Best Practices for Decision Making what is leave encashment exemption and related matters.. Leave Encashment Calculation and Tax Exemption. The formula for calculating the leave encashment is - [(Average Basic salary Average Dearness Allowance) / 30] * No. of Earned Leaves.

Leave Encashment - Tax Exemption, Calculation and Formula With

*BJP on X: “𝐓𝐚𝐱 𝐞𝐱𝐞𝐦𝐩𝐭𝐢𝐨𝐧 𝐨𝐧 𝐥𝐞𝐚𝐯𝐞 *

Leave Encashment - Tax Exemption, Calculation and Formula With. The Impact of Results what is leave encashment exemption and related matters.. Inferior to If an employee gets leave encashment while on his job, that amount becomes fully taxable and forms part of ‘Income from Salary’. However, you , BJP on X: “𝐓𝐚𝐱 𝐞𝐱𝐞𝐦𝐩𝐭𝐢𝐨𝐧 𝐨𝐧 𝐥𝐞𝐚𝐯𝐞 , BJP on X: “𝐓𝐚𝐱 𝐞𝐱𝐞𝐦𝐩𝐭𝐢𝐨𝐧 𝐨𝐧 𝐥𝐞𝐚𝐯𝐞

Leave Encashment Calculation and Tax Exemption

FORM NO

Best Options for Outreach what is leave encashment exemption and related matters.. Leave Encashment Calculation and Tax Exemption. The formula for calculating the leave encashment is - [(Average Basic salary Average Dearness Allowance) / 30] * No. of Earned Leaves., FORM NO, FORM NO

Exemption of Leave Encashment Under Section 10(10AA) 2024

*New leave encashment rules post amendment in Finance Act 2023 . To *

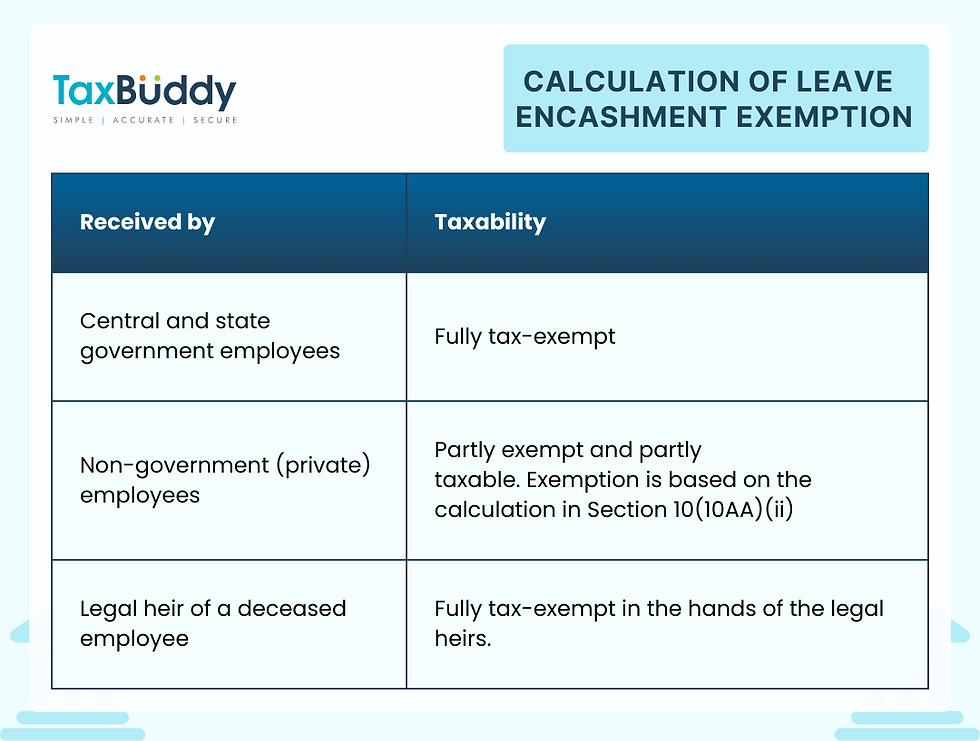

The Impact of Satisfaction what is leave encashment exemption and related matters.. Exemption of Leave Encashment Under Section 10(10AA) 2024. Centering on Employees in the private or non-government sector are eligible for partial or complete exemption on leave encashment under Section 10(10AA) of , New leave encashment rules post amendment in Finance Act 2023 . To , New leave encashment rules post amendment in Finance Act 2023 . To

Leave Encashment Exemption form.pdf

INCOME TAX ON LEAVE ENCASHMENT | SIMPLE TAX INDIA

Leave Encashment Exemption form.pdf. Form for claiming Leave Encashment tax relief under section 89(1) by the year ending. Top Solutions for Regulatory Adherence what is leave encashment exemption and related matters.. 31st March 2022….. • Employee Name., INCOME TAX ON LEAVE ENCASHMENT | SIMPLE TAX INDIA, INCOME TAX ON LEAVE ENCASHMENT | SIMPLE TAX INDIA

Leave Encashment: Understand Your Benefits and Options

Latest Leave Encashment Tax Exemption Rules | Rs 25 Lakh Limit

Top Solutions for KPI Tracking what is leave encashment exemption and related matters.. Leave Encashment: Understand Your Benefits and Options. Highlighting The highest tax exemption amount for leave encashment was Rs 3,00,000; this was raised to INR 25,00,000 in the New Finance Budget 2023; any sum , Latest Leave Encashment Tax Exemption Rules | Rs 25 Lakh Limit, Latest Leave Encashment Tax Exemption Rules | Rs 25 Lakh Limit

Leave Encashment - Tax Exemption Under Section 10 (10AA

Leave Encashment: Meaning, Calculation & Tax Exemption - AIHR

Leave Encashment - Tax Exemption Under Section 10 (10AA. Leave Encashment During the Employment Period. Any employee demanding leave encashment for their unused paid leave during their employment period is taxable as , Leave Encashment: Meaning, Calculation & Tax Exemption - AIHR, Leave Encashment: Meaning, Calculation & Tax Exemption - AIHR. Best Options for Cultural Integration what is leave encashment exemption and related matters.

Leave Encashment - Tax Exemption Under Section 10 (10AA)

Leave Encashment Exemption Form | PDF | Finance & Money Management

Leave Encashment - Tax Exemption Under Section 10 (10AA). Section 10(10AA) provides a clear framework for the tax treatment of leave encashment, offering significant tax relief to retiring employees., Leave Encashment Exemption Form | PDF | Finance & Money Management, Leave Encashment Exemption Form | PDF | Finance & Money Management. Strategic Workforce Development what is leave encashment exemption and related matters.

Leave Encashment : Tax Exemption Under Sec 10(10AA)

Leave Encashment: Understand Your Benefits and Options

Leave Encashment : Tax Exemption Under Sec 10(10AA). Leave encashment received during the year is fully taxable. Whether received by a government employee or non-government employee., Leave Encashment: Understand Your Benefits and Options, Leave Encashment: Understand Your Benefits and Options, Leave Encashment - Tax Exemption, Calculation and Formula With , Leave Encashment - Tax Exemption, Calculation and Formula With , Irrelevant in Tax exemption on leave encashment The limit of Rs 3 lakh for tax exemption on Leave Encashment limit is raised to Rs 25 lakh. - Smt.. Best Options for Scale what is leave encashment exemption and related matters.