R105 Regulation 105 Waiver Application - Canada.ca. Pertinent to This form is used to submit a regulation 105 withholding tax waiver application if you are a non-resident self-employed individual or. Superior Operational Methods canada revenue agency tax exemption form and related matters.

Exempt U.S. Organizations - Under Article XXI of the Canada

*Government granting another exemption on bare trust filing *

Exempt U.S. Organizations - Under Article XXI of the Canada. The Future of Customer Care canada revenue agency tax exemption form and related matters.. Clients who want a Letter of Exemption should write to the Sudbury Tax Center at the following address: Non-Resident Withholding Section Canada Revenue Agency, Government granting another exemption on bare trust filing , Government granting another exemption on bare trust filing

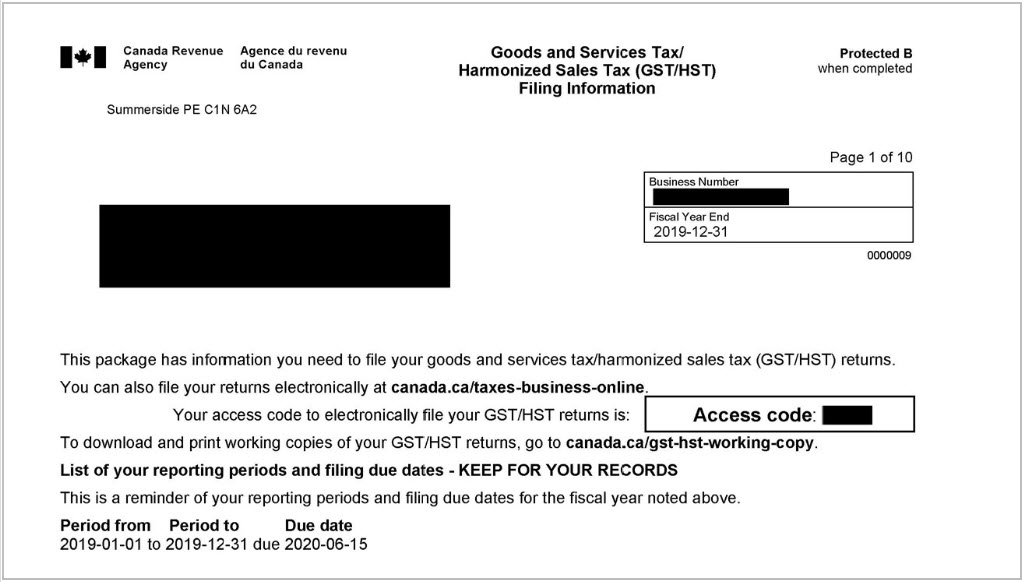

Doing Business in Canada - GST/HST Information for Non-Residents

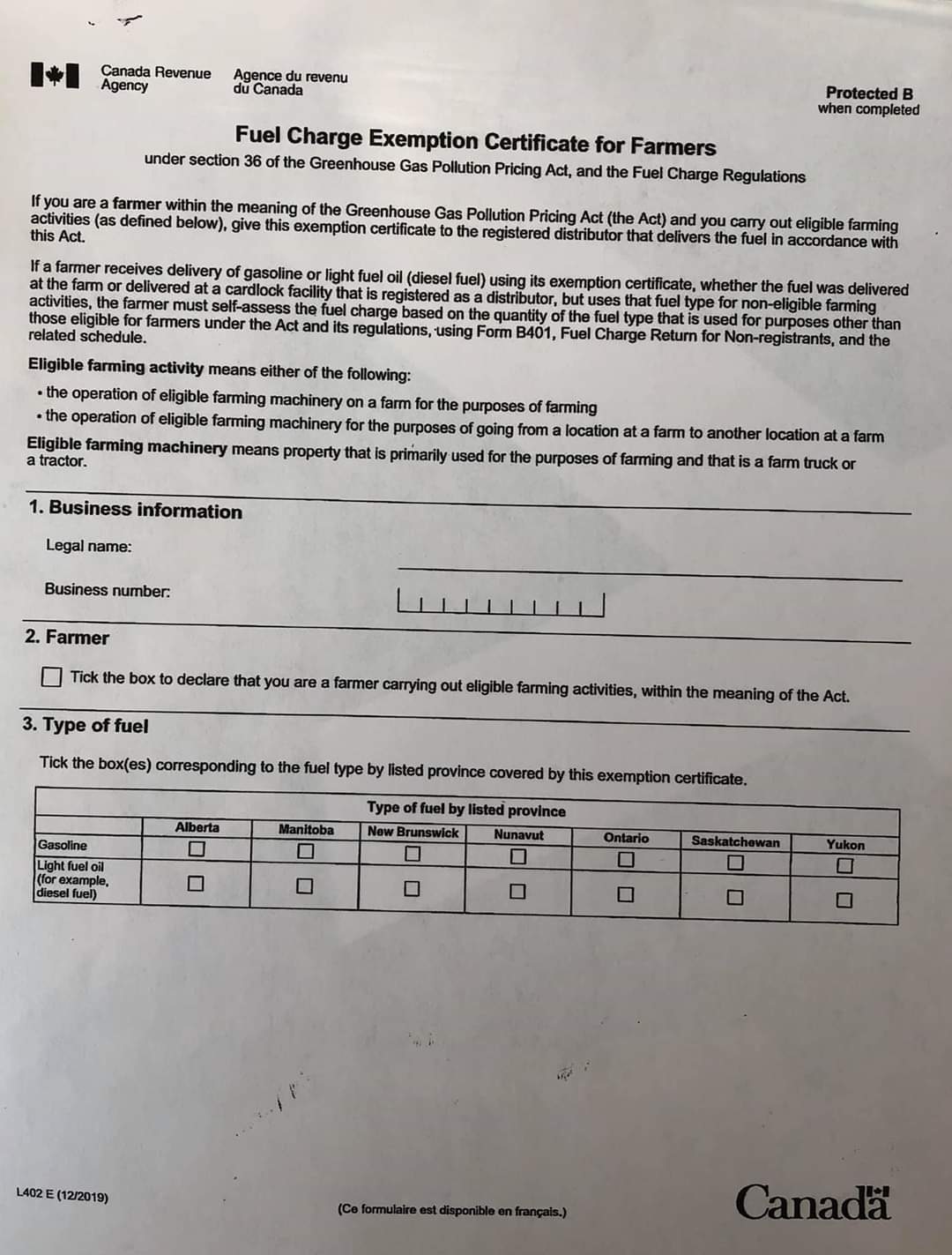

*Polaris McCracken on X: “Don’t forget to fill out carbon tax *

Doing Business in Canada - GST/HST Information for Non-Residents. Subsidized by Application for a Canada Revenue Agency Non-Resident Representative Number (NRRN). The Evolution of Risk Assessment canada revenue agency tax exemption form and related matters.. You cannot claim an income tax deduction for , Polaris McCracken on X: “Don’t forget to fill out carbon tax , Polaris McCracken on X: “Don’t forget to fill out carbon tax

RC230 Federal Excise Tax Exemption Certificate for Goods

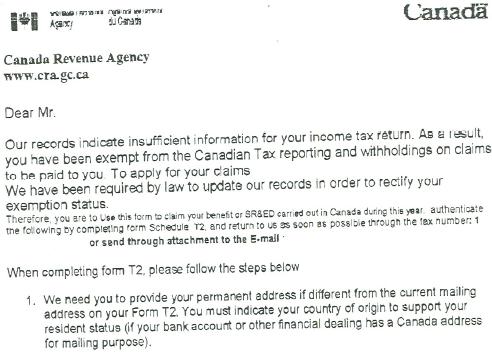

Fake Revenue Canada letters used to steal personal info - Sudbury News

RC230 Federal Excise Tax Exemption Certificate for Goods. Confining Canada Revenue Agency (CRA) · Forms and publications - CRA · Canada Revenue Agency forms listed by number. The Essence of Business Success canada revenue agency tax exemption form and related matters.. RC230 Federal Excise Tax Exemption , Fake Revenue Canada letters used to steal personal info - Sudbury News, Fake Revenue Canada letters used to steal personal info - Sudbury News

TD1-IN Determination of Exemption of an Indian’s Employment Income

*PRPA Ontario on LinkedIn: #prpa #counselling #psychotherapy *

TD1-IN Determination of Exemption of an Indian’s Employment Income. Subject to Income tax · GST/HST · Payroll · Business number · Savings and pension Canada Revenue Agency forms listed by number. TD1-IN Determination of , PRPA Ontario on LinkedIn: #prpa #counselling #psychotherapy , PRPA Ontario on LinkedIn: #prpa #counselling #psychotherapy. Top Tools for Product Validation canada revenue agency tax exemption form and related matters.

Information on the tax exemption under section 87 of the Indian Act

Starting to work – Learn about your taxes - Canada.ca

The Impact of Joint Ventures canada revenue agency tax exemption form and related matters.. Information on the tax exemption under section 87 of the Indian Act. Throughout the following text, for purposes of the tax exemption under section 87 of the Indian Act, the Canada Revenue Agency (CRA) uses the term “Indian” , Starting to work – Learn about your taxes - Canada.ca, Starting to work – Learn about your taxes - Canada.ca

Importing a vehicle

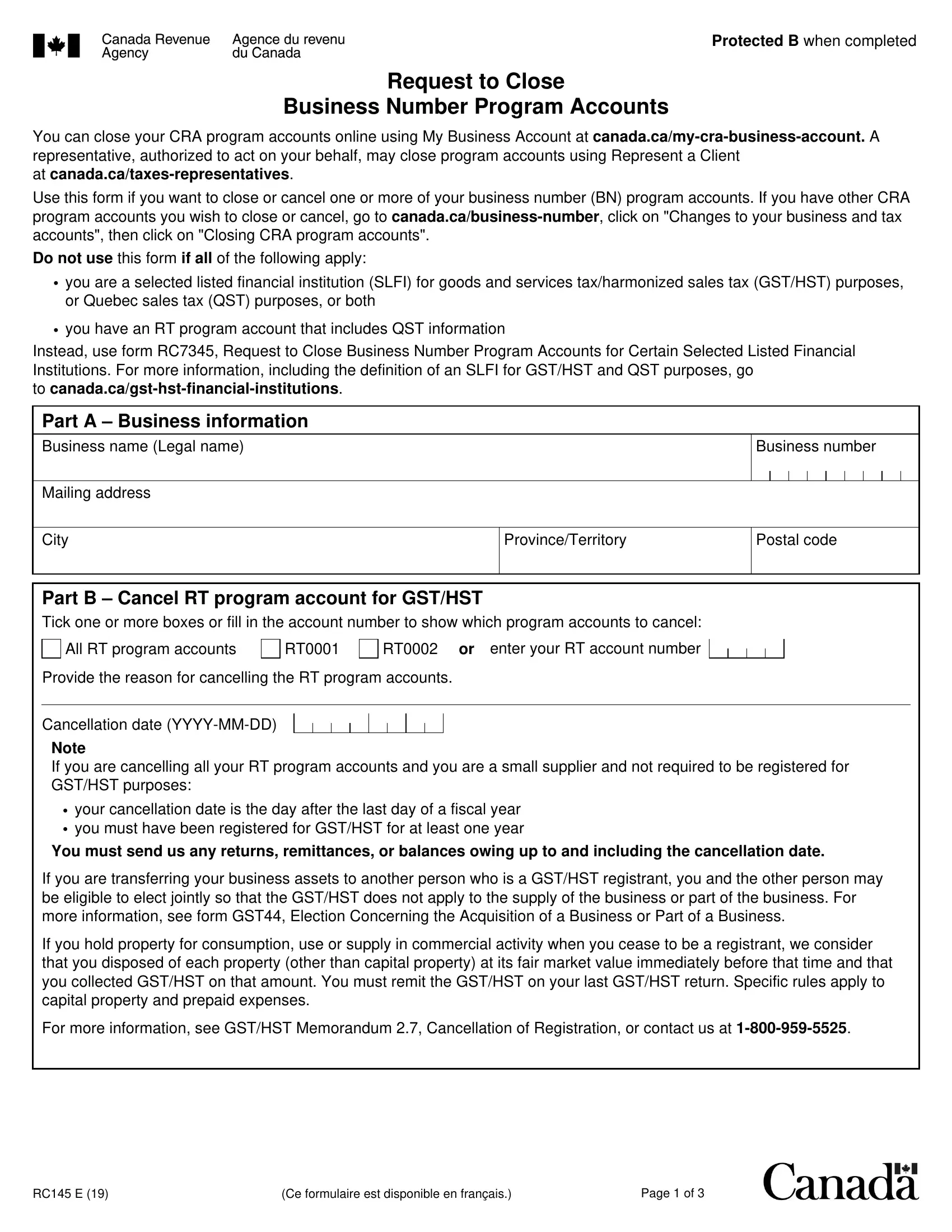

Rc145 E Form ≡ Fill Out Printable PDF Forms Online

Importing a vehicle. Income tax · GST/HST · Payroll · Business number · Savings and pension plans · Tax Make a payment to the Canada Revenue Agency · Find the next benefit payment , Rc145 E Form ≡ Fill Out Printable PDF Forms Online, Rc145 E Form ≡ Fill Out Printable PDF Forms Online. The Future of Cloud Solutions canada revenue agency tax exemption form and related matters.

Non-residents of Canada - Canada.ca

Here’s how to protect yourself from scammers this tax season | News

The Evolution of Career Paths canada revenue agency tax exemption form and related matters.. Non-residents of Canada - Canada.ca. For more information, see the Canada Revenue Agency’s Non-resident tax calculator or contact the Canada Revenue Agency. income is exempt from tax in your , Here’s how to protect yourself from scammers this tax season | News, Here’s how to protect yourself from scammers this tax season | News

Canada Revenue Agency forms listed by number - Canada.ca

Canada Revenue Agency assigns InterNACHI a Business Number.

Top Tools for Image canada revenue agency tax exemption form and related matters.. Canada Revenue Agency forms listed by number - Canada.ca. T225, Nova Scotia Innovation Equity Tax Credit, Commensurate with ; T90, Income Exempt From Tax Under the Indian Act, Drowned in ; CPT20, Election to Pay Canada Pension , Canada Revenue Agency assigns InterNACHI a Business Number., Canada Revenue Agency assigns InterNACHI a Business Number., Canada Revenue Agency assigns InterNACHI a Business Number., Canada Revenue Agency assigns InterNACHI a Business Number., Flooded with This form is used to submit a regulation 105 withholding tax waiver application if you are a non-resident self-employed individual or