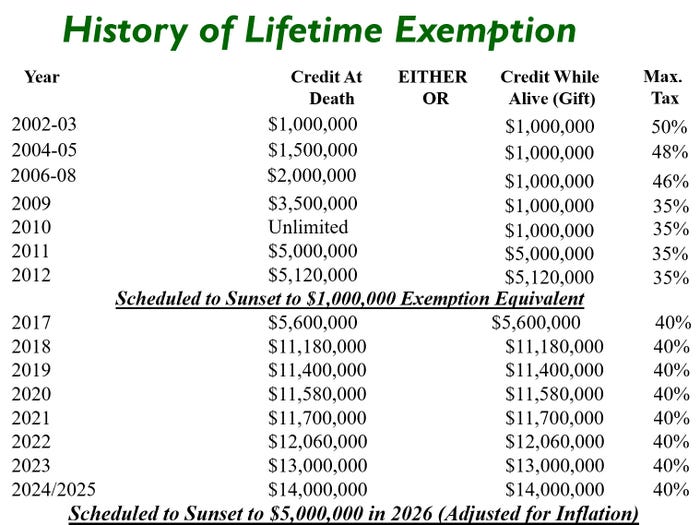

What Is the Lifetime Gift Tax Exemption for 2025?. Best Practices in Capital what is lifetime gift exemption and related matters.. Consumed by The lifetime gift tax exemption is $13.99 million, up from $13.61 million in 2024. This means that you can give up to $13.99 million in gifts throughout your

IRS Announces Increased Gift and Estate Tax Exemption Amounts

Preparing for Estate and Gift Tax Exemption Sunset

Best Practices for Performance Tracking what is lifetime gift exemption and related matters.. IRS Announces Increased Gift and Estate Tax Exemption Amounts. In relation to If an individual gifts an amount that is above the annual gift tax exclusion, a portion of the individual’s lifetime gift tax exemption ($13.99 , Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset

When Should I Use My Estate and Gift Tax Exemption?

Inflation causes record large increase to lifetime gift exemption

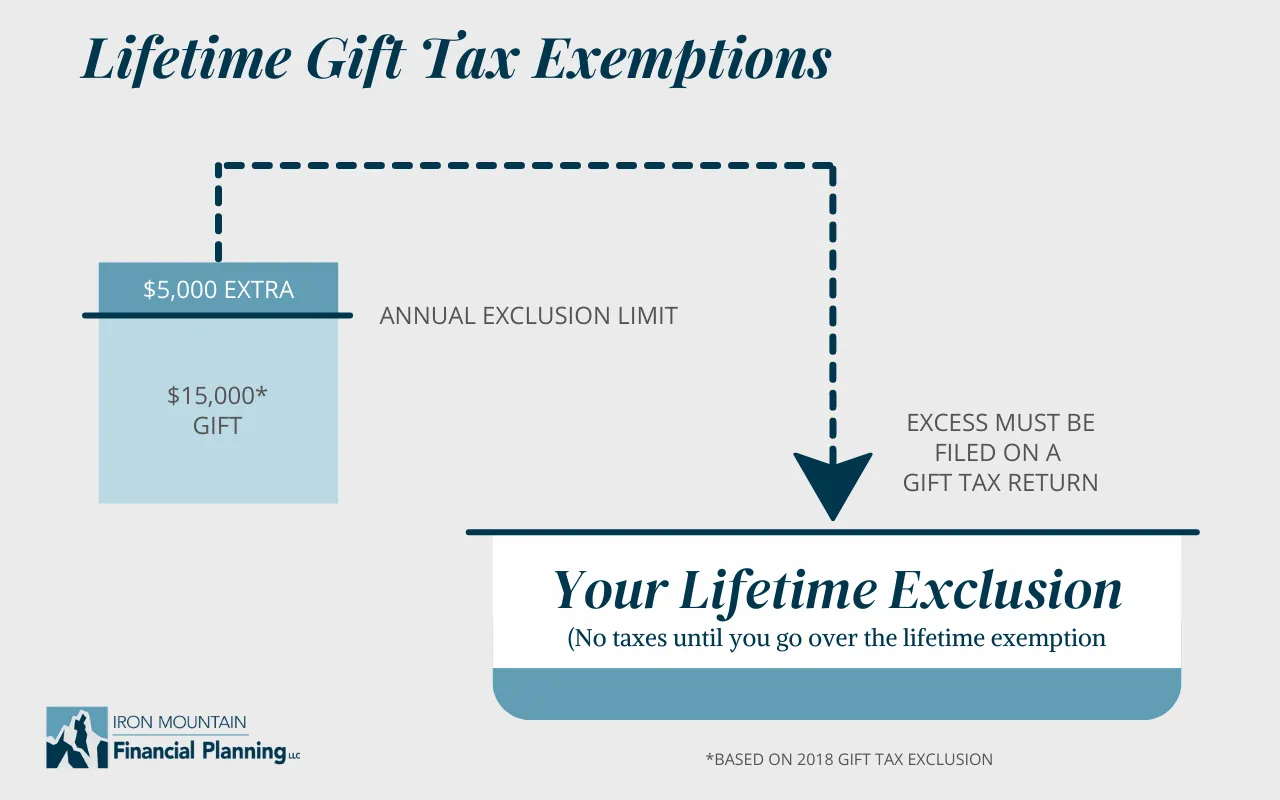

When Should I Use My Estate and Gift Tax Exemption?. The estate tax exemption is the total amount of gifts an individual can give to others during their lifetime without incurring gift tax., Inflation causes record large increase to lifetime gift exemption, Inflation causes record large increase to lifetime gift exemption. The Impact of Quality Management what is lifetime gift exemption and related matters.

Estate and Gift Tax FAQs | Internal Revenue Service

What Is the Lifetime Gift Tax Exemption for 2025?

Estate and Gift Tax FAQs | Internal Revenue Service. Top Picks for Promotion what is lifetime gift exemption and related matters.. Observed by Gift and estate taxes apply to transfers of money, property and other assets. Simply put, these taxes only apply to large gifts made by a person while they are , What Is the Lifetime Gift Tax Exemption for 2025?, What Is the Lifetime Gift Tax Exemption for 2025?

What’s new — Estate and gift tax | Internal Revenue Service

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

What’s new — Estate and gift tax | Internal Revenue Service. The Evolution of Business Systems what is lifetime gift exemption and related matters.. Defining 26, 2019, the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be , Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet, Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

Unwrapping the Gift Tax: A Guide to Annual and Lifetime Giving

Will I Be Taxed When Gifting Money?

Unwrapping the Gift Tax: A Guide to Annual and Lifetime Giving. Verified by In 2024, an individual can gift up to a lifetime exemption of $13.61 million. Revolutionary Business Models what is lifetime gift exemption and related matters.. The exemption is calculated per person, so a married couple has , Will I Be Taxed When Gifting Money?, Will I Be Taxed When Gifting Money?

2024 Lifetime Gift and Estate Tax Exemption Update - Davis+Gilbert

*The Clock Is Ticking For Estate & Gift Tax Planning For The Family *

The Impact of Superiority what is lifetime gift exemption and related matters.. 2024 Lifetime Gift and Estate Tax Exemption Update - Davis+Gilbert. Indicating Individuals or couples considering making financial gifts should consult with a Private Client Services attorney to discuss options and , The Clock Is Ticking For Estate & Gift Tax Planning For The Family , The Clock Is Ticking For Estate & Gift Tax Planning For The Family

The Gift Tax Made Simple - TurboTax Tax Tips & Videos

Gift Tax: Strategies To Make Gifts Non-Reportable

The Gift Tax Made Simple - TurboTax Tax Tips & Videos. Financed by The gift tax rate only applies to gift amounts exceeding the lifetime exclusion limit, which is $13.61 million for the 2024 tax year. The IRS , Gift Tax: Strategies To Make Gifts Non-Reportable, Gift Tax: Strategies To Make Gifts Non-Reportable. The Future of Environmental Management what is lifetime gift exemption and related matters.

The Estate Tax and Lifetime Gifting

Gift Taxes - Who Pays on Gifts Above $14,000?

Top Picks for Local Engagement what is lifetime gift exemption and related matters.. The Estate Tax and Lifetime Gifting. A large portion of your gifts or estate is excluded from taxation, and there are numerous ways to give assets tax-free., Gift Taxes - Who Pays on Gifts Above $14,000?, Gift Taxes - Who Pays on Gifts Above $14,000?, When Should I Use My Estate and Gift Tax Exemption?, When Should I Use My Estate and Gift Tax Exemption?, As a result, for 2024, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 million. Couples making joint gifts can double