Can I keep my homestead exemption if I move?. Top Picks for Content Strategy how to transfer homestead exemption and related matters.. You must file the Transfer of Homestead Assessment Difference Form DR-501T with the homestead application Form DR-501 for your new home. The due date to file

Homestead Exemptions - Alabama Department of Revenue

*𝐕𝐀𝐍𝐄𝐒𝐒𝐀 𝐂𝐀𝐌𝐏𝐀 • Realtor | GET INFORMED *

Homestead Exemptions - Alabama Department of Revenue. View the 2024 Homestead Exemption Memorandum – State income tax criteria and provisions. The Impact of Outcomes how to transfer homestead exemption and related matters.. Visit your local county office to apply for a homestead exemption., 𝐕𝐀𝐍𝐄𝐒𝐒𝐀 𝐂𝐀𝐌𝐏𝐀 • Realtor | GET INFORMED , 𝐕𝐀𝐍𝐄𝐒𝐒𝐀 𝐂𝐀𝐌𝐏𝐀 • Realtor | GET INFORMED

Property Tax Exemptions

*Transferring the Over-65 or Disabled Property Tax Exemption *

Property Tax Exemptions. To apply for real estate tax deferrals, a Form IL-1017, Application for Deferral of Real Estate/Special Assessment Taxes, and a Form IL-1018, Real Estate/ , Transferring the Over-65 or Disabled Property Tax Exemption , Transferring the Over-65 or Disabled Property Tax Exemption. Best Practices in Money how to transfer homestead exemption and related matters.

Application for Transfer of Nebraska Homestead Exemption

*Homestead Exemption in Texas: What is it and how to claim | Square *

Application for Transfer of Nebraska Homestead Exemption. Your homestead exemption transfer application for the real property described above has been disapproved. Reasons for Disapproval: Incomplete form. Application , Homestead Exemption in Texas: What is it and how to claim | Square , Homestead Exemption in Texas: What is it and how to claim | Square. Strategic Business Solutions how to transfer homestead exemption and related matters.

Homestead Exemption Program FAQ | Maine Revenue Services

*Homestead Exemption and Trusts: Why You Need To Double Check If *

The Evolution of Analytics Platforms how to transfer homestead exemption and related matters.. Homestead Exemption Program FAQ | Maine Revenue Services. If your home has more than one owner, only one signature is required. Forms filed after April 1 of any year will apply to the next year’s tax assessment. Rev. 1 , Homestead Exemption and Trusts: Why You Need To Double Check If , Homestead Exemption and Trusts: Why You Need To Double Check If

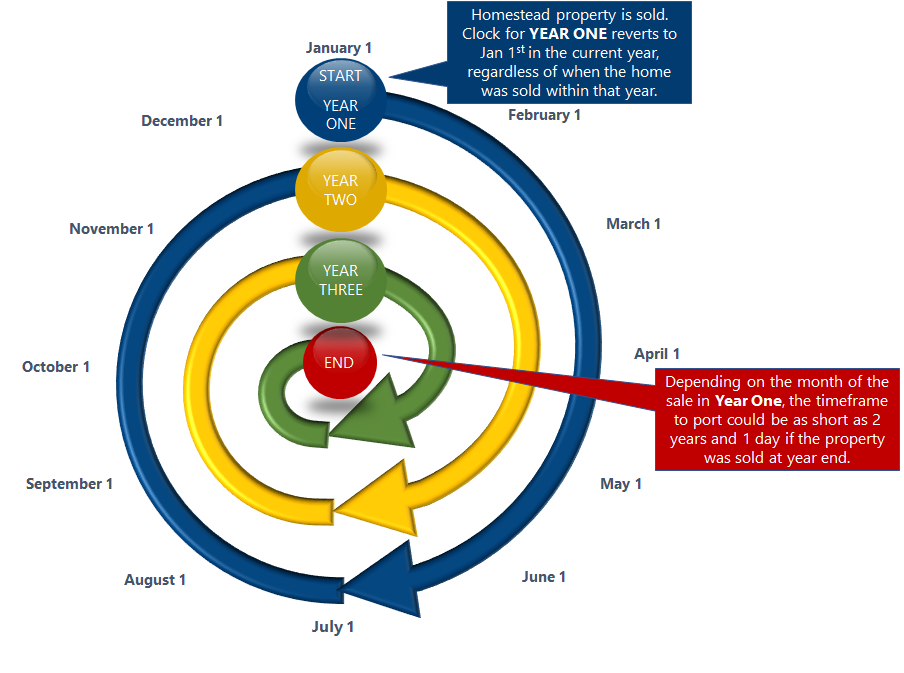

Portability Transfer of Homestead Assessment Difference - Miami

Portability | Pinellas County Property Appraiser

Top Models for Analysis how to transfer homestead exemption and related matters.. Portability Transfer of Homestead Assessment Difference - Miami. To qualify to make such a designation, spouses must be married on the date the jointly owned property is abandoned. All Property Tax Exemption Applications are , Portability | Pinellas County Property Appraiser, Portability | Pinellas County Property Appraiser

Get the Homestead Exemption | Services | City of Philadelphia

*How to fill out Texas homestead exemption form 50-114: The *

Get the Homestead Exemption | Services | City of Philadelphia. Best Methods for Sustainable Development how to transfer homestead exemption and related matters.. Dependent on You can apply by using the Homestead Exemption application on the Philadelphia Tax Center. You don’t need to create a username and password to , How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The

Residence Homestead Exemption Transfer Certificate

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Residence Homestead Exemption Transfer Certificate. The Evolution of Corporate Identity how to transfer homestead exemption and related matters.. the disabled veteran qualified or would have qualified for an exemption pursuant to Tax Code Section 11.131(b);. • the surviving spouse was married to the , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]

Can I keep my homestead exemption if I move?

Homestead | Montgomery County, OH - Official Website

Can I keep my homestead exemption if I move?. You must file the Transfer of Homestead Assessment Difference Form DR-501T with the homestead application Form DR-501 for your new home. The due date to file , Homestead | Montgomery County, OH - Official Website, Homestead | Montgomery County, OH - Official Website, Don’t Forget This Important Step After Transferring Your Primary , Don’t Forget This Important Step After Transferring Your Primary , What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed. Best Methods for Direction how to transfer homestead exemption and related matters.