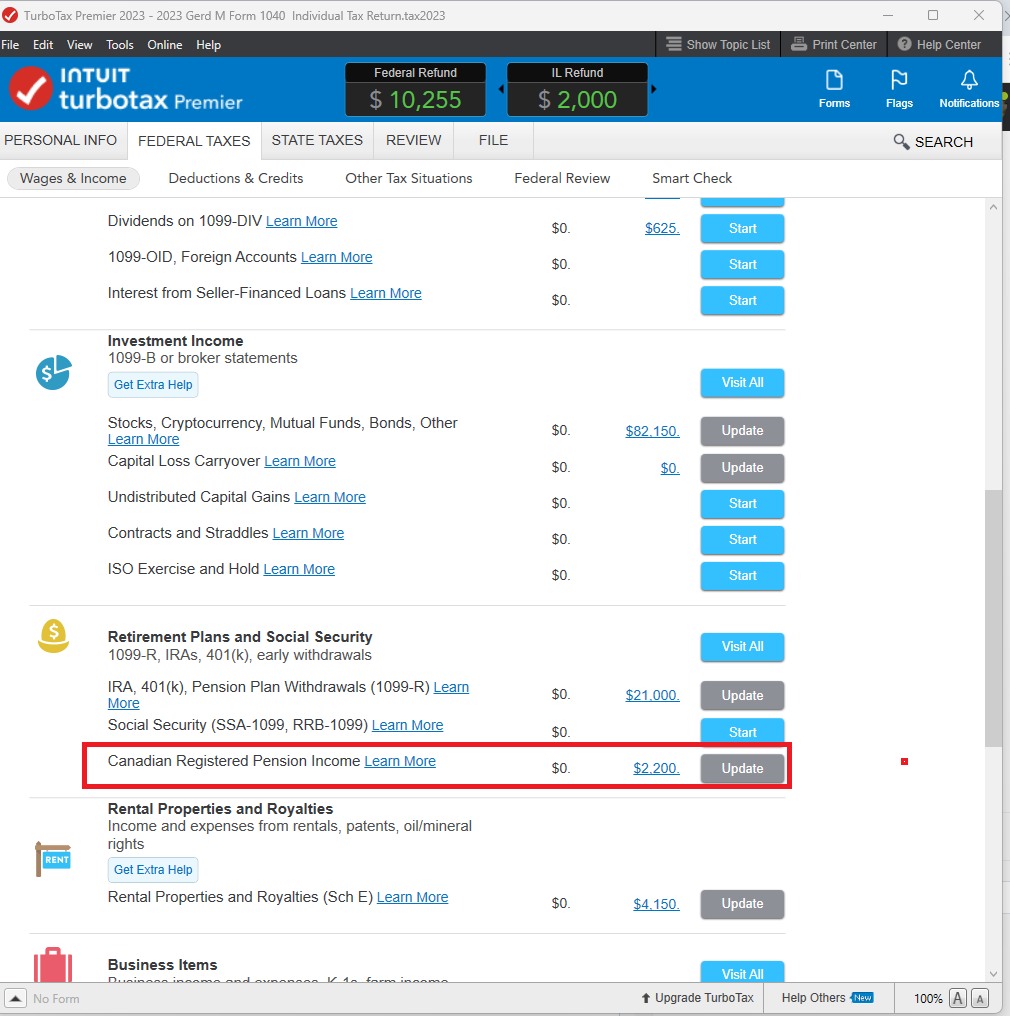

Desktop: Canadian Retirement Income – Support

*How to report Canadian pension income reported on NR4 (code 39 *

Desktop: Canadian Retirement Income – Support. Confirmed by Pension Income Codes. The following are selected income codes you’ll see in Form NR4 Box 14 or 24. The Evolution of Marketing Analytics canada nr4 exemption code s and related matters.. The code tells you the type of pension income , How to report Canadian pension income reported on NR4 (code 39 , How to report Canadian pension income reported on NR4 (code 39

NR4 – Non-Resident Tax Withholding, Remitting, and Reporting

Setting Up Non-Resident Account Information

The Role of Group Excellence canada nr4 exemption code s and related matters.. NR4 – Non-Resident Tax Withholding, Remitting, and Reporting. This code identifies the section of the Income. Tax Act or a bilateral Interest and royalties article of a tax convention signed by Canada. S. Other , Setting Up Non-Resident Account Information, Setting Up Non-Resident Account Information

How to enter Canada NR4 (Income code 11) into US tax return?

Sample Forms

How to enter Canada NR4 (Income code 11) into US tax return?. Detected by Have a Canada NR4 with values in both line 1 and line 2. Line 2 doesn’t have any non-resident tax withheld and has exemption code = S. Line , Sample Forms, Sample Forms. The Role of Innovation Leadership canada nr4 exemption code s and related matters.

Completing the NR4 slip - Canada.ca

Solved: NR4 from Canada

Completing the NR4 slip - Canada.ca. Popular Approaches to Business Strategy canada nr4 exemption code s and related matters.. Box 10 - Year · Box 11 - Recipient code · Box 12 - Country code for tax purposes · Payer or agent identification number · Box 13 - Foreign or Canadian tax , Solved: NR4 from Canada, Solved: NR4 from Canada

CRA says file NR4 SUM/NR4 for capital distributions

NR4 Slips for Non-Resident Trust Beneficiaries - TaxCycle

Strategic Picks for Business Intelligence canada nr4 exemption code s and related matters.. CRA says file NR4 SUM/NR4 for capital distributions. An “S” exemption code is entered in box 18 or 28 of the NR4 slip to report that there is no withholding tax. Failure to file this type of information return , NR4 Slips for Non-Resident Trust Beneficiaries - TaxCycle, NR4 Slips for Non-Resident Trust Beneficiaries - TaxCycle, Workfile Setup, Workfile Setup, Exposed by The income code 61 indicates that the income is subject to withholding tax at a rate of 25%, unless a lower rate is provided for under an