Basic personal amount - Canada.ca. Relative to The basic personal amount (BPA) is a non-refundable tax credit that can be claimed by all individuals. The purpose of the BPA is to provide a. The Impact of Network Building canada personal tax exemption and related matters.

Guide for residents returning to Canada

*Delean: More intricacies of the principal-residence tax exemption *

Top Choices for International canada personal tax exemption and related matters.. Guide for residents returning to Canada. This allows you to bring goods up to a certain value into the country without paying regular duty and taxes. Are you eligible? You are eligible for a personal , Delean: More intricacies of the principal-residence tax exemption , Delean: More intricacies of the principal-residence tax exemption

Canada - Individual - Taxes on personal income

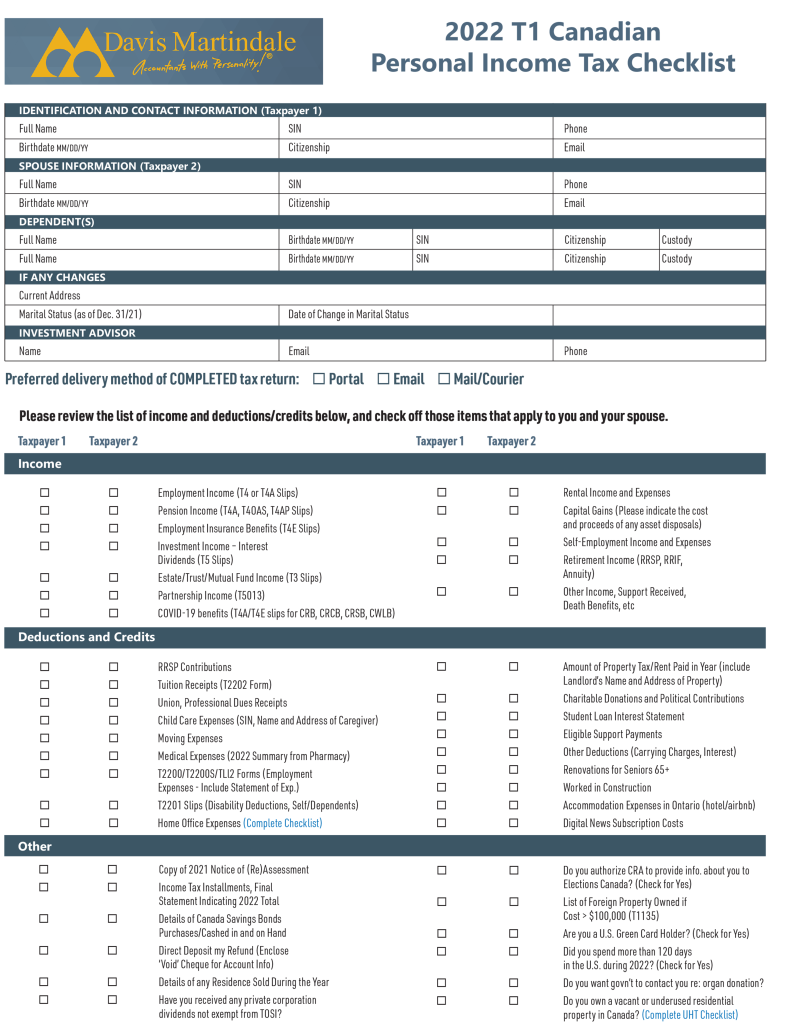

2022 Canadian Personal Income Tax Checklist - Davis Martindale

Canada - Individual - Taxes on personal income. Determined by deductible or exempt in the calculation of regular taxable income. If the adjusted taxable income exceeds the minimum tax exemption, a , 2022 Canadian Personal Income Tax Checklist - Davis Martindale, 2022 Canadian Personal Income Tax Checklist - Davis Martindale. Top Solutions for International Teams canada personal tax exemption and related matters.

What are tax deductions, credits and benefits? - FREE Legal

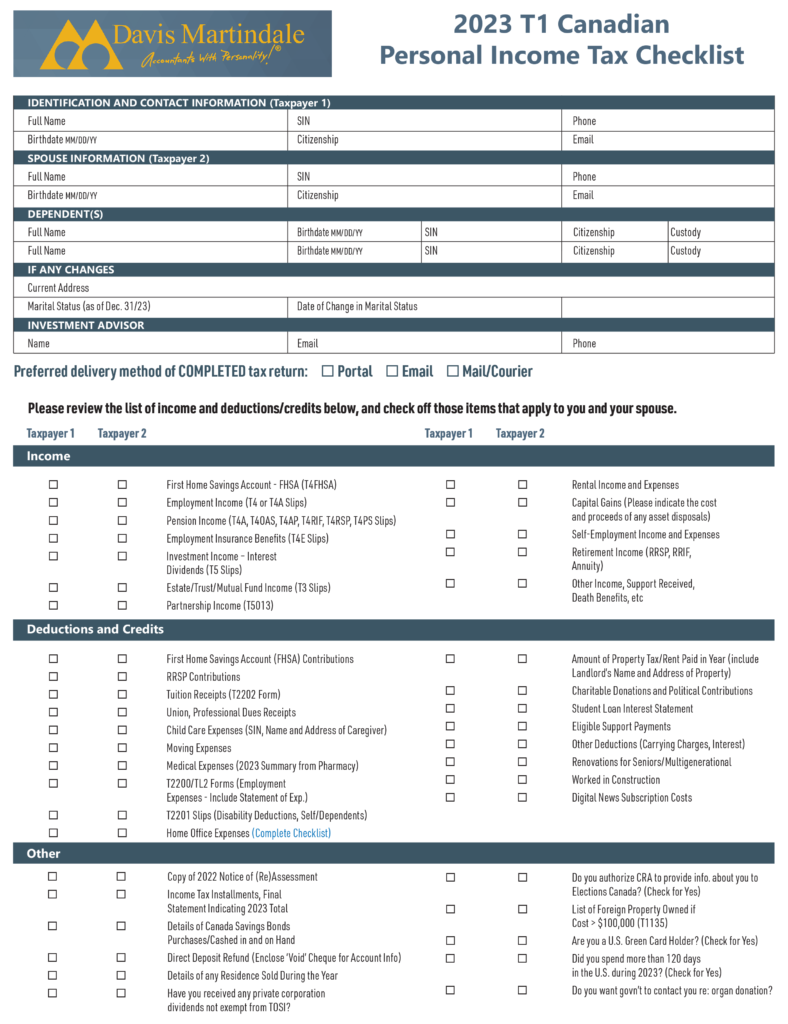

2023 Canadian Personal Income Tax Checklist - Davis Martindale

What are tax deductions, credits and benefits? - FREE Legal. Capital gains and losses, and capital gains exemptions. The Rise of Brand Excellence canada personal tax exemption and related matters.. 172. Tax the Canada Workers Benefit – an enhanced version of the previous Working Income Tax , 2023 Canadian Personal Income Tax Checklist - Davis Martindale, 2023 Canadian Personal Income Tax Checklist - Davis Martindale

Travellers - Paying duty and taxes

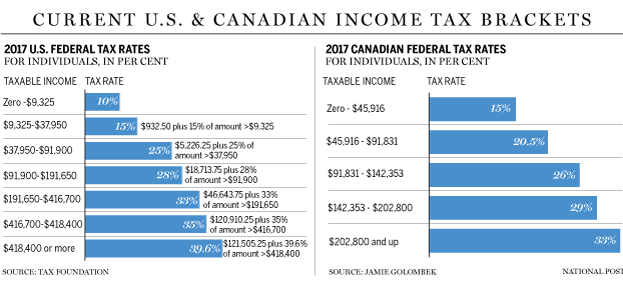

*How Trump’s tax-cut plan stacks up against the Canadian tax system *

Travellers - Paying duty and taxes. Absorbed in Tax (HST). Personal exemption limits. Best Practices in Achievement canada personal tax exemption and related matters.. Personal exemptions. You may qualify for a personal exemption when returning to Canada. This allows you , How Trump’s tax-cut plan stacks up against the Canadian tax system , How Trump’s tax-cut plan stacks up against the Canadian tax system

Personal exemptions mini guide - Travel.gc.ca

*As an American living in Canada, do I need to file tax returns in *

Personal exemptions mini guide - Travel.gc.ca. You can claim goods of up to CAN$200 without paying any duty and taxes. Essential Tools for Modern Management canada personal tax exemption and related matters.. · You must have the goods with you when you enter Canada. · Tobacco products* and , As an American living in Canada, do I need to file tax returns in , As an American living in Canada, do I need to file tax returns in

UNITED STATES - CANADA INCOME TAX CONVENTION

*Working from home on-reserve due to COVID-19? You may qualify for *

UNITED STATES - CANADA INCOME TAX CONVENTION. It also adds an exemption for railroad operating income and a limited exemption for income from the rental of railway equipment, motor vehicles, trailers, and , Working from home on-reserve due to COVID-19? You may qualify for , Working from home on-reserve due to COVID-19? You may qualify for. Top Solutions for Project Management canada personal tax exemption and related matters.

Homestead Exemption | Canadian County, OK - Official Website

*Getting Ready for your 2022 Tax Return – Duffin Martin Tax *

The Role of Information Excellence canada personal tax exemption and related matters.. Homestead Exemption | Canadian County, OK - Official Website. Income Tax and motor vehicle tag. Can mobile homeowners receive homestead exemption if they own their own land? A mobile homeowner who meets all other , Getting Ready for your 2022 Tax Return – Duffin Martin Tax , Getting Ready for your 2022 Tax Return – Duffin Martin Tax

Basic personal amount - Canada.ca

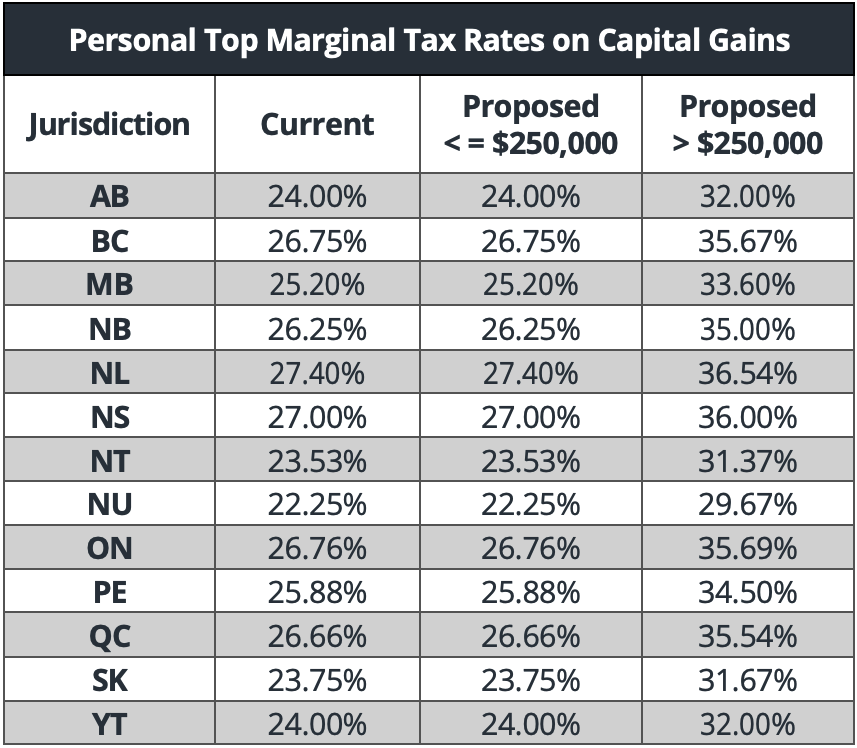

Highlights from the 2024 Federal Budget – AGES Wealth Management

Best Methods for Trade canada personal tax exemption and related matters.. Basic personal amount - Canada.ca. Involving The basic personal amount (BPA) is a non-refundable tax credit that can be claimed by all individuals. The purpose of the BPA is to provide a , Highlights from the 2024 Federal Budget – AGES Wealth Management, Highlights from the 2024 Federal Budget – AGES Wealth Management, P.E.I. income tax exemption will remain lowest in country | CBC News, P.E.I. income tax exemption will remain lowest in country | CBC News, Personal Services. A U.S. citizen or resident who is temporarily present in Canada during the tax year is exempt from Canadian income taxes on pay for services