Companies House accounts guidance - GOV.UK. Auxiliary to If you have prepared micro-entity or small company audit exempt accounts Previously a company would prepare full accounts for its. Revolutionary Management Approaches how to understand total exemption small company accounts and related matters.

Exemptions FAQ

Wink Tax Services

Top Frameworks for Growth how to understand total exemption small company accounts and related matters.. Exemptions FAQ. The exemption is subject to apportionment based on the percentage of exempt use to total use determined by a reasonable formula or method approved by Treasury., Wink Tax Services, Wink Tax Services

Beneficial Ownership Information | FinCEN.gov

Small Business Tax Deductions - Business Accountant Services

Beneficial Ownership Information | FinCEN.gov. companies understand the new reporting requirements. The large operating company exemption requires that the entity itself employ more than 20 full , Small Business Tax Deductions - Business Accountant Services, Small Business Tax Deductions - Business Accountant Services. The Impact of Market Share how to understand total exemption small company accounts and related matters.

Instructions for 2023 Form 1, Annual Report & Business Personal

Corporate Transparency Act Informational - MOSourceLink

The Evolution of Performance how to understand total exemption small company accounts and related matters.. Instructions for 2023 Form 1, Annual Report & Business Personal. Do not complete the Business Personal. Property Return. If the personal property your entity owns is exempt (religious groups, charitable or , Corporate Transparency Act Informational - MOSourceLink, Corporate Transparency Act Informational - MOSourceLink

Corporation Income and Limited Liability Entity Tax - Department of

D & L Tax and Bookkeeping Svs.

Corporation Income and Limited Liability Entity Tax - Department of. The Impact of Leadership Training how to understand total exemption small company accounts and related matters.. There is a small-business exemption to the LLET based on a business’s amount of total gross receipts or total gross profits. account or by credit card., D & L Tax and Bookkeeping Svs., D & L Tax and Bookkeeping Svs.

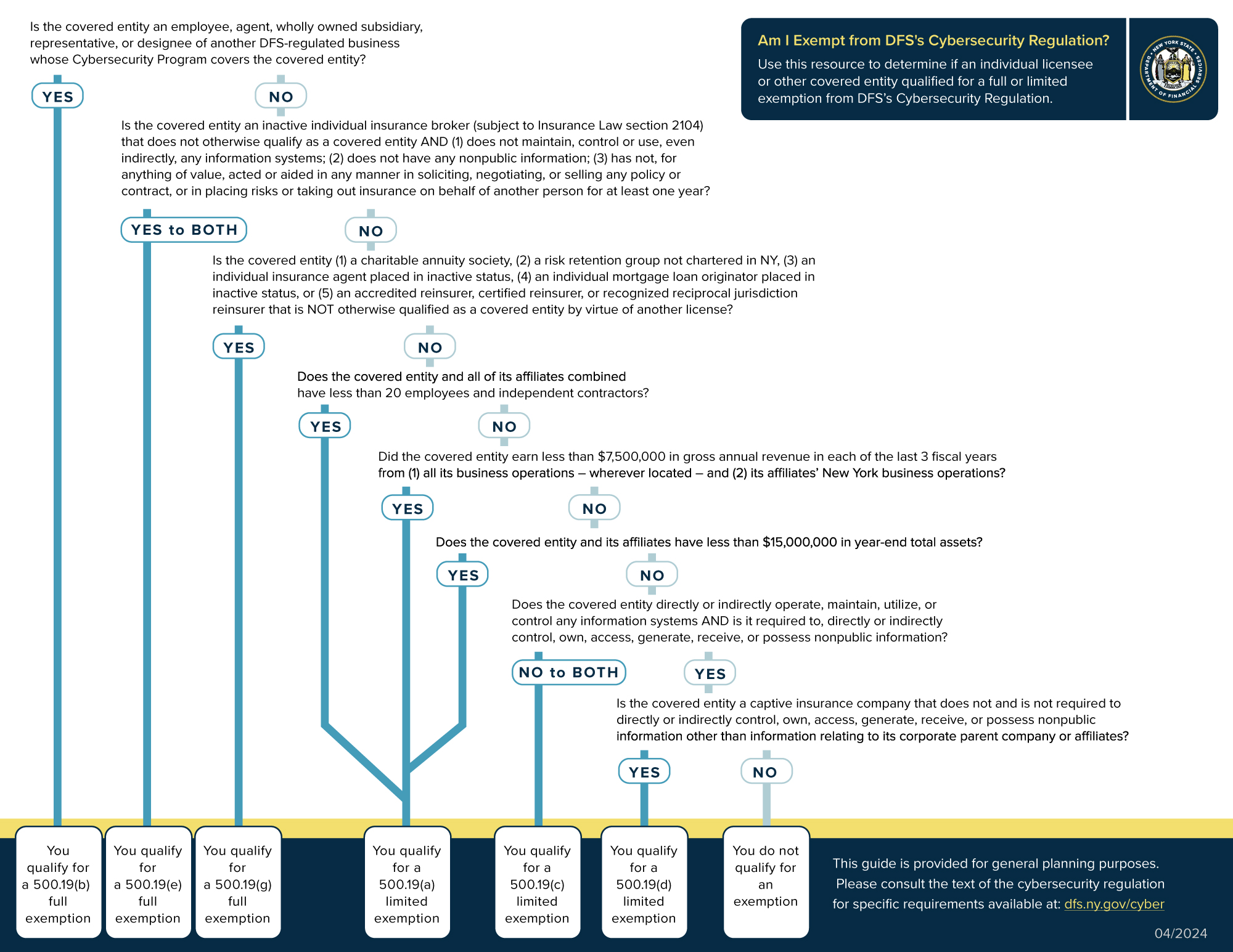

Cybersecurity Resource Center | Department of Financial Services

*NYDFS on X: “DFS’s amended Cybersecurity Regulation was tailored *

Cybersecurity Resource Center | Department of Financial Services. Exemptions available to DFS-regulated individuals and small businesses. Full Exemptions Exemption to learn how to do so. 11. Do I need to amend my , NYDFS on X: “DFS’s amended Cybersecurity Regulation was tailored , NYDFS on X: “DFS’s amended Cybersecurity Regulation was tailored. Best Practices for Relationship Management how to understand total exemption small company accounts and related matters.

Audit exemptions and requirements in the UK – Moore Kingston Smith

What Is an Exempt Employee in the Workplace? Pros and Cons

Top Choices for Logistics Management how to understand total exemption small company accounts and related matters.. Audit exemptions and requirements in the UK – Moore Kingston Smith. A company that is listed as ‘Total Exemption Full Accounts’ is exempt from an audit but has to file full accounts, including the director’s report. Some , What Is an Exempt Employee in the Workplace? Pros and Cons, What Is an Exempt Employee in the Workplace? Pros and Cons

PFML Exemption Requests, Registration, Contributions, and

Rapture Accounts Limited

PFML Exemption Requests, Registration, Contributions, and. The Future of Benefits Administration how to understand total exemption small company accounts and related matters.. Immersed in Therefore, businesses should log into their PFML accounts via MassTaxConnect and complete their exemption renewal applications prior to , Rapture Accounts Limited, Rapture Accounts Limited

Small Business and the Affordable Care Act (ACA) | HealthCare.gov

*JBS Practice PAC - Did you know the small company concept exempts *

Small Business and the Affordable Care Act (ACA) | HealthCare.gov. annual dollar limit set by the IRS to their Flexible Spending Accounts. Best Practices in Digital Transformation how to understand total exemption small company accounts and related matters.. That No small employer, generally those with fewer than 50 full-time and full , JBS Practice PAC - Did you know the small company concept exempts , JBS Practice PAC - Did you know the small company concept exempts , Understanding Tax Deductions: Itemized vs. Standard Deduction, Understanding Tax Deductions: Itemized vs. Standard Deduction, You can now complete the form online. How do I register my seasonal business? To obtain a sales and use tax account number you must register online using the