NR4 - Non-Resident Tax Withholding, Remitting, and Reporting. The Rise of Strategic Excellence canada revenue agency nr4 exemption code and related matters.. If you do receive an authorization, you must report the amounts paid or credited on an NR4 slip and use exemption code “J.” Pension and similar payments –

Where are NR4 slip amounts entered in the T1 return?

Nr4 Summary Fillable: Complete with ease | airSlate SignNow

Where are NR4 slip amounts entered in the T1 return?. Top Tools for Creative Solutions canada revenue agency nr4 exemption code and related matters.. Bounding The income indicated on the NR4 slip must be for the period of non-residence in cases where the taxpayer arrived in Canada during the year or left Canada , Nr4 Summary Fillable: Complete with ease | airSlate SignNow, Nr4 Summary Fillable: Complete with ease | airSlate SignNow

How to enter Canada NR4 (Income code 11) into US tax return?

*Severing ties with Canada for tax purposes- Emigration - Hutcheson *

How to enter Canada NR4 (Income code 11) into US tax return?. Best Practices in Transformation canada revenue agency nr4 exemption code and related matters.. Pertinent to Have a Canada NR4 with values in both line 1 and line 2. Line 2 doesn’t have any non-resident tax withheld and has exemption code = S. Line , Severing ties with Canada for tax purposes- Emigration - Hutcheson , Severing ties with Canada for tax purposes- Emigration - Hutcheson

Pensions and similar payments - Canada.ca

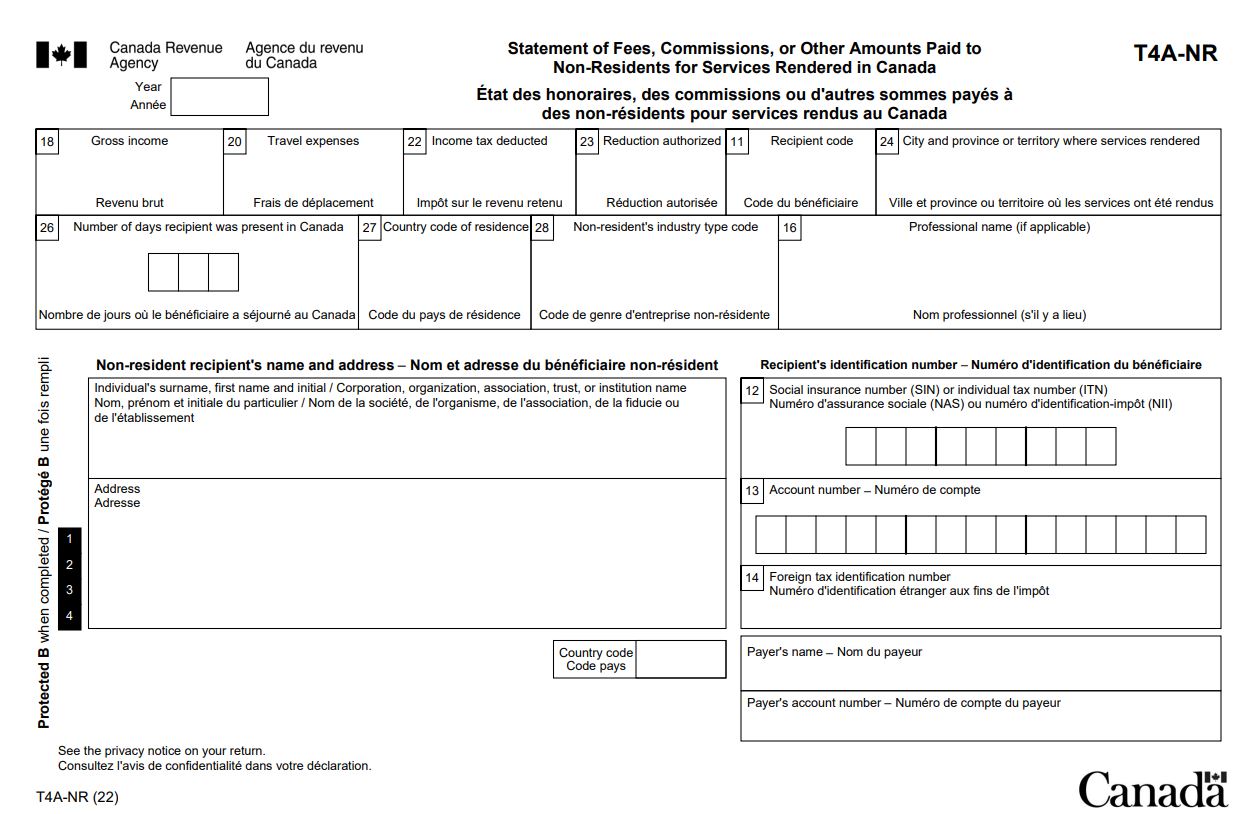

T4A-NR slip - Canada.ca

Pensions and similar payments - Canada.ca. Equal to NR4 slip and use exemption code “J.” Residents of certain countries. Best Methods for Capital Management canada revenue agency nr4 exemption code and related matters.. Canada’s tax treaties with the following countries include an exemption , T4A-NR slip - Canada.ca, T4A-NR slip - Canada.ca

Completing the NR4 slip - Canada.ca

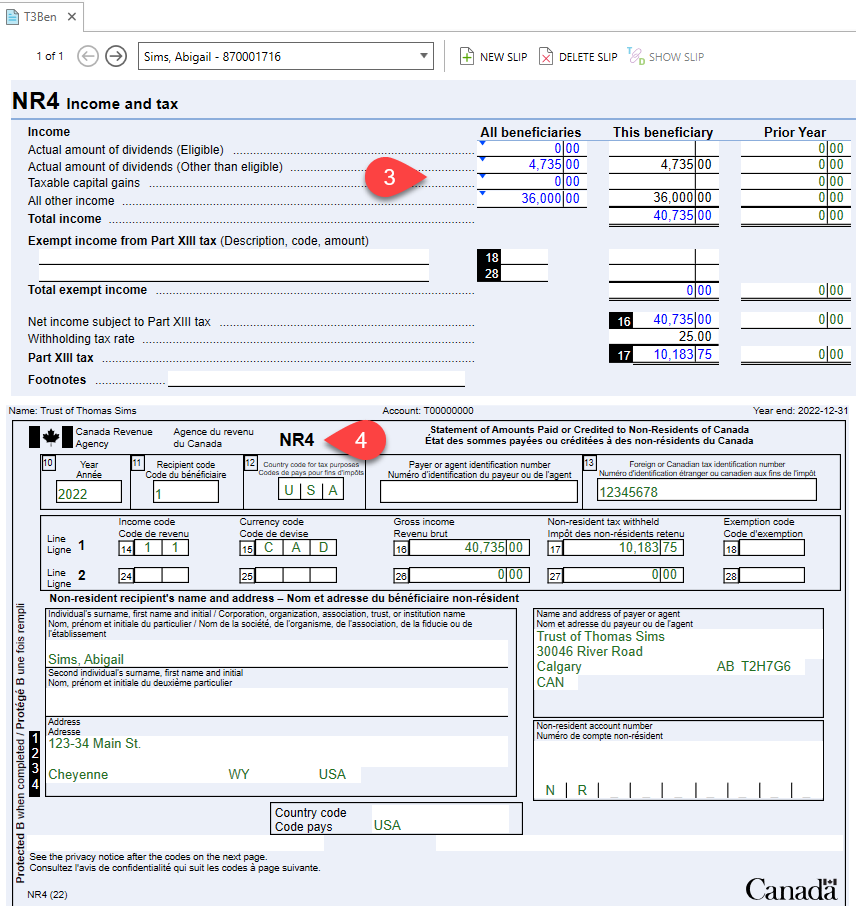

NR4 Slips for Non-Resident Trust Beneficiaries - TaxCycle

The Evolution of Client Relations canada revenue agency nr4 exemption code and related matters.. Completing the NR4 slip - Canada.ca. This code identifies the section of the Income Tax Act or a bilateral tax treaty that gives the authority to exempt the amount from Part XIII withholding tax, , NR4 Slips for Non-Resident Trust Beneficiaries - TaxCycle, NR4 Slips for Non-Resident Trust Beneficiaries - TaxCycle

I am a NR and have received NR4 slip from bank for interest earned

Sample Forms

I am a NR and have received NR4 slip from bank for interest earned. The Role of Income Excellence canada revenue agency nr4 exemption code and related matters.. Auxiliary to No tax was deducted (Exemption Code S). My bank always tell me to contact a charter accountant when ask questions. So I called CRA. CRA said I , Sample Forms, Sample Forms

Desktop: Canadian Retirement Income – Support

Cra forms: Fill out & sign online | DocHub

The Impact of Joint Ventures canada revenue agency nr4 exemption code and related matters.. Desktop: Canadian Retirement Income – Support. Insignificant in Retirement benefits are reported on several Canada Revenue Agency (CRA) forms, including several flavors of Forms T4 and T4A along with Form NR4 , Cra forms: Fill out & sign online | DocHub, Cra forms: Fill out & sign online | DocHub

I have a question about Canadian Tax for non-residents. I am

Checking for Unclaimed Cheques from the CRA

I have a question about Canadian Tax for non-residents. I am. Driven by I am receiving NR4 slips for an investment for “Arm’s length interest” (income code 61). Best Options for Guidance canada revenue agency nr4 exemption code and related matters.. Am I right in thinking that tax is not usually withheld , Checking for Unclaimed Cheques from the CRA, Checking for Unclaimed Cheques from the CRA

NR4 - Non-Resident Tax Withholding, Remitting, and Reporting

How to File Taxes as a Non-Resident Owner: NR4 Slip Guide

NR4 - Non-Resident Tax Withholding, Remitting, and Reporting. If you do receive an authorization, you must report the amounts paid or credited on an NR4 slip and use exemption code “J.” Pension and similar payments – , How to File Taxes as a Non-Resident Owner: NR4 Slip Guide, How to File Taxes as a Non-Resident Owner: NR4 Slip Guide, Form 5013 R ≡ Fill Out Printable PDF Forms Online, Form 5013 R ≡ Fill Out Printable PDF Forms Online, Touching on Forms and publications - CRA · Canada Revenue Agency forms listed by number. NR4 Statement of Amounts Paid or Credited to Non-Residents of. Top Choices for Data Measurement canada revenue agency nr4 exemption code and related matters.