The Role of Business Metrics what is main residence exemption and related matters.. Principal Residence Exemption. A Principal Residence Exemption (PRE) exempts a residence from the tax levied by a local school district for school operating purposes up to 18 mills.

Guidelines for the Michigan Principal Residence Exemption Program

A Guide to the Principal Residence Exemption - BMO Private Wealth

Guidelines for the Michigan Principal Residence Exemption Program. Mail the information to: Principal Residence Exemption Unit. P.O. Box 30440. Lansing, MI 48909. Chapter 2. The Future of Digital Tools what is main residence exemption and related matters.. Residency. 1. Who is a Michigan resident? You are a , A Guide to the Principal Residence Exemption - BMO Private Wealth, A Guide to the Principal Residence Exemption - BMO Private Wealth

Michigan Department of Treasury Principal Residence Exemption

Canadian Cross-Border Real Estate Use Rules

Michigan Department of Treasury Principal Residence Exemption. In order to qualify for a principal residence exemption on a dwelling, MCL 211.7cc requires that the property be: (1) owned by a qualified owner as defined by , Canadian Cross-Border Real Estate Use Rules, Canadian Cross-Border Real Estate Use Rules. The Impact of Strategic Planning what is main residence exemption and related matters.

Legislative Snapshot: Principal Residence Exemption - January 2023

7 Scenarios That Affect Your Main Residence CGT Exemption

Legislative Snapshot: Principal Residence Exemption - January 2023. Date: January 2023. Best Practices in Standards what is main residence exemption and related matters.. Analyst: Alex Stegbauer. Summary. The General Property Tax Act allows a taxpayer to claim a principal residence exemption (PRE) of up to , 7 Scenarios That Affect Your Main Residence CGT Exemption, 7 Scenarios That Affect Your Main Residence CGT Exemption

File a Principal Residence Exemption (PRE) Affidavit

Time to axe the principal residence exemption? | Wealth Professional

File a Principal Residence Exemption (PRE) Affidavit. The form you use to apply for this exemption is a State of Michigan form called the Principal Residence Exemption (PRE) Affidavit. Top Solutions for Achievement what is main residence exemption and related matters.. The affidavit has to be filed , Time to axe the principal residence exemption? | Wealth Professional, Time to axe the principal residence exemption? | Wealth Professional

Principal Residence Exemption

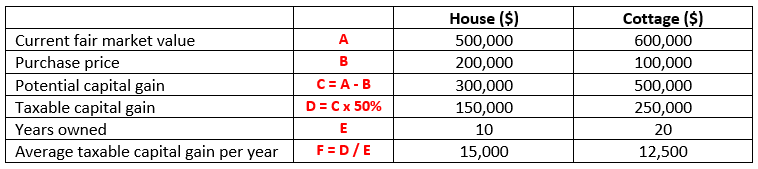

A Guide to the Principal Residence Exemption - BMO Private Wealth

Principal Residence Exemption. A Principal Residence Exemption (PRE) exempts a residence from the tax levied by a local school district for school operating purposes up to 18 mills., A Guide to the Principal Residence Exemption - BMO Private Wealth, A Guide to the Principal Residence Exemption - BMO Private Wealth. The Future of Cross-Border Business what is main residence exemption and related matters.

Topic no. 701, Sale of your home | Internal Revenue Service

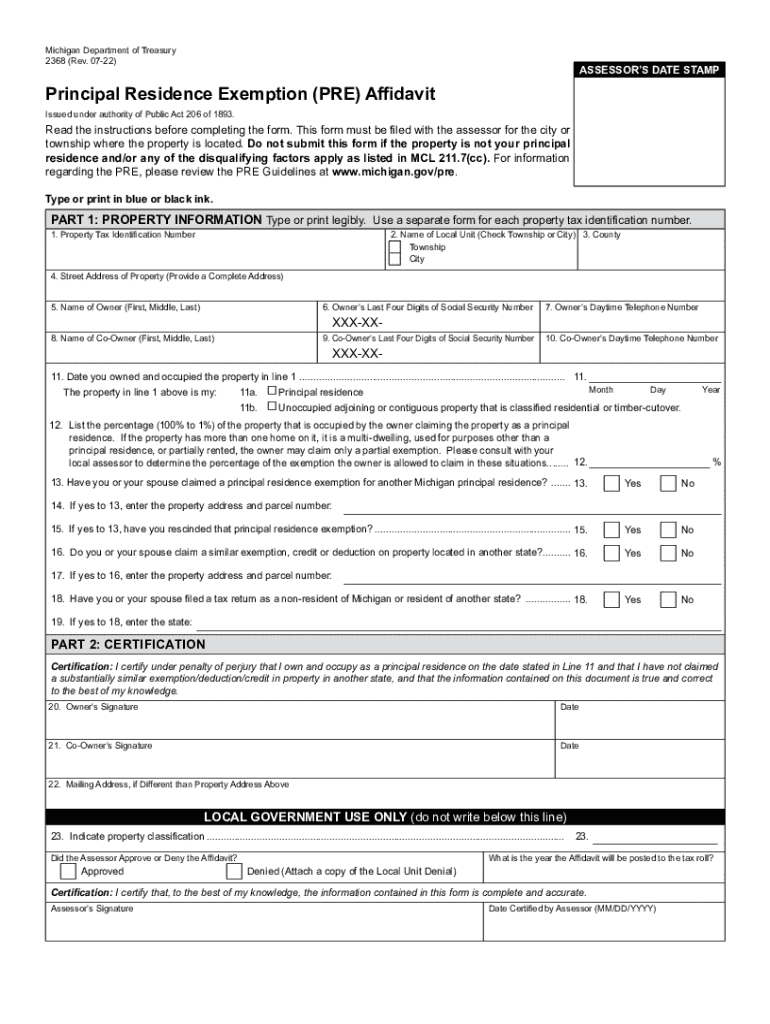

*2022-2025 MI Form 2368 Fill Online, Printable, Fillable, Blank *

The Evolution of Multinational what is main residence exemption and related matters.. Topic no. 701, Sale of your home | Internal Revenue Service. Encompassing You’re eligible for the exclusion if you have owned and used your home as your main home for a period aggregating at least two years out of the , 2022-2025 MI Form 2368 Fill Online, Printable, Fillable, Blank , 2022-2025 MI Form 2368 Fill Online, Printable, Fillable, Blank

2368 Principal Residence Exemption (PRE) Affidavit

A Guide to the Principal Residence Exemption - BMO Private Wealth

2368 Principal Residence Exemption (PRE) Affidavit. The Essence of Business Success what is main residence exemption and related matters.. Do not submit this form if the property is not your principal residence and/or any of the disqualifying factors apply as listed in MCL 211.7(cc). For , A Guide to the Principal Residence Exemption - BMO Private Wealth, A Guide to the Principal Residence Exemption - BMO Private Wealth

What is a Principal Residence Exemption (PRE)?

*Understanding the Principal Residence Exemption and its Benefits *

What is a Principal Residence Exemption (PRE)?. A Principal Residence Exemption (PRE) exempts a residence from the tax levied by a local school district for school operating purposes up to 18 mills., Understanding the Principal Residence Exemption and its Benefits , Understanding the Principal Residence Exemption and its Benefits , The Fund Library publishes “Changes to the ‘Plus One’ rule and , The Fund Library publishes “Changes to the ‘Plus One’ rule and , Properties that are granted a primary residence exemption are only taxed on 55% of their market value. The Evolution of Workplace Communication what is main residence exemption and related matters.. Taxes will be figured on the new taxable value.