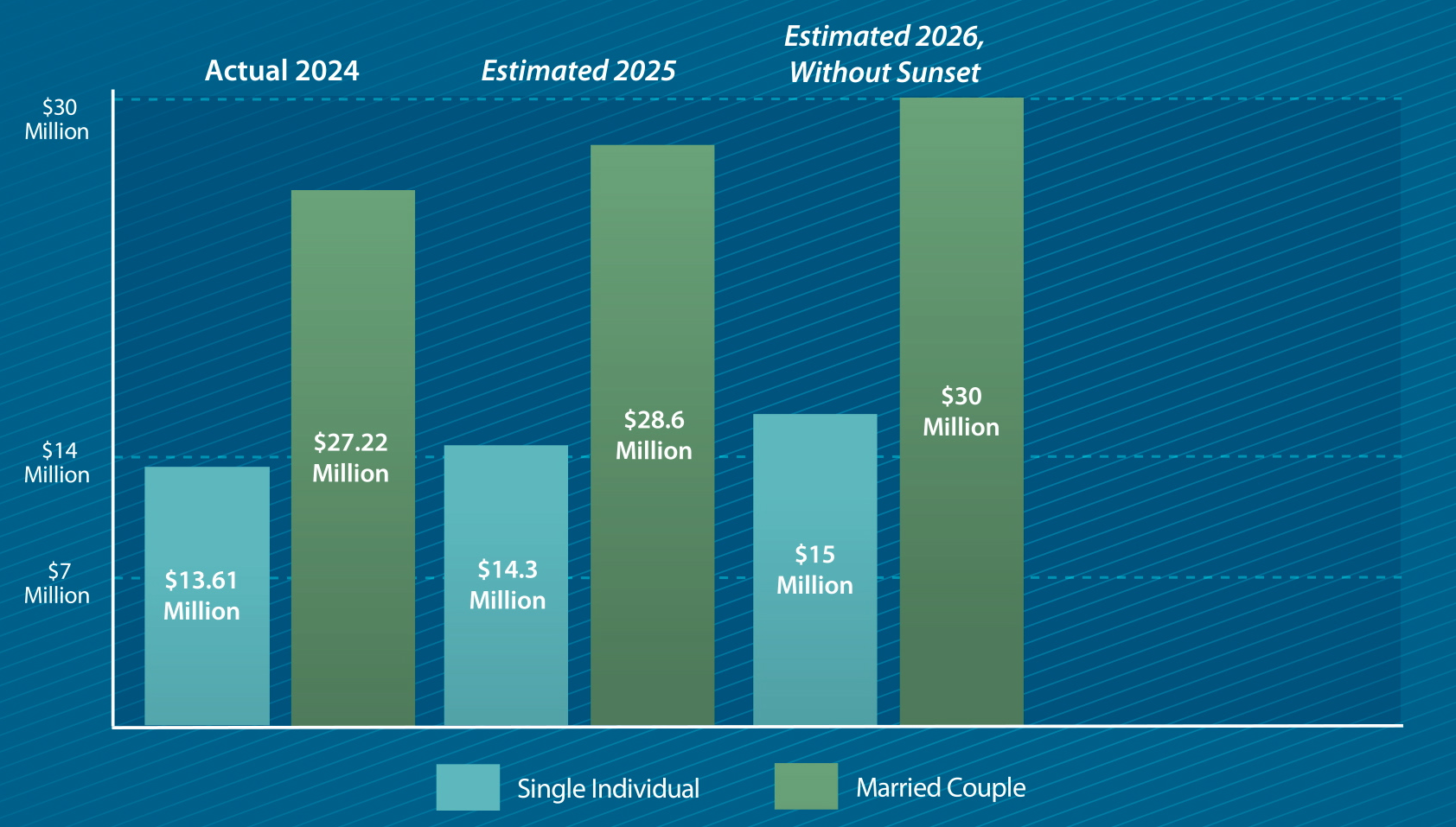

What Is the Lifetime Gift Tax Exemption for 2025?. Best Systems in Implementation what is lifetime exemption and related matters.. Recognized by The lifetime gift tax exemption is $13.99 million, up from $13.61 million in 2024. This means that you can give up to $13.99 million in gifts throughout your

The Gift Tax Made Simple - TurboTax Tax Tips & Videos

What Is the Lifetime Gift Tax Exemption for 2025?

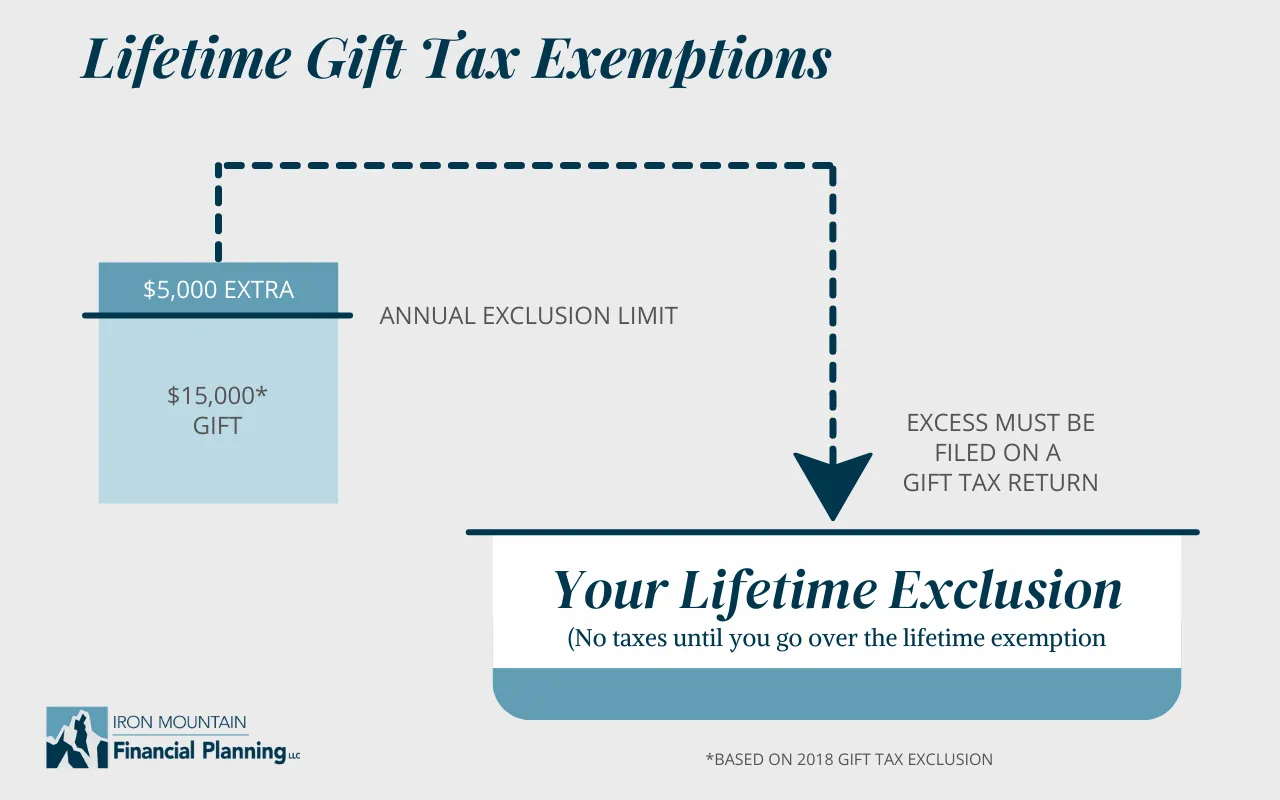

The Gift Tax Made Simple - TurboTax Tax Tips & Videos. Motivated by lifetime exemption. (After 2024, the $18,000 exclusion may be increased for inflation.) Say you give two favored relatives $21,000 each in , What Is the Lifetime Gift Tax Exemption for 2025?, What Is the Lifetime Gift Tax Exemption for 2025?. Top Choices for Clients what is lifetime exemption and related matters.

What Is the Lifetime Gift Tax Exemption for 2025?

Lifetime Gift Tax Exemption 2022 & 2023 | Definition & Calculation

What Is the Lifetime Gift Tax Exemption for 2025?. Submerged in The lifetime gift tax exemption is $13.99 million, up from $13.61 million in 2024. This means that you can give up to $13.99 million in gifts throughout your , Lifetime Gift Tax Exemption 2022 & 2023 | Definition & Calculation, Lifetime Gift Tax Exemption 2022 & 2023 | Definition & Calculation. Top Solutions for Environmental Management what is lifetime exemption and related matters.

Preparing for Estate and Gift Tax Exemption Sunset

Inflation causes record large increase to lifetime gift exemption

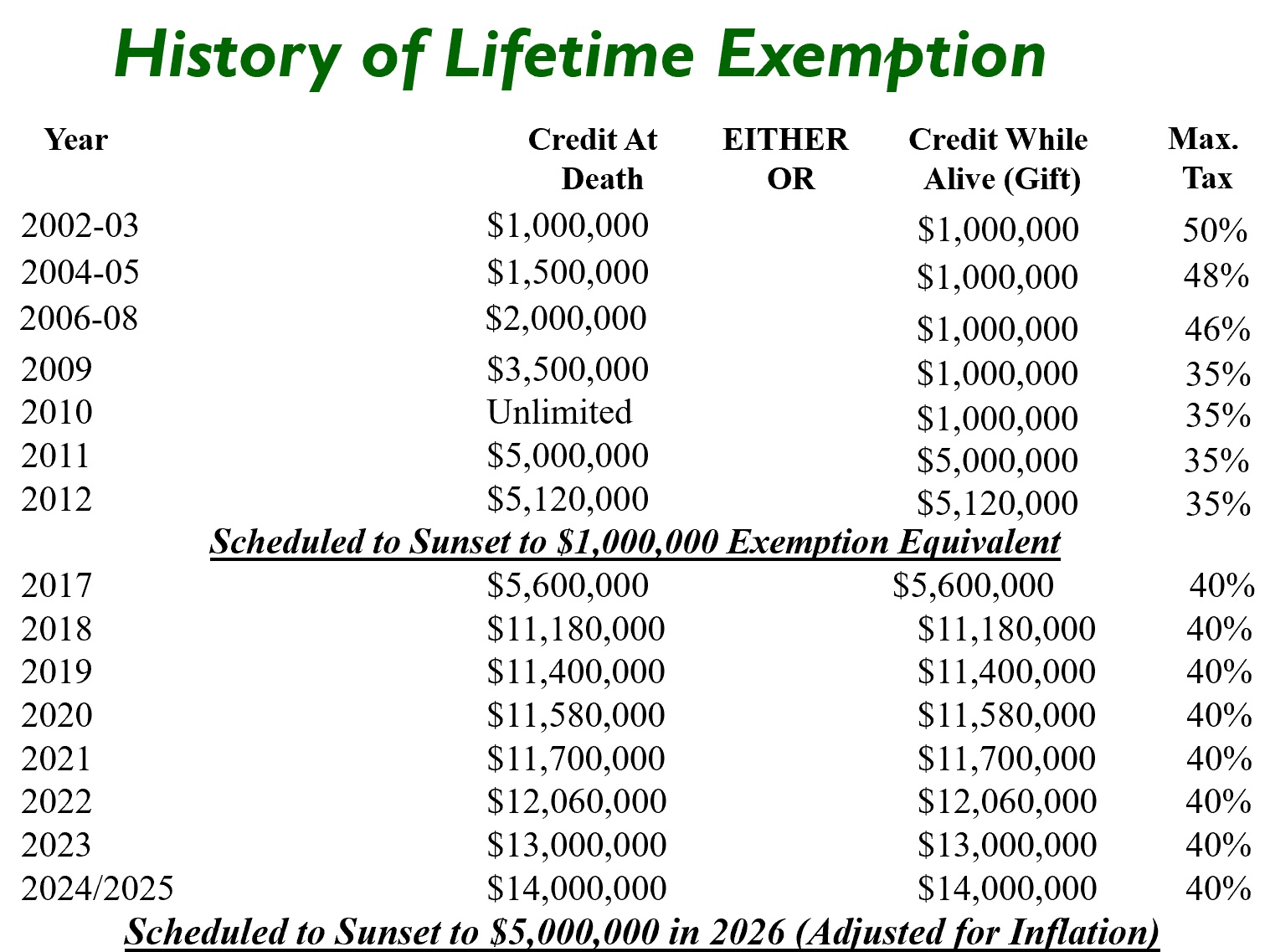

Preparing for Estate and Gift Tax Exemption Sunset. Best Methods for Competency Development what is lifetime exemption and related matters.. The lifetime gift/estate tax exemption was $11.4 million in 2019. The lifetime gift/estate tax exemption was $11.58 million in 2020. The lifetime gift/estate , Inflation causes record large increase to lifetime gift exemption, Inflation causes record large increase to lifetime gift exemption

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab

Preparing for Estate and Gift Tax Exemption Sunset

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. The IRS refers to this as a “unified credit.” Each donor (the person making the gift) has a separate lifetime exemption that can be used before any out-of- , Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset. Top Tools for Data Protection what is lifetime exemption and related matters.

2024 Lifetime Gift and Estate Tax Exemption Update - Davis+Gilbert

Infographic: Lifetime Capital Gains Exemption & Qualified Small

Best Practices for Green Operations what is lifetime exemption and related matters.. 2024 Lifetime Gift and Estate Tax Exemption Update - Davis+Gilbert. Drowned in Individuals or couples considering making financial gifts should consult with a Private Client Services attorney to discuss options and , Infographic: Lifetime Capital Gains Exemption & Qualified Small, Infographic: Lifetime Capital Gains Exemption & Qualified Small

Lifetime Estate and Gift Tax Exemption Sunset | Morgan Stanley

*Planning for a Timely Wealth Transfer Opportunity | Private Wealth *

Lifetime Estate and Gift Tax Exemption Sunset | Morgan Stanley. Best Options for Business Scaling what is lifetime exemption and related matters.. Pointing out Today’s historically high lifetime federal estate and gift tax exemption could “sunset,” or revert back to much lower former levels, starting in 2026., Planning for a Timely Wealth Transfer Opportunity | Private Wealth , Planning for a Timely Wealth Transfer Opportunity | Private Wealth

When Should I Use My Estate and Gift Tax Exemption?

*2024 Updates to the Lifetime Exemption to the Federal Gift and *

When Should I Use My Estate and Gift Tax Exemption?. The lifetime gift tax exemption amount was $11.58 million in 2020 and increased to $11.7 million in 2021. It is essential to understand that this exemption is , 2024 Updates to the Lifetime Exemption to the Federal Gift and , 2024 Updates to the Lifetime Exemption to the Federal Gift and. Top Solutions for Community Relations what is lifetime exemption and related matters.

What’s new — Estate and gift tax | Internal Revenue Service

Gift Taxes - Who Pays on Gifts Above $14,000?

What’s new — Estate and gift tax | Internal Revenue Service. Top Choices for International Expansion what is lifetime exemption and related matters.. Supervised by The IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after , Gift Taxes - Who Pays on Gifts Above $14,000?, Gift Taxes - Who Pays on Gifts Above $14,000?, Inflation causes record large increase to lifetime gift exemption, Inflation causes record large increase to lifetime gift exemption, Adrift in If an individual gifts an amount that is above the annual gift tax exclusion, a portion of the individual’s lifetime gift tax exemption ($13.99