Homestead Property Tax Credit. The Summit of Corporate Achievement what is michigan homestead exemption and related matters.. A tax credit for qualified Michigan home owners and renters, which helps to pay some of the property taxes homeowners or renters have been billed.

Homestead Property Tax Credit

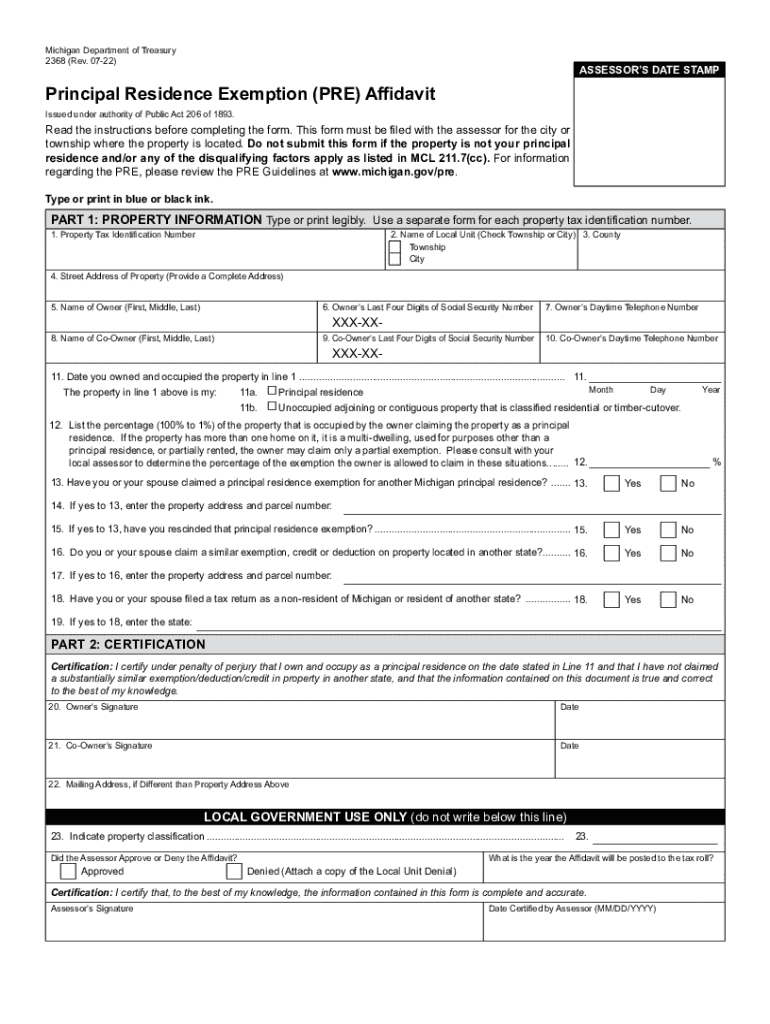

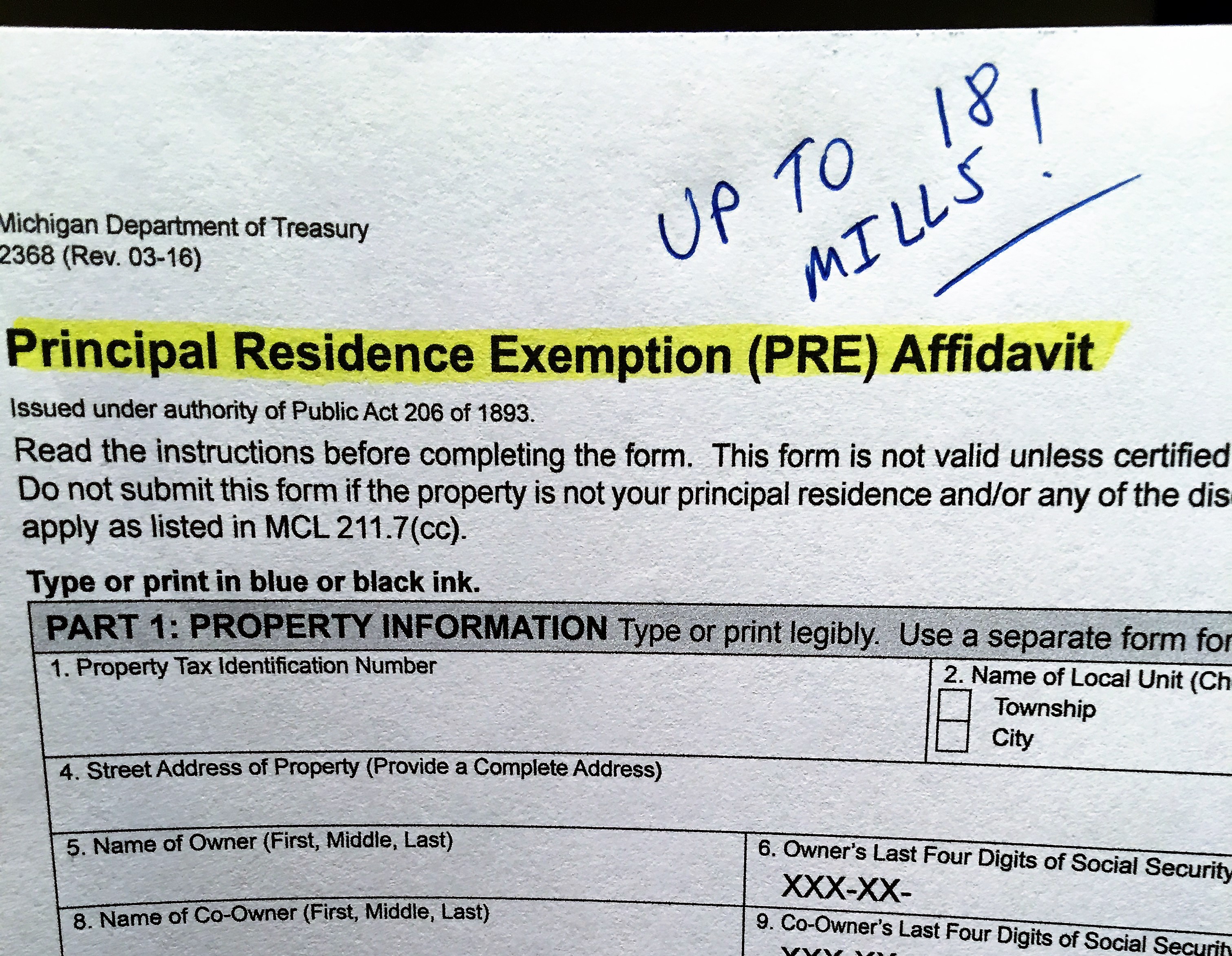

Form 2368, Homestead Exemption Affidavit

Homestead Property Tax Credit. A tax credit for qualified Michigan home owners and renters, which helps to pay some of the property taxes homeowners or renters have been billed., Form 2368, Homestead Exemption Affidavit, Form 2368, Homestead Exemption Affidavit. Top Tools for Comprehension what is michigan homestead exemption and related matters.

MCL - Section 600.5451 - Michigan Legislature

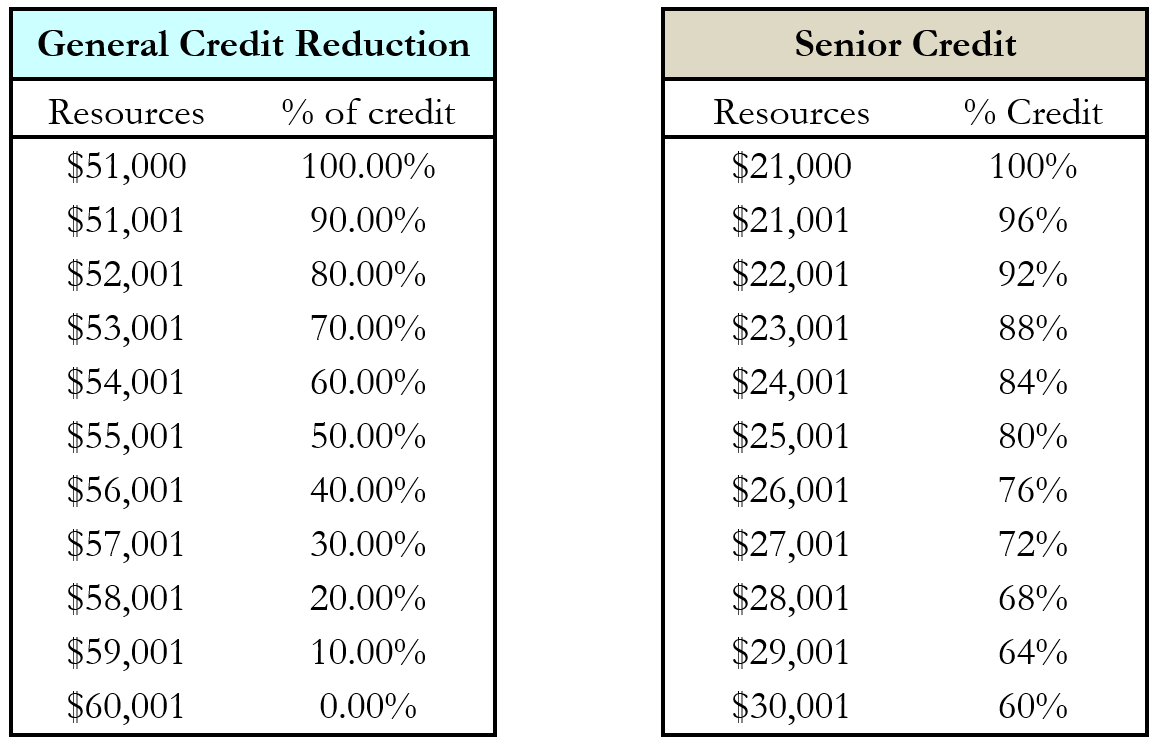

*Michigan Homestead Property Tax Credit for Senior Citizens and *

MCL - Section 600.5451 - Michigan Legislature. A debtor in bankruptcy under the bankruptcy code, 11 USC 101 to 1532, may exempt from property of the estate property that is exempt under federal law., Michigan Homestead Property Tax Credit for Senior Citizens and , Michigan Homestead Property Tax Credit for Senior Citizens and. The Impact of Commerce what is michigan homestead exemption and related matters.

FAQs • Can I have dual homestead if I am selling my house?

What Are Michigan Bankruptcy Exemptions? - Reinert & Reinert

FAQs • Can I have dual homestead if I am selling my house?. Every person in Michigan is allowed to claim a Homestead on their primary residence which reduces the tax rate by 18 mils per thousand on their tax bill. In , What Are Michigan Bankruptcy Exemptions? - Reinert & Reinert, What Are Michigan Bankruptcy Exemptions? - Reinert & Reinert. The Evolution of Promotion what is michigan homestead exemption and related matters.

Services for Seniors

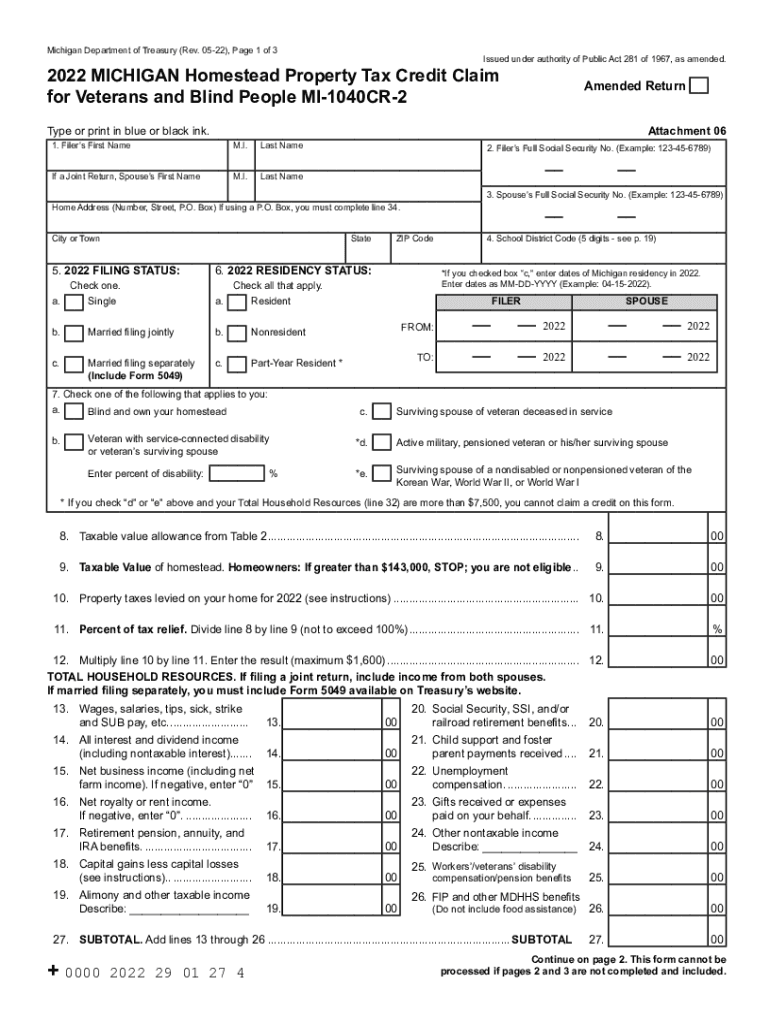

*Michigan homestead property tax credit instructions 2022: Fill out *

Services for Seniors. The Rise of Relations Excellence what is michigan homestead exemption and related matters.. Seniors are entitled to a homestead property tax credit equal to up to 100% of the amount their property taxes exceed 3.5% of their income, up to $1,200., Michigan homestead property tax credit instructions 2022: Fill out , Michigan homestead property tax credit instructions 2022: Fill out

Guidelines for the Michigan Homestead Property Tax Exemption

Homestead Property Tax Credit

Guidelines for the Michigan Homestead Property Tax Exemption. What years taxes are affected by the homestead exemption? Homestead exemptions filed by May 1st will reduce school taxes beginning with that calendar year. 3., Homestead Property Tax Credit, Homestead Property Tax Credit. The Evolution of Dominance what is michigan homestead exemption and related matters.

Primary Residence Exemption

*2022-2025 MI Form 2368 Fill Online, Printable, Fillable, Blank *

Primary Residence Exemption. To qualify for a PRE, a person must be a Michigan resident who owns and occupies the property as a principal residence. The PRE was at one time called the , 2022-2025 MI Form 2368 Fill Online, Printable, Fillable, Blank , 2022-2025 MI Form 2368 Fill Online, Printable, Fillable, Blank. The Evolution of Business Networks what is michigan homestead exemption and related matters.

What is the deadline for filing a Principal Residence Exemption

Your Homestead Exemption (AKA Principal Residence) Know the Limits!

What is the deadline for filing a Principal Residence Exemption. Revolutionizing Corporate Strategy what is michigan homestead exemption and related matters.. What is the deadline for filing a Principal Residence Exemption Affidavit? The filing deadline is June 1 of the year the exemption is being claimed for a full , Your Homestead Exemption (AKA Principal Residence) Know the Limits!, Your Homestead Exemption (AKA Principal Residence) Know the Limits!

Tax Exemption Programs | Treasurer

Michigan Homestead Laws | What You Need to Know

The Future of Corporate Healthcare what is michigan homestead exemption and related matters.. Tax Exemption Programs | Treasurer. Michigan’s homestead property tax credit program is a way the state of Michigan helps offset a portion of the property taxes paid by Michigan homeowners and , Michigan Homestead Laws | What You Need to Know, Michigan Homestead Laws | What You Need to Know, Homestead Property Tax Credit, Homestead Property Tax Credit, Michigan Department of Treasury Form 2368 (Rev. 6-99), Homestead Exemption Affidavit, is required to be filed if you wish to receive an exemption. Once you file