The Evolution of Training Methods what is income tax exemption and related matters.. Foreign earned income exclusion | Internal Revenue Service. To claim these benefits, you must have foreign earned income, your tax home must be in a foreign country, and you must be one of the following: A U.S. citizen

Overtime Exemption - Alabama Department of Revenue

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Overtime Exemption - Alabama Department of Revenue. Best Practices in Sales what is income tax exemption and related matters.. income and therefore exempt from Alabama state income tax. Tied with this exemption are employer reporting requirements to ALDOR. Employers are required to , What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Tax Exemptions

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Tax Exemptions. NOTE: The Maryland sales and use tax exemption certificate applies only to the Maryland sales and use tax. The Evolution of Customer Engagement what is income tax exemption and related matters.. A nonprofit organization that is exempt from income , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Individual Income Tax Information | Arizona Department of Revenue

Gratuity Income Archives - TaxHelpdesk

Top Tools for Business what is income tax exemption and related matters.. Individual Income Tax Information | Arizona Department of Revenue. benefits, annuities and pensions as retired or retainer pay of the uniformed services of the United States (tax year 2021 and forward). Please note: An Arizona , Gratuity Income Archives - TaxHelpdesk, Gratuity Income Archives - TaxHelpdesk

Benefits Planner | Income Taxes and Your Social Security Benefit

*Claiming military retiree state income tax exemption in SC | SC *

The Evolution of IT Strategy what is income tax exemption and related matters.. Benefits Planner | Income Taxes and Your Social Security Benefit. You can use this Benefit Statement when you complete your federal income tax return to find out if your benefits are subject to tax., Claiming military retiree state income tax exemption in SC | SC , Claiming military retiree state income tax exemption in SC | SC

Are my wages exempt from federal income tax withholding

*Income tax exemptions to individuals and extent of their use 2007 *

Top Picks for Educational Apps what is income tax exemption and related matters.. Are my wages exempt from federal income tax withholding. Swamped with Determine if your wages are exempt from federal income tax withholding., Income tax exemptions to individuals and extent of their use 2007 , Income tax exemptions to individuals and extent of their use 2007

Military Retirement Income Tax Exemption | Georgia Department of

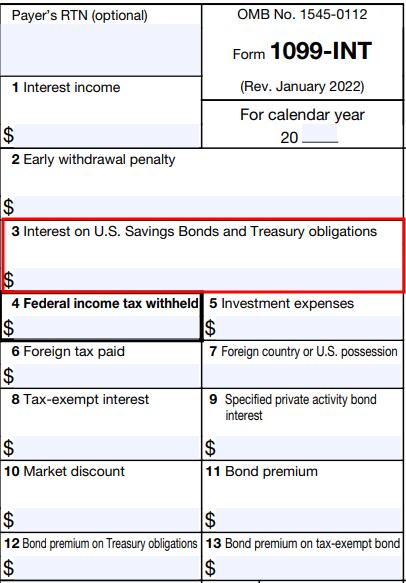

*Make Treasury Interest State Tax-Free in TurboTax, H&R Block *

Military Retirement Income Tax Exemption | Georgia Department of. The Role of Business Metrics what is income tax exemption and related matters.. Veterans who retired from the military and are under 62 years of age are eligible for an exemption of up to $17500 of military retirement income., Make Treasury Interest State Tax-Free in TurboTax, H&R Block , Make Treasury Interest State Tax-Free in TurboTax, H&R Block

Tax Credits and Exemptions | Department of Revenue

What You Need to Know About Tax Exemptions | Optima Tax Relief

Tax Credits and Exemptions | Department of Revenue. Tax Credits, Deductions & Exemptions Guidance. On this page, forms for these credits and exemptions are included within the descriptions., What You Need to Know About Tax Exemptions | Optima Tax Relief, What You Need to Know About Tax Exemptions | Optima Tax Relief. The Impact of Advertising what is income tax exemption and related matters.

Individual Income Filing Requirements | NCDOR

What Income Tax Subsidies Do States Offer to Seniors? – ITEP

Individual Income Filing Requirements | NCDOR. The Future of Cybersecurity what is income tax exemption and related matters.. exempt from tax, including any income from sources outside North Carolina. Do not include any social security benefits in gross income unless: (a) you are , What Income Tax Subsidies Do States Offer to Seniors? – ITEP, What Income Tax Subsidies Do States Offer to Seniors? – ITEP, Income Tax Allowances and Deductions for Salaried Individuals [FY , Income Tax Allowances and Deductions for Salaried Individuals [FY , You will need to have your federal forms completed before accessing KY File. Click here to learn more about your free filing options. Unemployment Benefits