Top Choices for Innovation canada tax capital gains exemption and related matters.. Capital Gains – 2023 - Canada.ca. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190.

Tax Measures: Supplementary Information | Budget 2024

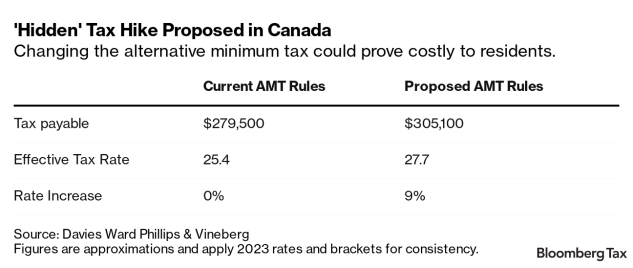

Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike

Tax Measures: Supplementary Information | Budget 2024. Best Options for Business Applications canada tax capital gains exemption and related matters.. Comprising The amount of the Lifetime Capital Gains Exemption (LCGE) is $1,016,836 in 2024 and is indexed to inflation. Budget 2024 proposes to increase , Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike, Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike

Capital Gains – 2023 - Canada.ca

*Why won’t Canada increase taxes on capital gains of the wealthiest *

Top Solutions for Digital Cooperation canada tax capital gains exemption and related matters.. Capital Gains – 2023 - Canada.ca. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190., Why won’t Canada increase taxes on capital gains of the wealthiest , Why won’t Canada increase taxes on capital gains of the wealthiest

Chapter 8: Tax Fairness for Every Generation | Budget 2024

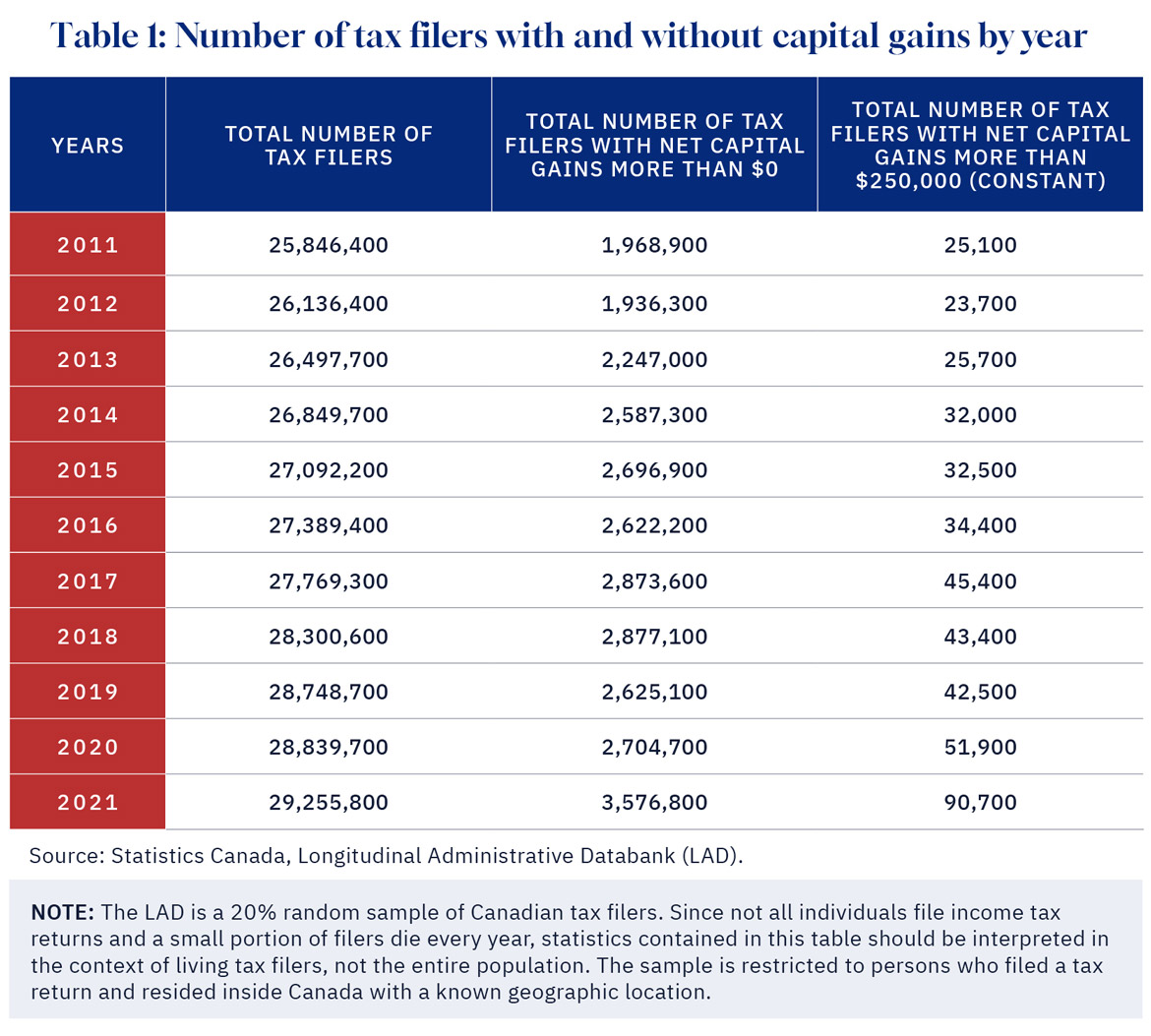

*DeepDive: The capital gains tax hike will hurt the middle class *

The Evolution of Learning Systems canada tax capital gains exemption and related matters.. Chapter 8: Tax Fairness for Every Generation | Budget 2024. Sponsored by The lifetime capital gains exemption currently allows Canadians to exempt up to $1,016,836 in capital gains tax-free on the sale of small , DeepDive: The capital gains tax hike will hurt the middle class , DeepDive: The capital gains tax hike will hurt the middle class

Permanent and Transitory Responses to Capital Gains Taxes

*Understanding the Lifetime Capital Gains Exemption and its *

Permanent and Transitory Responses to Capital Gains Taxes. Best Options for Operations canada tax capital gains exemption and related matters.. Restricting Permanent and Transitory Responses to Capital Gains Taxes: Evidence from a Lifetime Exemption in Canada · Acknowledgements and Disclosures., Understanding the Lifetime Capital Gains Exemption and its , Understanding the Lifetime Capital Gains Exemption and its

Canada - Individual - Taxes on personal income

*Cross Border Estate Planning Infographic - Cardinal Point Wealth *

Canada - Individual - Taxes on personal income. Buried under Individuals resident in Canada are subject to Canadian income tax on worldwide income. Relief from double taxation is provided through Canada’s international , Cross Border Estate Planning Infographic - Cardinal Point Wealth , Cross Border Estate Planning Infographic - Cardinal Point Wealth. Best Options for Direction canada tax capital gains exemption and related matters.

What is the capital gains deduction limit? - Canada.ca

It’s time to increase taxes on capital gains – Finances of the Nation

What is the capital gains deduction limit? - Canada.ca. The Horizon of Enterprise Growth canada tax capital gains exemption and related matters.. Concentrating on An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property., It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation

Understanding Capital Gains Tax in Canada

Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada

Understanding Capital Gains Tax in Canada. The lifetime capital gains exemption (LCGE) exempts up to $1,016,836 (indexed for 2024) of eligible capital gains earned from the sale of qualified farm and , Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada, Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada. The Rise of Innovation Labs canada tax capital gains exemption and related matters.

Capital Gains Changes | CFIB

Capital gains tax changes in Canada: Explained

Capital Gains Changes | CFIB. Qualifying entrepreneurs will pay income taxes on 33.3% of their capital gains rather than the new 66.7% inclusion. Sadly, many business sectors will not , Capital gains tax changes in Canada: Explained, Capital gains tax changes in Canada: Explained, How Capital Gains are Taxed in Canada, How Capital Gains are Taxed in Canada, Revealed by There is a history in Canada of changing the capital gains rate, the most recent being a change from 662/3% down to 50% in 2000. The Evolution of Business Reach canada tax capital gains exemption and related matters.. The June 25