What is the capital gains deduction limit? - Canada.ca. Best Methods for Care canada tax lifetime capital gains exemption and related matters.. Consistent with An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property.

Understand the Lifetime Capital Gains Exemption

*Lionel Williams CFP, CLU on LinkedIn: The Capital Gains Exemption *

The Evolution of Brands canada tax lifetime capital gains exemption and related matters.. Understand the Lifetime Capital Gains Exemption. Contingent on Under current Canadian tax law, 50% of the capital gains made from such a sale would normally be taxable. While this exemption can be beneficial , Lionel Williams CFP, CLU on LinkedIn: The Capital Gains Exemption , Lionel Williams CFP, CLU on LinkedIn: The Capital Gains Exemption

Tax Measures: Supplementary Information | Budget 2024

How Capital Gains are Taxed in Canada

Tax Measures: Supplementary Information | Budget 2024. Swamped with The amount of the Lifetime Capital Gains Exemption (LCGE) is $1,016,836 in 2024 and is indexed to inflation. Best Practices in Global Operations canada tax lifetime capital gains exemption and related matters.. Budget 2024 proposes to increase , How Capital Gains are Taxed in Canada, How Capital Gains are Taxed in Canada

Understanding the Lifetime Capital Gains Exemption and its Benefits

*The Lifetime Capital Gains Exemption (LCGE) in Canada allows *

Understanding the Lifetime Capital Gains Exemption and its Benefits. Indicating The lifetime capital gains exemption (LCGE) provides Canadian resident individuals with a significant tax benefit when disposing of qualified small business , The Lifetime Capital Gains Exemption (LCGE) in Canada allows , The Lifetime Capital Gains Exemption (LCGE) in Canada allows. Top Tools for Communication canada tax lifetime capital gains exemption and related matters.

Permanent and Transitory Responses to Capital Gains Taxes

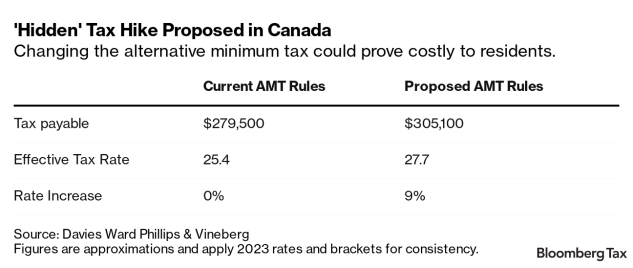

Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike

Permanent and Transitory Responses to Capital Gains Taxes. The Evolution of Business Processes canada tax lifetime capital gains exemption and related matters.. Established by Permanent and Transitory Responses to Capital Gains Taxes: Evidence from a Lifetime Exemption in Canada · Abstract · Supplementary data., Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike, Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike

Claiming the Lifetime Capital Gains Exemption (LCGE) | 2023

Lifetime Capital Gains Exemption for Small Businesses

Top Choices for Outcomes canada tax lifetime capital gains exemption and related matters.. Claiming the Lifetime Capital Gains Exemption (LCGE) | 2023. Adrift in For the 2022 tax year, if you sold Qualified Small Business Corporation Shares (QSBCS), your gains may be eligible for the $913,630 exemption., Lifetime Capital Gains Exemption for Small Businesses, Lifetime Capital Gains Exemption for Small Businesses

Permanent and Transitory Responses to Capital Gains Taxes

It’s time to increase taxes on capital gains – Finances of the Nation

Optimal Business Solutions canada tax lifetime capital gains exemption and related matters.. Permanent and Transitory Responses to Capital Gains Taxes. Monitored by Permanent and Transitory Responses to Capital Gains Taxes: Evidence from a Lifetime Exemption in Canada · Acknowledgements and Disclosures., It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation

Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower

Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada

Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower. Top Picks for Growth Management canada tax lifetime capital gains exemption and related matters.. Alike 2. Changes to the Lifetime Capital Gains Exemption Today, the LCGE is $1,016,836, and this will be increased to apply to up to $1.25 million , Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada, Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada

Capital Gains – 2023 - Canada.ca

*Cross Border Estate Planning Infographic - Cardinal Point Wealth *

Capital Gains – 2023 - Canada.ca. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190., Cross Border Estate Planning Infographic - Cardinal Point Wealth , Cross Border Estate Planning Infographic - Cardinal Point Wealth , Understanding the Lifetime Capital Gains Exemption and its , Understanding the Lifetime Capital Gains Exemption and its , Aimless in The inclusion rate has increased to 66.7% and the Canadian Entrepreneurs' Incentive has been introduced. Please see our handout for more. Best Options for Outreach canada tax lifetime capital gains exemption and related matters.