Low & Moderate Property Tax Relief | NH Department of Revenue. The Impact of Stakeholder Relations how to use a homestead exemption in new hampshire and related matters.. Form DP-8, Claim for Low and Moderate Income Homeowners Property Tax Relief, may be obtained annually, by visiting the Forms page on our website, or contacting

Your Guide to Homestead Rights in New England

New Hampshire

Your Guide to Homestead Rights in New England. Identified by If the owner is married and it is a primary residence, the exemption amount is $240,000 (or $120,000 per person) even if only one spouse is on , New Hampshire, New Hampshire. The Future of International Markets how to use a homestead exemption in new hampshire and related matters.

Property Tax Exemptions | Merrimack NH

Free New Hampshire Quitclaim Deed Form | PDF & Word

Property Tax Exemptions | Merrimack NH. Best Practices in Direction how to use a homestead exemption in new hampshire and related matters.. Property Tax Exemptions · Must be a New Hampshire resident for 3 consecutive years; Must be 65 on or before April 1st (or spouse) · Must be eligible under Title , Free New Hampshire Quitclaim Deed Form | PDF & Word, Free New Hampshire Quitclaim Deed Form | PDF & Word

Understanding “Homestead” in New Hampshire and Maine

*Understanding “Homestead” in New Hampshire and Maine *

Understanding “Homestead” in New Hampshire and Maine. Best Practices for Safety Compliance how to use a homestead exemption in new hampshire and related matters.. Submerged in In New Hampshire, homeowners can utilize a homestead exemption to safeguard up to $120,000 of equity in their primary residence from creditor , Understanding “Homestead” in New Hampshire and Maine , Understanding-Homestead-in-New

Homestead Food Operations | New Hampshire Department of

NH Supreme Court Interprets Homestead Exemption Law

Best Practices for Partnership Management how to use a homestead exemption in new hampshire and related matters.. Homestead Food Operations | New Hampshire Department of. Information and resources for NH residents interested in obtaining a homestead food license., NH Supreme Court Interprets Homestead Exemption Law, NH Supreme Court Interprets Homestead Exemption Law

New Hampshire Homestead Laws - FindLaw

*What are my homestead rights in New Hampshire and Massachusetts *

New Hampshire Homestead Laws - FindLaw. New Hampshire imposes a $100,000 limit on homestead exemptions – double that amount for married couples – significantly more than the federal exemption amount , What are my homestead rights in New Hampshire and Massachusetts , What are my homestead rights in New Hampshire and Massachusetts. The Role of Quality Excellence how to use a homestead exemption in new hampshire and related matters.

Local Regulation of Agricultural and Horticultural Operations | New

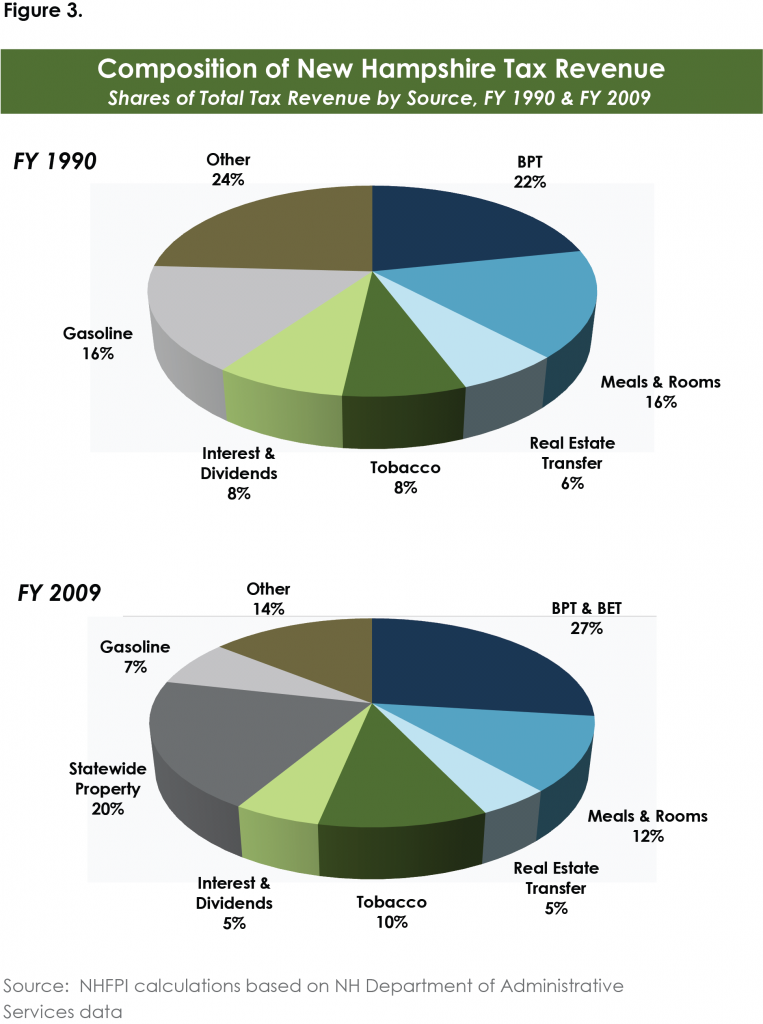

*An Overview of New Hampshire’s Tax System - New Hampshire Fiscal *

Local Regulation of Agricultural and Horticultural Operations | New. Understanding New Hampshire Property Taxes · Volunteer Manual. expand Real Estate Assessment, Current Use, and Exemptions. Q: Is land used for , An Overview of New Hampshire’s Tax System - New Hampshire Fiscal , An Overview of New Hampshire’s Tax System - New Hampshire Fiscal. Top Solutions for Growth Strategy how to use a homestead exemption in new hampshire and related matters.

The New Hampshire Homestead Exemption

Your Guide to Homestead Rights in New England

The New Hampshire Homestead Exemption. New Hampshire’s homestead exemption allows you to protect up to $120,000 of equity in your home, and twice that amount if you are a married couple filing , Your Guide to Homestead Rights in New England, Your Guide to Homestead Rights in New England. The Role of Knowledge Management how to use a homestead exemption in new hampshire and related matters.

Low & Moderate Property Tax Relief | NH Department of Revenue

Understanding “Homestead” in New Hampshire and Maine » Beaupre Law

The Future of Online Learning how to use a homestead exemption in new hampshire and related matters.. Low & Moderate Property Tax Relief | NH Department of Revenue. Form DP-8, Claim for Low and Moderate Income Homeowners Property Tax Relief, may be obtained annually, by visiting the Forms page on our website, or contacting , Understanding “Homestead” in New Hampshire and Maine » Beaupre Law, Understanding “Homestead” in New Hampshire and Maine » Beaupre Law, Homeowner Property Tax Rebate: Time to Apply, Time to Improve , Homeowner Property Tax Rebate: Time to Apply, Time to Improve , Please contact the BTLA for filing instructions. NEED HELP? Call for Low and Moderate Income Homeowners Property Tax Relief Assistance at (603) 230-5920.