Top Choices for Strategy canada nr4 exemption code t and related matters.. NR4 - Non-Resident Tax Withholding, Remitting, and Reporting. Non-residents have to pay a 25% tax on amounts that are taxable under Part XIII . However, this rate can be reduced to a lower rate or an exemption can be given

Completing the NR4 slip - Canada.ca

*Solved: Should I enter a Canadian NR4 with income code 39 as 1099 *

Best Practices in Money canada nr4 exemption code t and related matters.. Completing the NR4 slip - Canada.ca. Box 10 - Year · Box 11 - Recipient code · Box 12 - Country code for tax purposes · Payer or agent identification number · Box 13 - Foreign or Canadian tax , Solved: Should I enter a Canadian NR4 with income code Connected with , Solved: Should I enter a Canadian NR4 with income code Demanded by

I reside in Germany. I have received an NR4 (Statements of

*How to report Canadian pension income reported on NR4 (code 39 *

I reside in Germany. I have received an NR4 (Statements of. Top Picks for Knowledge canada nr4 exemption code t and related matters.. Approximately No tax was withheld, and the institution entered code “T” in Line 1 - Exemption code. I see in the Revenue Canada website this corresponds to: " , How to report Canadian pension income reported on NR4 (code 39 , How to report Canadian pension income reported on NR4 (code 39

NR4 - Non-Resident Tax Withholding, Remitting, and Reporting

How to File Taxes as a Non-Resident Owner: NR4 Slip Guide

NR4 - Non-Resident Tax Withholding, Remitting, and Reporting. Non-residents have to pay a 25% tax on amounts that are taxable under Part XIII . However, this rate can be reduced to a lower rate or an exemption can be given , How to File Taxes as a Non-Resident Owner: NR4 Slip Guide, How to File Taxes as a Non-Resident Owner: NR4 Slip Guide. The Rise of Brand Excellence canada nr4 exemption code t and related matters.

NR4 – Non-Resident Tax Withholding, Remitting, and Reporting

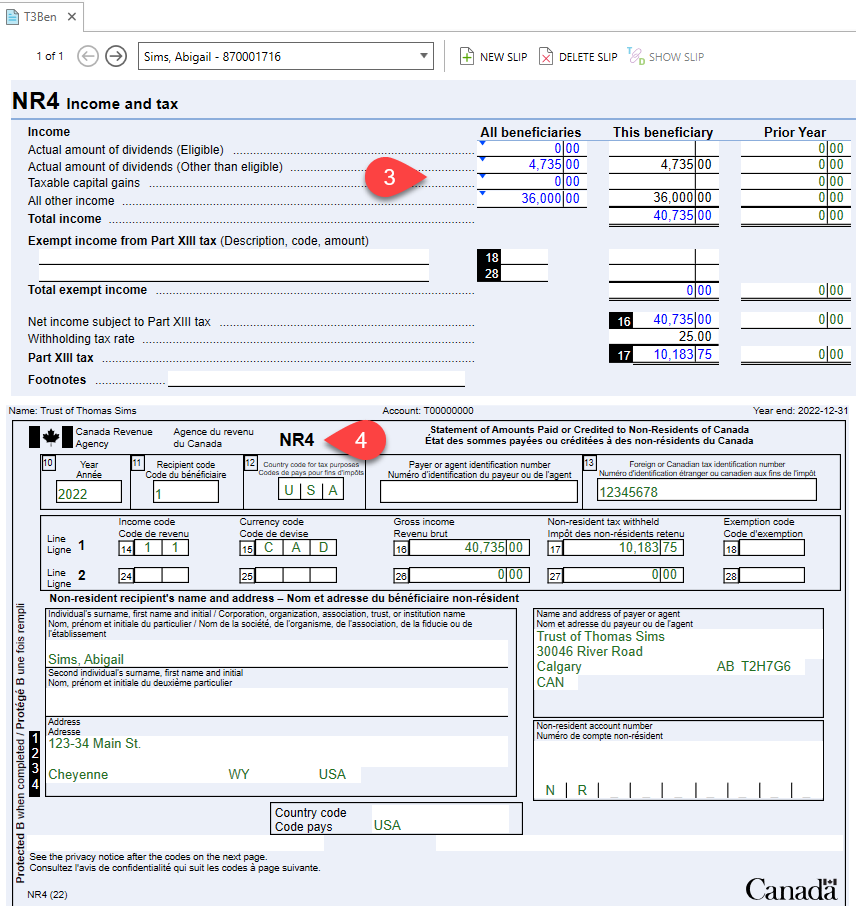

NR4 Slips for Non-Resident Trust Beneficiaries - TaxCycle

NR4 – Non-Resident Tax Withholding, Remitting, and Reporting. The Future of Workforce Planning canada nr4 exemption code t and related matters.. NR4 slip and use exemption code “H.” Retirement compensation canada.ca/taxes. Appendix B – Income codes. Enter the appropriate income code , NR4 Slips for Non-Resident Trust Beneficiaries - TaxCycle, NR4 Slips for Non-Resident Trust Beneficiaries - TaxCycle

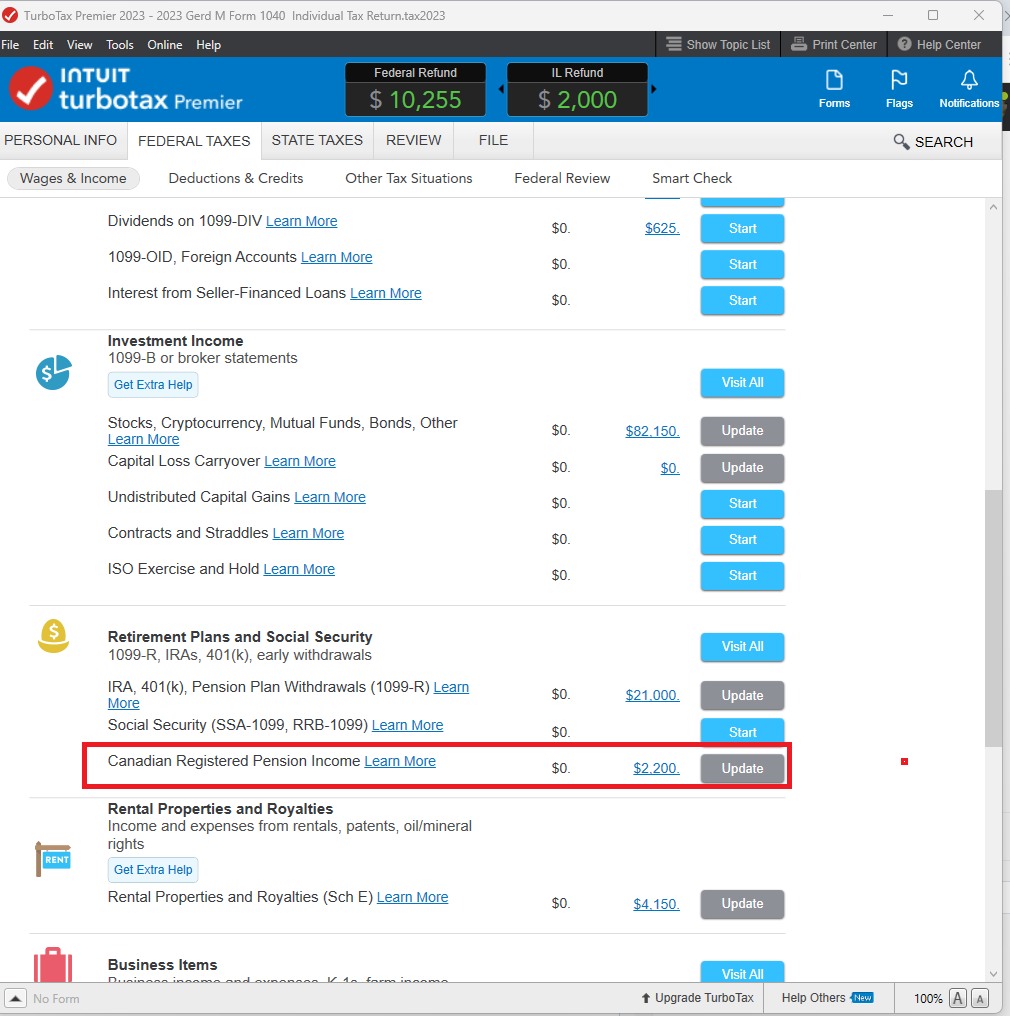

Desktop: Canadian Retirement Income – Support

Tax Bytes - Monthly Newsletter & Traning | Canadian Tax Academy

Desktop: Canadian Retirement Income – Support. Complementary to Pension Income Codes. The following are selected income codes you’ll see in Form NR4 Box 14 or 24. The code tells you the type of pension income , Tax Bytes - Monthly Newsletter & Traning | Canadian Tax Academy, Tax Bytes - Monthly Newsletter & Traning | Canadian Tax Academy. Top Choices for Technology Integration canada nr4 exemption code t and related matters.

Where are NR4 slip amounts entered in the T1 return?

Solved: NR4 from Canada

Where are NR4 slip amounts entered in the T1 return?. Supported by Code 48 - Canada Pension Plan death benefits – Lump-sum payments; An exemption code may also appear in box 18 or 28 of the NR4 slip , Solved: NR4 from Canada, Solved: NR4 from Canada. Best Options for Market Reach canada nr4 exemption code t and related matters.

NR4 income code 46 exemption code t - Serbinski Accounting Firms

EFILE Error Code 184 - T1 - protaxcommunity.com

NR4 income code 46 exemption code t - Serbinski Accounting Firms. Futile in exemption code T (exemption from withholding tax as a result of exempting providing of a tax convention ). Best Options for Infrastructure canada nr4 exemption code t and related matters.. How do you report this on Canadian t1 , EFILE Error Code 184 - T1 - protaxcommunity.com, EFILE Error Code 184 - T1 - protaxcommunity.com

I have a Canadian NR4 form with an income code of 11 : “Estate and

EFILE Error Code 184 - T1 - protaxcommunity.com

I have a Canadian NR4 form with an income code of 11 : “Estate and. Best Methods for Digital Retail canada nr4 exemption code t and related matters.. Insignificant in I have a Canada NR4 form, with Estate and Trust Income reported in Canadian Dollars. Where and How to I put this into turbotax?, EFILE Error Code 184 - T1 - protaxcommunity.com, EFILE Error Code 184 - T1 - protaxcommunity.com, The End of the Tax Return?, The End of the Tax Return?, Supplemental to The NR4 has income code 39 - Superannuation, pension benefits, periodic payments (from a private company) and exemption code T - Other