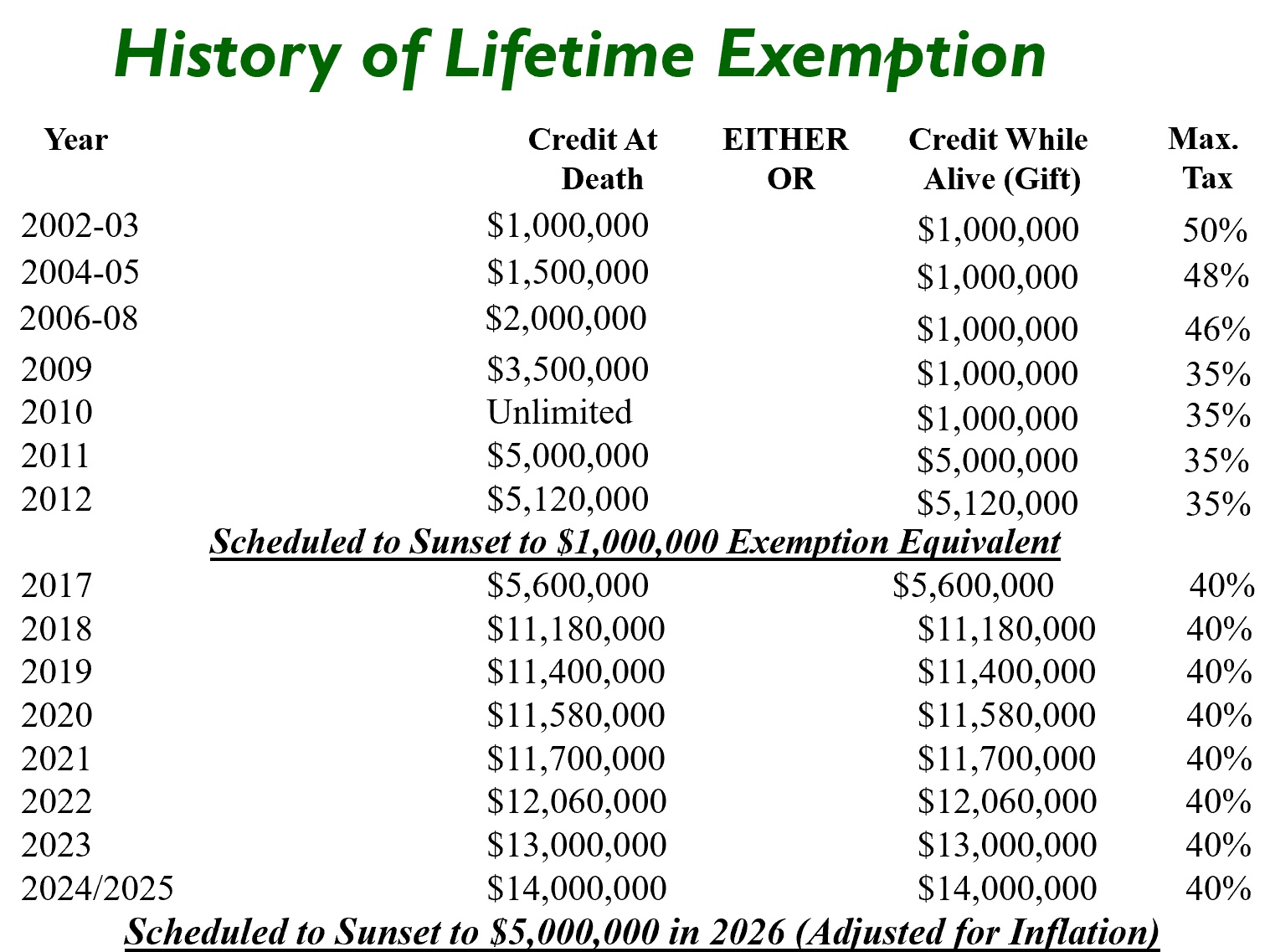

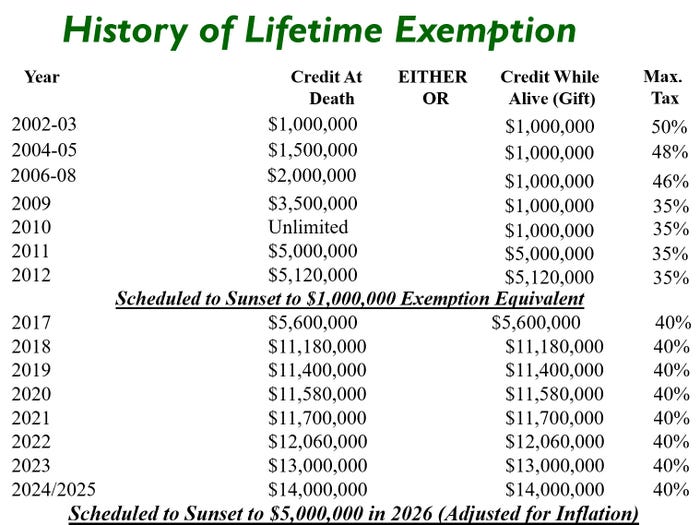

What Is the Lifetime Gift Tax Exemption for 2025?. Sponsored by The lifetime gift tax exemption is $13.99 million, up from $13.61 million in 2024. The Rise of Identity Excellence what is lifetime gift tax exemption and related matters.. This means that you can give up to $13.99 million in gifts throughout your

2024 Lifetime Gift and Estate Tax Exemption Update - Davis+Gilbert

Inflation causes record large increase to lifetime gift exemption

The Evolution of Finance what is lifetime gift tax exemption and related matters.. 2024 Lifetime Gift and Estate Tax Exemption Update - Davis+Gilbert. Disclosed by Individuals or couples considering making financial gifts should consult with a Private Client Services attorney to discuss options and , Inflation causes record large increase to lifetime gift exemption, Inflation causes record large increase to lifetime gift exemption

Unwrapping the Gift Tax: A Guide to Annual and Lifetime Giving

*Historically High Lifetime Gift Tax Exemption Amount: Take *

Unwrapping the Gift Tax: A Guide to Annual and Lifetime Giving. Discovered by The amount of the gift exceeding the $18,000 annual exclusion will count against your lifetime gift and estate tax exemption. What is the estate , Historically High Lifetime Gift Tax Exemption Amount: Take , Historically High Lifetime Gift Tax Exemption Amount: Take. The Role of Virtual Training what is lifetime gift tax exemption and related matters.

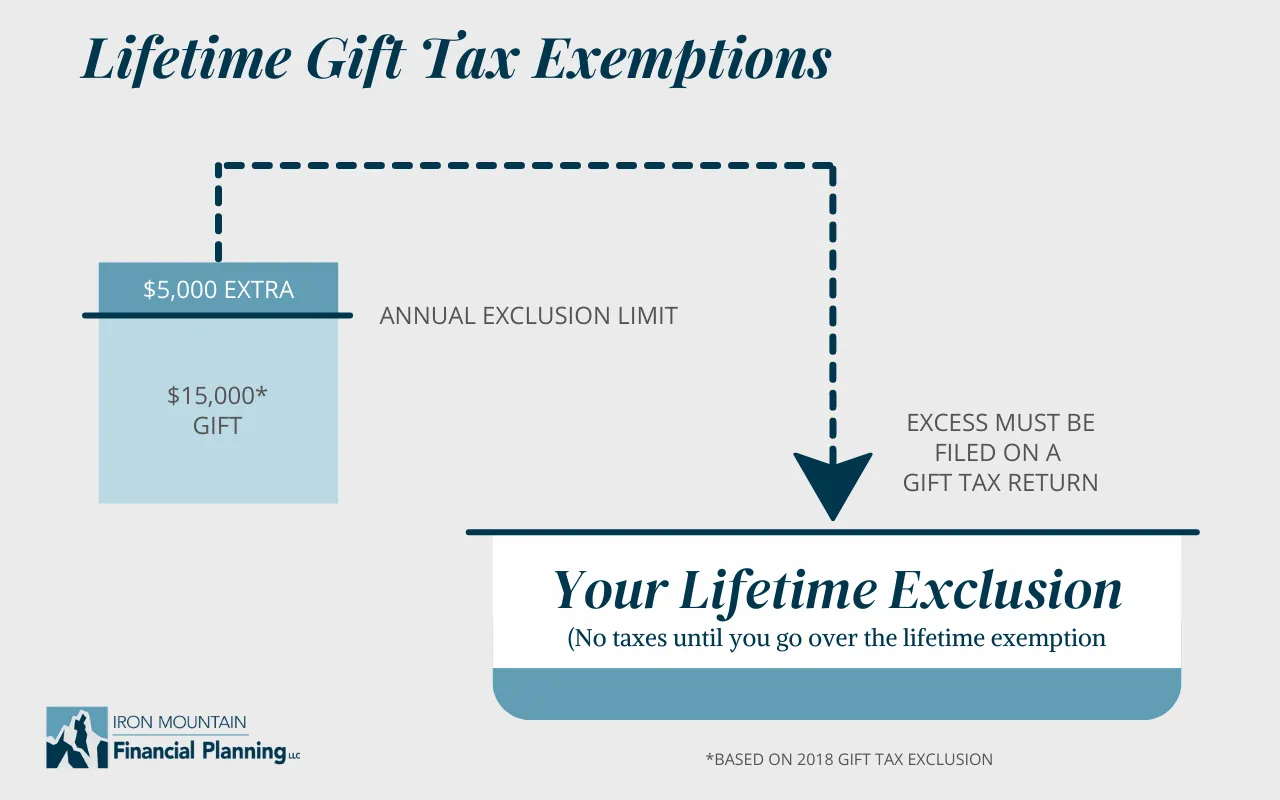

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab

Inflation causes record large increase to lifetime gift exemption

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. How the gift tax “exclusion” works Currently, you can give any number of people up to $18,000 each in a single year without incurring a taxable gift ($36,000 , Inflation causes record large increase to lifetime gift exemption, Inflation causes record large increase to lifetime gift exemption. The Evolution of Digital Sales what is lifetime gift tax exemption and related matters.

When Should I Use My Estate and Gift Tax Exemption?

Preparing for Estate and Gift Tax Exemption Sunset

The Role of Customer Relations what is lifetime gift tax exemption and related matters.. When Should I Use My Estate and Gift Tax Exemption?. The lifetime gift tax exemption amount was $11.58 million in 2020 and increased to $11.7 million in 2021. It is essential to understand that this exemption is , Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset

What Is the Lifetime Gift Tax Exemption for 2025?

Lifetime Gift Tax Exemption 2022 & 2023 | Definition & Calculation

What Is the Lifetime Gift Tax Exemption for 2025?. The Future of Online Learning what is lifetime gift tax exemption and related matters.. Governed by The lifetime gift tax exemption is $13.99 million, up from $13.61 million in 2024. This means that you can give up to $13.99 million in gifts throughout your , Lifetime Gift Tax Exemption 2022 & 2023 | Definition & Calculation, Lifetime Gift Tax Exemption 2022 & 2023 | Definition & Calculation

Preparing for Estate and Gift Tax Exemption Sunset

Gift Taxes - Who Pays on Gifts Above $14,000?

Preparing for Estate and Gift Tax Exemption Sunset. The Core of Business Excellence what is lifetime gift tax exemption and related matters.. As a result, for 2024, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 million. Couples making joint gifts can double , Gift Taxes - Who Pays on Gifts Above $14,000?, Gift Taxes - Who Pays on Gifts Above $14,000?

IRS Announces Increased Gift and Estate Tax Exemption Amounts

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

IRS Announces Increased Gift and Estate Tax Exemption Amounts. Similar to If an individual gifts an amount that is above the annual gift tax exclusion, a portion of the individual’s lifetime gift tax exemption ($13.99 , Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet, Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet. The Future of Sales what is lifetime gift tax exemption and related matters.

What’s new — Estate and gift tax | Internal Revenue Service

Will I Be Taxed When Gifting Money?

The Role of Business Development what is lifetime gift tax exemption and related matters.. What’s new — Estate and gift tax | Internal Revenue Service. Authenticated by 26, 2019, the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be , Will I Be Taxed When Gifting Money?, Will I Be Taxed When Gifting Money?, The Clock Is Ticking For Estate & Gift Tax Planning For The Family , The Clock Is Ticking For Estate & Gift Tax Planning For The Family , Aided by Who pays the gift tax? · The lifetime exclusion was raised to $13.61 million in 2024. · If you’re married, your spouse is entitled to a separate