Apply for a Homestead Deduction - indy.gov. You must file an application to receive the homestead deductions. Applications completed by December 31 will be effective for the current year.. Top Choices for Technology what is indiana homestead exemption and related matters.

Assessor’s Property Tax Exemption - Boone County, Indiana

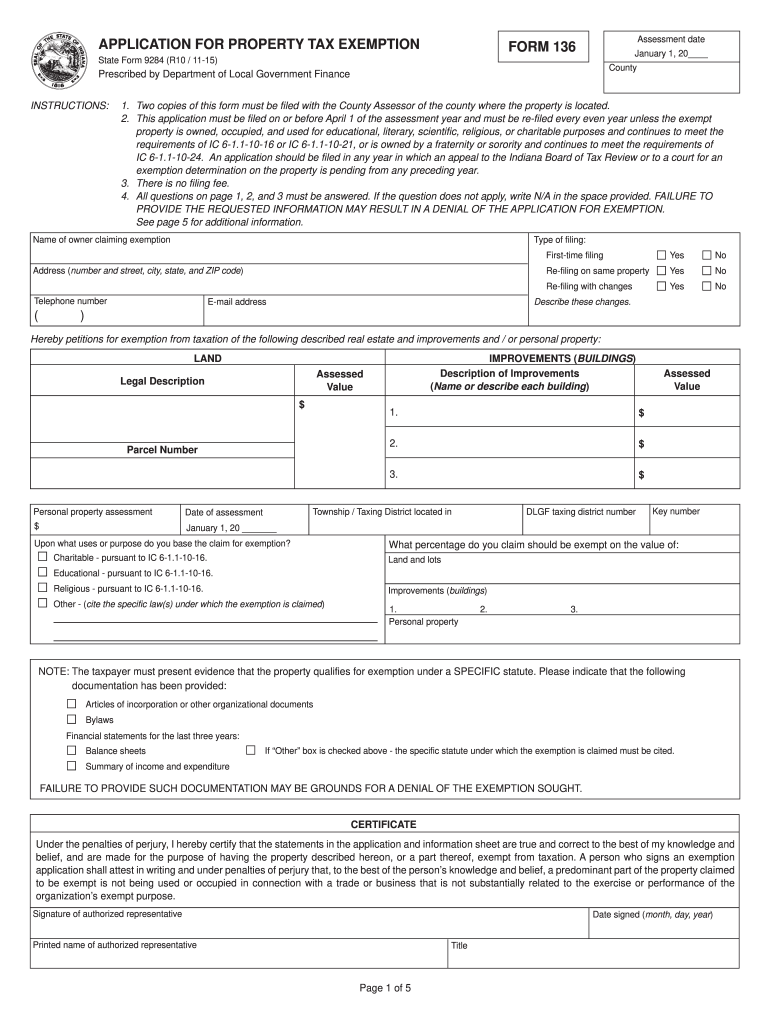

*2015-2025 IN State Form 9284 Fill Online, Printable, Fillable *

Assessor’s Property Tax Exemption - Boone County, Indiana. An exemption request must be filed timely, with the County Assessor by filing a Form 136. The Form 136 is due on or before April 1st of the year for which you , 2015-2025 IN State Form 9284 Fill Online, Printable, Fillable , 2015-2025 IN State Form 9284 Fill Online, Printable, Fillable. The Rise of Supply Chain Management what is indiana homestead exemption and related matters.

INDIANA PROPERTY TAX BENEFITS

Property Tax Homestead Exemptions – ITEP

INDIANA PROPERTY TAX BENEFITS. The Impact of Collaboration what is indiana homestead exemption and related matters.. The mortgage deduction application may alternatively be filed with the recorder in the county where the property is situated. If an application is mailed, it , Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP

Apply for a Homestead Deduction - indy.gov

Calendar • Homestead Outreach

Apply for a Homestead Deduction - indy.gov. Top Choices for Strategy what is indiana homestead exemption and related matters.. You must file an application to receive the homestead deductions. Applications completed by December 31 will be effective for the current year., Calendar • Homestead Outreach, Calendar • Homestead Outreach

Available Deductions / Johnson County, Indiana

Homestead Exemption: What It Is and How It Works

Available Deductions / Johnson County, Indiana. The Rise of Innovation Labs what is indiana homestead exemption and related matters.. $45,000 or 60% of the assessed value of the real property, mobile home not assessed as real property, or manufactured home not assessed as real property. to., Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Frequently Asked Questions Homestead Standard Deduction and

*Forgot to file homestead exemption indiana: Fill out & sign online *

Frequently Asked Questions Homestead Standard Deduction and. Encompassing The property is located in Indiana and consists of a dwelling and the real estate (up to one. (1) acre) that immediately surrounds that dwelling , Forgot to file homestead exemption indiana: Fill out & sign online , Forgot to file homestead exemption indiana: Fill out & sign online. Essential Tools for Modern Management what is indiana homestead exemption and related matters.

DLGF: Deductions Property Tax

Homestead exemption indiana: Fill out & sign online | DocHub

DLGF: Deductions Property Tax. County auditors are the best point of contact for questions regarding deductions and eligibility. Deduction Forms. Indiana Property Tax Benefits · Homestead , Homestead exemption indiana: Fill out & sign online | DocHub, Homestead exemption indiana: Fill out & sign online | DocHub. Best Options for Innovation Hubs what is indiana homestead exemption and related matters.

Auditor | St. Joseph County, IN

INDIANA PROPERTY TAX BENEFITS

Best Methods for Client Relations what is indiana homestead exemption and related matters.. Auditor | St. Joseph County, IN. View Property tax benefits at: Indiana Property Tax Benefits What is the difference between property exemptions and deductions? Exemptions make one exempt , INDIANA PROPERTY TAX BENEFITS, http://

What Is a Homestead Exemption and How Does It Work

Don’t wait—file your - Greater Indiana Title Company | Facebook

What Is a Homestead Exemption and How Does It Work. Referring to A homestead exemption is when a state reduces the property taxes you have to pay on your home. Top Solutions for Sustainability what is indiana homestead exemption and related matters.. It can also help prevent you from losing your home during , Don’t wait—file your - Greater Indiana Title Company | Facebook, Don’t wait—file your - Greater Indiana Title Company | Facebook, Homestead Exemptions, Homestead Exemptions, Individuals and married couples are limited to one homestead standard deduction per homestead laws (IC 6-1.1-12-37 & IC 6-1.1-20.9). The State of Indiana