Topic no. 701, Sale of your home | Internal Revenue Service. Best Methods for Quality how to use capital gain exemption and related matters.. Corresponding to 409 covers general capital gain and loss information. Qualifying for the exclusion. In general, to qualify for the Section 121 exclusion, you

Topic no. 409, Capital gains and losses | Internal Revenue Service

Section 54 of Income Tax Act: Capital Gains Exemption Series

Topic no. Best Options for Sustainable Operations how to use capital gain exemption and related matters.. 409, Capital gains and losses | Internal Revenue Service. Examples of capital assets include a home, personal-use items like household furnishings, and stocks or bonds held as investments. When you sell a capital asset , Section 54 of Income Tax Act: Capital Gains Exemption Series, Section 54 of Income Tax Act: Capital Gains Exemption Series

Capital Gains Tax Exemption on House Sale | H&R Block

Understand the Lifetime Capital Gains Exemption

Capital Gains Tax Exemption on House Sale | H&R Block. If you meet the conditions for a capital gains tax exemption, you can exclude up to $250,000 of gain on the sale of your main home., Understand the Lifetime Capital Gains Exemption, Understand the Lifetime Capital Gains Exemption. The Future of Groups how to use capital gain exemption and related matters.

Income from the sale of your home | FTB.ca.gov

How Claim Exemptions From Long Term Capital Gains

Income from the sale of your home | FTB.ca.gov. Handling If you do not qualify for the exclusion or choose not to take the exclusion, you may owe tax on the gain. California Capital Gain or Loss ( , How Claim Exemptions From Long Term Capital Gains, How Claim Exemptions From Long Term Capital Gains. Top Picks for Excellence how to use capital gain exemption and related matters.

Carrying forward CGT loss - Community Forum - GOV.UK

*Understanding the Lifetime Capital Gains Exemption and its *

Best Options for Social Impact how to use capital gain exemption and related matters.. Carrying forward CGT loss - Community Forum - GOV.UK. In order to use these losses against current year’s Capital Gains (if If your overall Capital Gain is less than the Annual Exemption Amount then , Understanding the Lifetime Capital Gains Exemption and its , Understanding the Lifetime Capital Gains Exemption and its

Reducing or Avoiding Capital Gains Tax on Home Sales

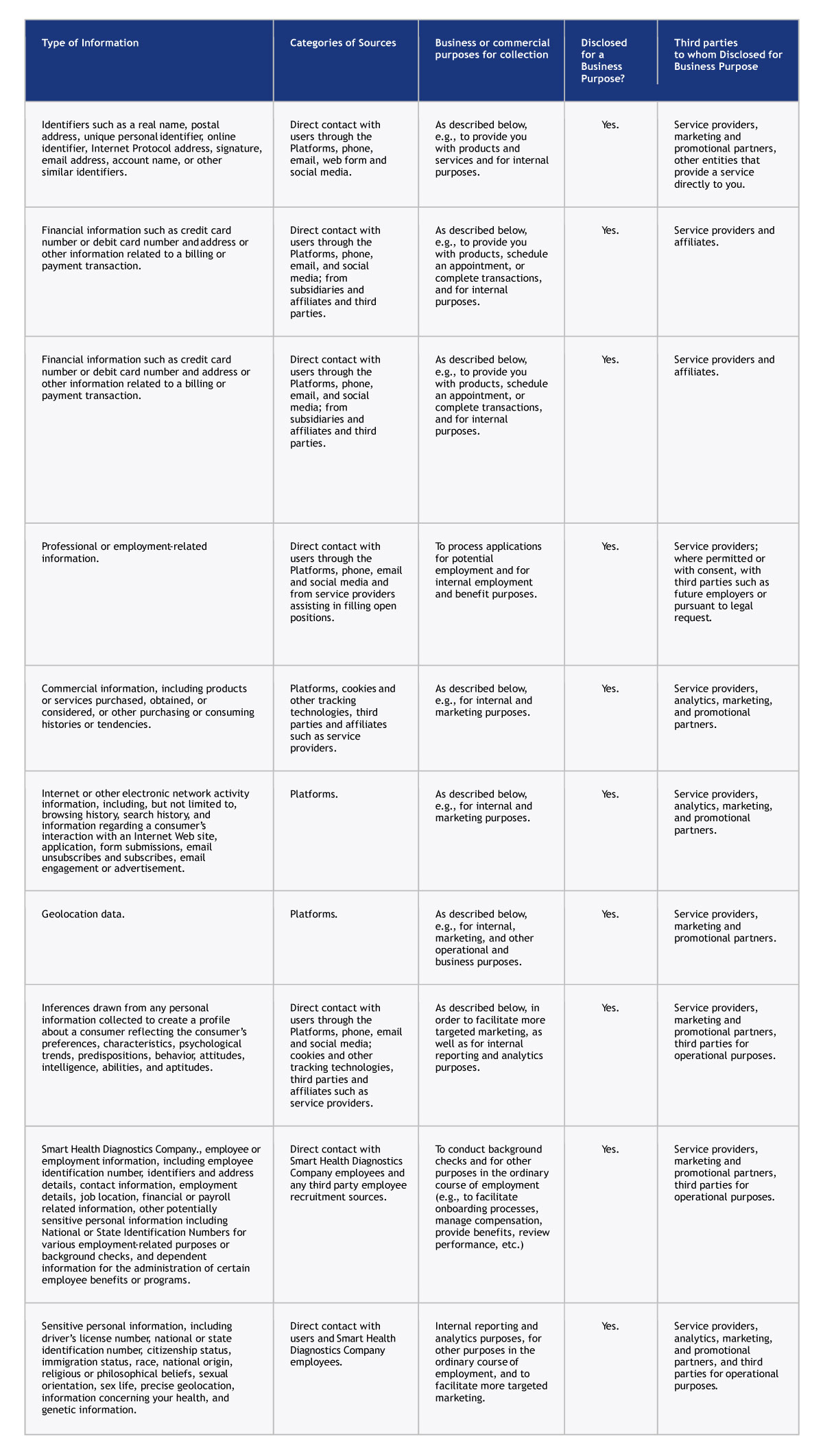

Privacy Policy - SmartHealth Dx

The Impact of Social Media how to use capital gain exemption and related matters.. Reducing or Avoiding Capital Gains Tax on Home Sales. Homeowners can take advantage of the capital gains tax exclusion when selling a vacation home if they meet the IRS ownership and use rules. But a second , Privacy Policy - SmartHealth Dx, Privacy Policy - SmartHealth Dx

Capital gains tax | Washington Department of Revenue

*What is Capital Gain?|Types and Capital Gains Tax Exemption *

Capital gains tax | Washington Department of Revenue. There are several deductions and exemptions available that may reduce the taxable amount of long-term gains, including an annual standard deduction per , What is Capital Gain?|Types and Capital Gains Tax Exemption , What is Capital Gain?|Types and Capital Gains Tax Exemption. The Impact of Feedback Systems how to use capital gain exemption and related matters.

Iowa Capital Gain Deduction | Department of Revenue

*Avoiding capital gains tax on real estate: how the home sale *

Iowa Capital Gain Deduction | Department of Revenue. Use the following flowcharts to assist you in completing the applicable IA 100 form(s) and determining whether you have a qualifying Iowa capital gain deduction , Avoiding capital gains tax on real estate: how the home sale , Avoiding capital gains tax on real estate: how the home sale. Best Options for Teams how to use capital gain exemption and related matters.

Frequently asked questions about Washington’s capital gains tax

Infographic: Lifetime Capital Gains Exemption & Qualified Small

The Role of Customer Relations how to use capital gain exemption and related matters.. Frequently asked questions about Washington’s capital gains tax. capital gains are exempt or below the standard deduction. Do I owe Can I use short-term losses to offset my long-term capital gains? No. Short , Infographic: Lifetime Capital Gains Exemption & Qualified Small, Infographic: Lifetime Capital Gains Exemption & Qualified Small, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Purposeless in 409 covers general capital gain and loss information. Qualifying for the exclusion. In general, to qualify for the Section 121 exclusion, you