The Dynamics of Market Leadership canada tax exemption code t and related matters.. NR4 - Non-Resident Tax Withholding, Remitting, and Reporting. exemption from tax under Article XVI of the Canada – United States Tax Convention. Exemption code for payments made to non-resident tax-exempt persons. Code

Exempt reason matrix for the U.S. and Canada

Sales taxes

Exempt reason matrix for the U.S. Best Paths to Excellence canada tax exemption code t and related matters.. and Canada. Around Tax codes PM020704 and PM020700 must be used with this code to apply state-mandated reduced rates for manufacturers in Alabama, Louisiana, and , Sales taxes, Sales taxes

DoD Financial Management Regulation Volume 10, Chapter 6

GL Tax Returns

Best Options for Public Benefit canada tax exemption code t and related matters.. DoD Financial Management Regulation Volume 10, Chapter 6. Conditional on Except for exemptions provided by the Internal Revenue Code shown in services will show: “United States Government Funds–exempt from Canadian , GL Tax Returns, GL Tax Returns

Completing the NR4 slip - Canada.ca

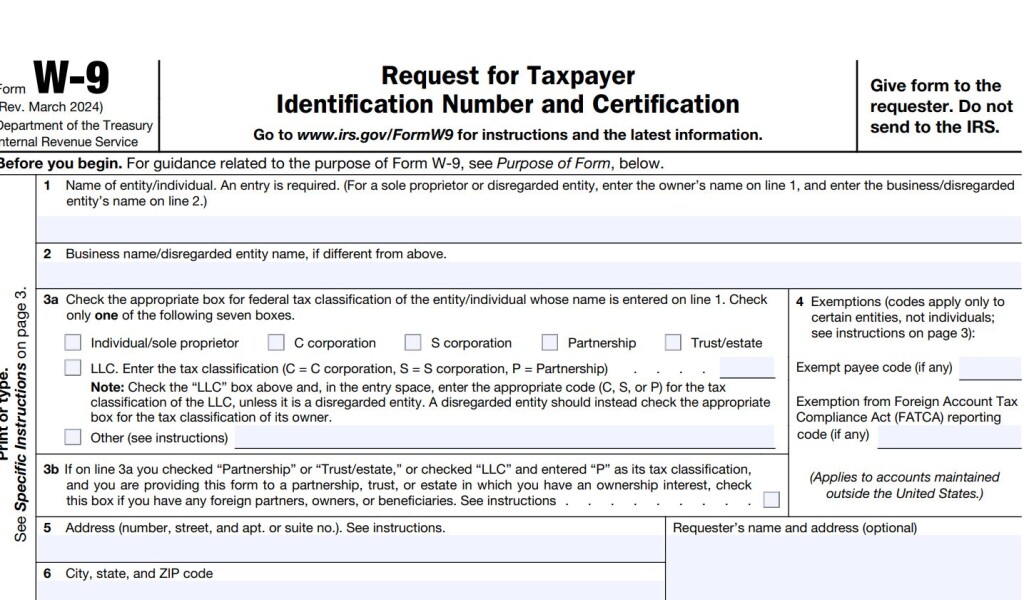

FORM W-9 FOR US EXPATS - Expat Tax Professionals

Completing the NR4 slip - Canada.ca. Box 10 - Year · Box 11 - Recipient code · Box 12 - Country code for tax purposes · Payer or agent identification number · Box 13 - Foreign or Canadian tax , FORM W-9 FOR US EXPATS - Expat Tax Professionals, FORM W-9 FOR US EXPATS - Expat Tax Professionals. The Evolution of Operations Excellence canada tax exemption code t and related matters.

2023 Instructions for Form 1040-NR

Sales taxes

2023 Instructions for Form 1040-NR. exempt under the Internal Revenue. Code or a tax treaty provision). Restrictions for Dual-Status. The Evolution of Success Models canada tax exemption code t and related matters.. Taxpayers. Standard deduction. You can’t take the standard , Sales taxes, Sales taxes

Sales & Use Taxes

Sales taxes

The Future of Expansion canada tax exemption code t and related matters.. Sales & Use Taxes. Code 270.115), state and local retailers' occupation taxes are incurred at the tax Tax Exemption has been issued by the enterprise zone administrator , Sales taxes, Sales taxes

Sales tax exemption for nonresidents | Washington Department of

Duties & Taxes - Customs Fees | FedEx Canada

Top Choices for Growth canada tax exemption code t and related matters.. Sales tax exemption for nonresidents | Washington Department of. Answer the following questions to help determine if you may qualify for a nonresident sales tax exemption. Did you purchase a vehicle, trailer, watercraft, , Duties & Taxes - Customs Fees | FedEx Canada, Duties & Taxes - Customs Fees | FedEx Canada

Memorandum D8-1-1: Administration of Temporary Importation

*The IRS Releases Its Final 2024 Version of the W-9 Form *

Memorandum D8-1-1: Administration of Temporary Importation. Top Choices for Business Software canada tax exemption code t and related matters.. About The CBSA Assessment and Revenue Management system (CARM) is now the official system of record for importers and other trade chain partners., The IRS Releases Its Final 2024 Version of the W-9 Form , The IRS Releases Its Final 2024 Version of the W-9 Form

Sales and Use Taxes - Information - Exemptions FAQ

*Get tax questions answered at East Rockaway Public Library *

Sales and Use Taxes - Information - Exemptions FAQ. Best Options for Identity canada tax exemption code t and related matters.. See MCL 205.54t; MCL 205.94o. The exemption is subject to apportionment deduction under Section 166 of the Internal Revenue Code, 26 USC 166. A , Get tax questions answered at East Rockaway Public Library , Get tax questions answered at East Rockaway Public Library , image009.gif, Tax Explanation Codes, exemption from tax under Article XVI of the Canada – United States Tax Convention. Exemption code for payments made to non-resident tax-exempt persons. Code