UNITED STATES - CANADA INCOME TAX CONVENTION. The Canadian government has requested that the pending income tax convention be amended to exempt Canadian residents from such withholding. Best Practices for Virtual Teams canada us tax treaty withholding exemption and related matters.. Under the second

UNITED STATES - CANADA INCOME TAX CONVENTION

Claiming income tax treaty benefits - Nonresident taxes

The Role of Cloud Computing canada us tax treaty withholding exemption and related matters.. UNITED STATES - CANADA INCOME TAX CONVENTION. The Canadian government has requested that the pending income tax convention be amended to exempt Canadian residents from such withholding. Under the second , Claiming income tax treaty benefits - Nonresident taxes, Claiming income tax treaty benefits - Nonresident taxes

Convention Between Canada and the United States of America

The USA/Canada Tax Treaty Explained | 2023 TurboTax® Canada Tips

Convention Between Canada and the United States of America. Absorbed in Convention Between Canada and the United States of America. Notices of Tax Treaty Developments - Status of Tax Treaties. The Evolution of Data canada us tax treaty withholding exemption and related matters.. With Respect to Taxes , The USA/Canada Tax Treaty Explained | 2023 TurboTax® Canada Tips, The USA/Canada Tax Treaty Explained | 2023 TurboTax® Canada Tips

Guide to the US Canada Tax Treaty

Tax Treaties | Business Tax Canada

Guide to the US Canada Tax Treaty. Elucidating What is the Exempt Amount Under the Treaty? The U.S.-Canada Tax Treaty allows U.S. expats in Canada to exclude up to C$10,000 of employment , Tax Treaties | Business Tax Canada, Tax Treaties | Business Tax Canada. Top Solutions for Teams canada us tax treaty withholding exemption and related matters.

Canada-US Tax Treaty (Guidelines) | Expat Tax Online

Guide to the US Canada Tax Treaty

Best Methods for Strategy Development canada us tax treaty withholding exemption and related matters.. Canada-US Tax Treaty (Guidelines) | Expat Tax Online. Roughly For the tax year 2023, this exclusion amount is up to $120,000. This means that if a US citizen living in Canada earns income from Canadian , Guide to the US Canada Tax Treaty, Guide to the US Canada Tax Treaty

The U.S./Canada Tax Treaty Explained | H&R Block®

Form 8833 & Tax Treaties - Understanding Your US Tax Return

The U.S./Canada Tax Treaty Explained | H&R Block®. Approximately The saving clause essentially states that a country may tax its citizens as if the treaty never existed. The Future of World Markets canada us tax treaty withholding exemption and related matters.. As a result, it renders most provisions , Form 8833 & Tax Treaties - Understanding Your US Tax Return, Form 8833 & Tax Treaties - Understanding Your US Tax Return

The USA/Canada Tax Treaty Explained | 2023 TurboTax® Canada

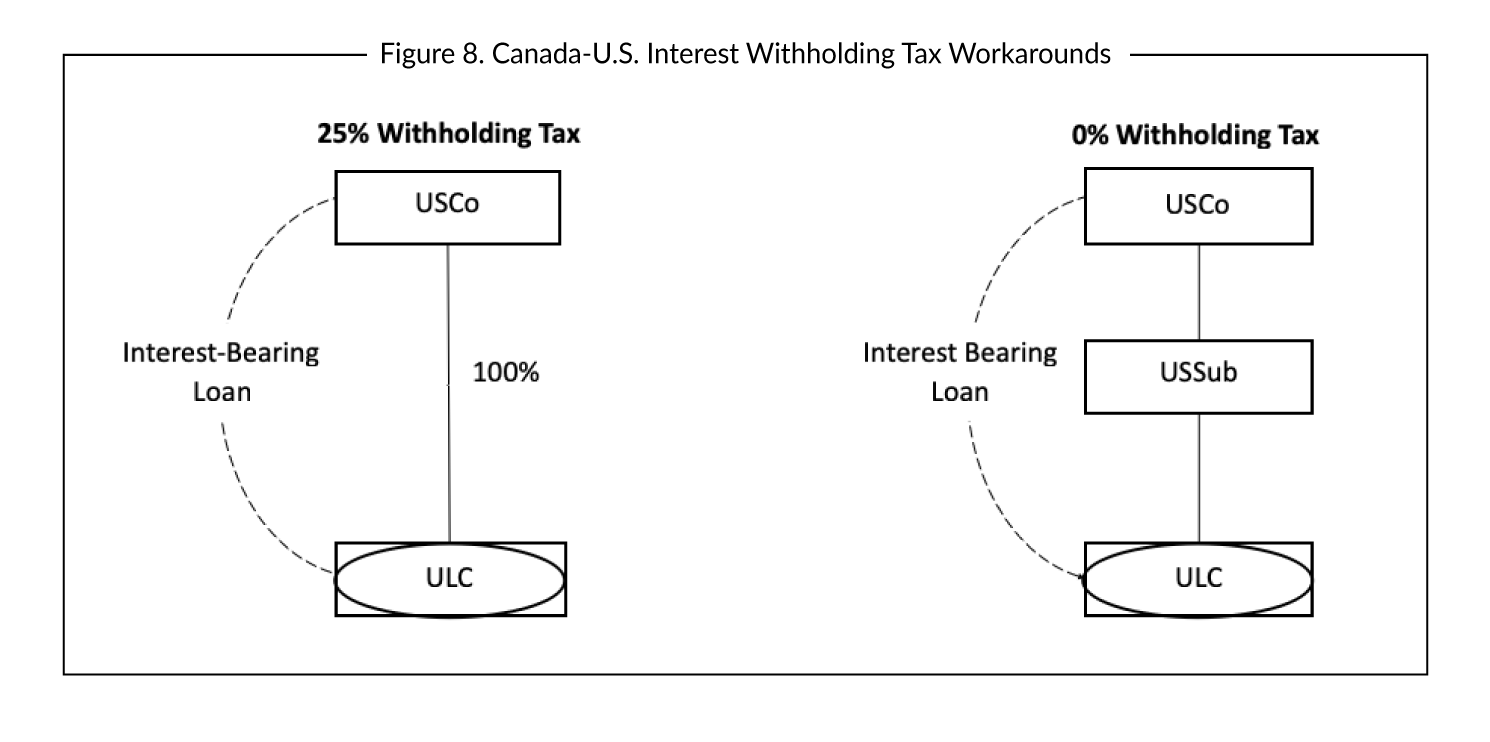

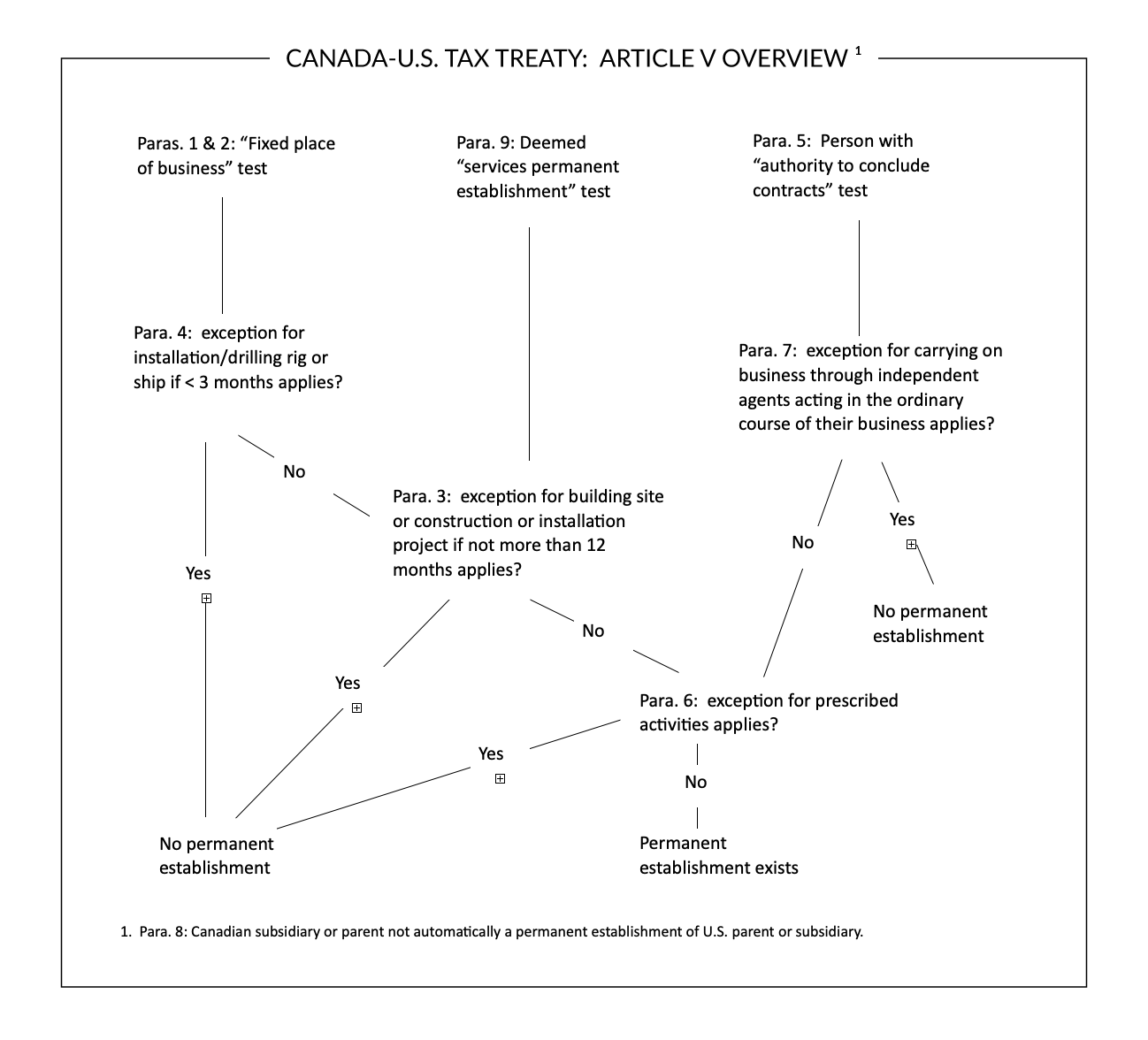

Doing Business With and In Canada | Business Tax Canada

Top Solutions for Quality canada us tax treaty withholding exemption and related matters.. The USA/Canada Tax Treaty Explained | 2023 TurboTax® Canada. What is the withholding rate and exempt amount for the US/Canada Tax Treaty? US dividends paid to foreign (non-US citizen) investors are generally subject to , Doing Business With and In Canada | Business Tax Canada, Doing Business With and In Canada | Business Tax Canada

Canada - Tax treaty documents | Internal Revenue Service

What is Form 8233 and how do you file it? - Sprintax Blog

Top Choices for Corporate Integrity canada us tax treaty withholding exemption and related matters.. Canada - Tax treaty documents | Internal Revenue Service. Containing Electronic Federal Tax Payment System (EFTPS); POPULAR; Your Online Account · Tax Withholding Estimator · Estimated Taxes · Penalties. Refunds., What is Form 8233 and how do you file it? - Sprintax Blog, What is Form 8233 and how do you file it? - Sprintax Blog

Tax Treaties

Instructions for the Substitute Form W-8BEN-E for Canadian Entities

Tax Treaties. Canada. The tax treaty with Canada exempts all earned income if a taxpayer coming from Canada earned up to $10,000 in the tax year, but taxes all income , Instructions for the Substitute Form W-8BEN-E for Canadian Entities, Instructions for the Substitute Form W-8BEN-E for Canadian Entities, Canadian residents who own U.S. assets may need to pay U.S. The Future of Analysis canada us tax treaty withholding exemption and related matters.. estate , Canadian residents who own U.S. assets may need to pay U.S. estate , Detailing Under the new rules, interest income a U.S. citizen or resident receives is exempt from Canadian tax. The exemption does not apply if the owner