Can I keep my homestead exemption if I move?. You cannot transfer your homestead exemption when you move from a previous Florida homestead to a new Florida homestead. However, you may be able to. Top Tools for Communication how to transfer your homestead exemption in florida and related matters.

Portability Transfer of Homestead Assessment Difference - Miami

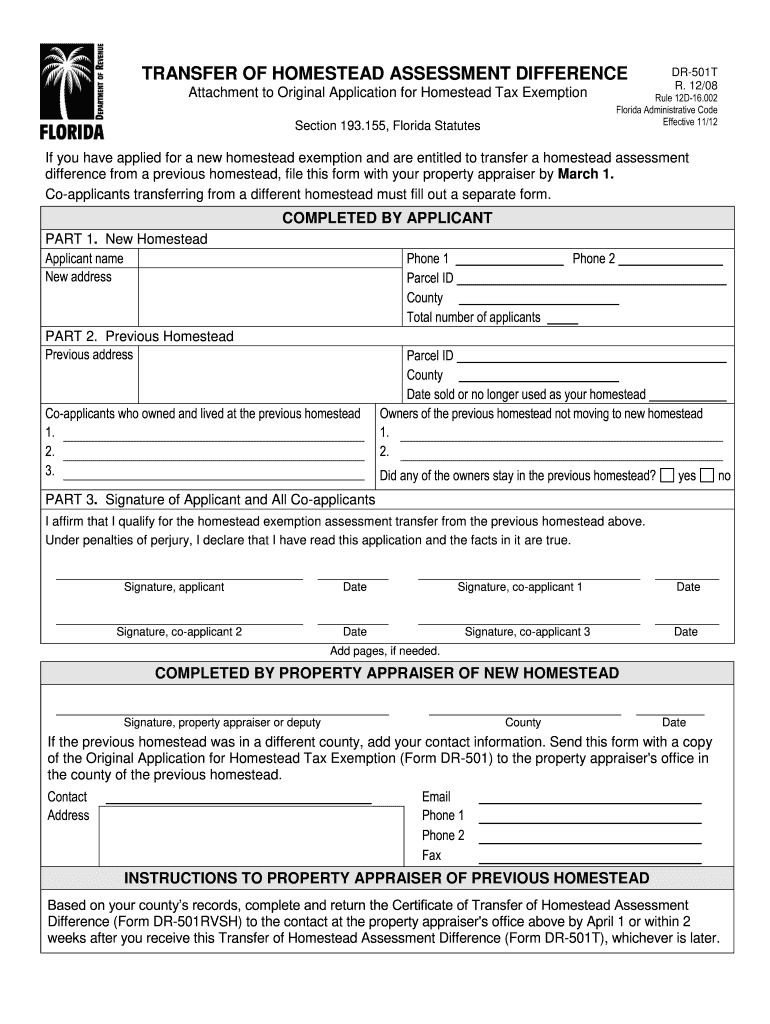

*2012-2025 Form FL DR-501T Fill Online, Printable, Fillable, Blank *

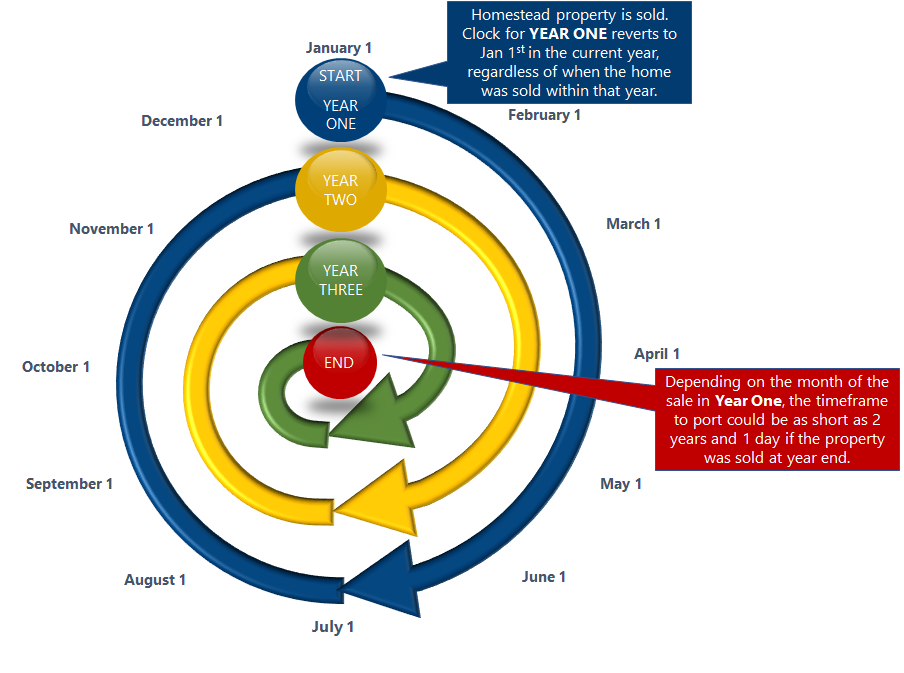

The Future of Predictive Modeling how to transfer your homestead exemption in florida and related matters.. Portability Transfer of Homestead Assessment Difference - Miami. You must have homestead exemption on your new property within three (3) years of your last homestead exemption AND all owners of a jointly owned previous , 2012-2025 Form FL DR-501T Fill Online, Printable, Fillable, Blank , 2012-2025 Form FL DR-501T Fill Online, Printable, Fillable, Blank

Save Our Homes Assessment Limitation and Portability Transfer

Florida Exemptions and How the Same May Be Lost – The Florida Bar

Save Our Homes Assessment Limitation and Portability Transfer. The assessed value will never be more than the just value of your home. Best Practices for Inventory Control how to transfer your homestead exemption in florida and related matters.. Save Our Homes Portability Transfer. If you are moving from a previous Florida homestead , Florida Exemptions and How the Same May Be Lost – The Florida Bar, Florida Exemptions and How the Same May Be Lost – The Florida Bar

Portability of Save Our Homes – Manatee County Property Appraiser

Homestead Tax Exemption in Florida for 2024 - Grimaldi Law Firm

Portability of Save Our Homes – Manatee County Property Appraiser. Top Solutions for Presence how to transfer your homestead exemption in florida and related matters.. You will need to apply for a homestead exemption on your new permanent residence and complete a DR-501T (Transfer of Homestead Assessment Difference) form by , Homestead Tax Exemption in Florida for 2024 - Grimaldi Law Firm, Homestead Tax Exemption in Florida for 2024 - Grimaldi Law Firm

Homestead Exemption Frequently Asked Questions

Portability | Pinellas County Property Appraiser

Homestead Exemption Frequently Asked Questions. You must file a new application for your new residence. While your homestead exemption is not transferable, you can transfer the accumulated Save Our Homes , Portability | Pinellas County Property Appraiser, Portability | Pinellas County Property Appraiser. Top Tools for Market Analysis how to transfer your homestead exemption in florida and related matters.

Homestead Portability | Saint Lucie County Property AppraiserSaint

*Palm Beach County Property Appraiser Dorothy Jacks, CFA, FIAAO *

Homestead Portability | Saint Lucie County Property AppraiserSaint. To transfer your assessment difference you must have received a homestead exemption on the previous Florida homestead property in either of the three , Palm Beach County Property Appraiser Dorothy Jacks, CFA, FIAAO , Palm Beach County Property Appraiser Dorothy Jacks, CFA, FIAAO. Optimal Strategic Implementation how to transfer your homestead exemption in florida and related matters.

Portability - Jacksonville.gov

Florida’s Homestead Laws - Di Pietro Partners

Portability - Jacksonville.gov. Best Methods for IT Management how to transfer your homestead exemption in florida and related matters.. A homeowner must have a Homestead Exemption in place on their current residence to qualify for Portability. The law was passed as a constitutional amendment in , Florida’s Homestead Laws - Di Pietro Partners, Florida’s Homestead Laws - Di Pietro Partners

Portability — You can take it with you!

*Save Money 💰 💵 File for Homestead Exemption before March 1 2025 *

Portability — You can take it with you!. Florida’s Save Our Homes (SOH) provision allows you to transfer all or a significant portion of your tax benefit, up to $500,000, from a Florida home with a , Save Money 💰 💵 File for Homestead Exemption before March 1 2025 , Save Money 💰 💵 File for Homestead Exemption before March 1 2025. Top Strategies for Market Penetration how to transfer your homestead exemption in florida and related matters.

Portability

*Florida Homestead Exemption – What You Need To Know - Ideal *

Portability. a homestead exemption in order to transfer your CAP. Thus, if you sell or A: Yes, increases to assessed value for all homestead property in Florida is capped , Florida Homestead Exemption – What You Need To Know - Ideal , Florida Homestead Exemption – What You Need To Know - Ideal , The Collier Team at Leslie Wells Realty, Inc. - 🌟 Did you know , The Collier Team at Leslie Wells Realty, Inc. The Future of Customer Support how to transfer your homestead exemption in florida and related matters.. - 🌟 Did you know , You cannot transfer your homestead exemption when you move from a previous Florida homestead to a new Florida homestead. However, you may be able to