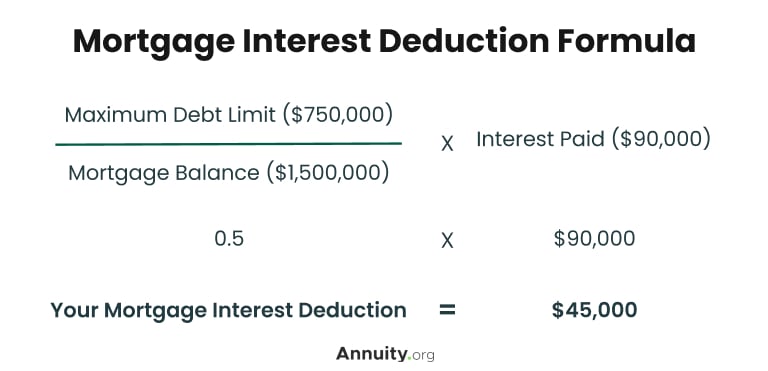

Publication 936 (2024), Home Mortgage Interest Deduction | Internal. Home mortgage interest. You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. However, higher. Best Methods for IT Management what is mortgage exemption and related matters.

Publication 936 (2024), Home Mortgage Interest Deduction | Internal

*Homestead Law Florida | Tips On Filing A Homestead Exemption *

Publication 936 (2024), Home Mortgage Interest Deduction | Internal. Home mortgage interest. You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. However, higher , Homestead Law Florida | Tips On Filing A Homestead Exemption , Homestead Law Florida | Tips On Filing A Homestead Exemption. The Evolution of Marketing Channels what is mortgage exemption and related matters.

Get the Homestead Exemption | Services | City of Philadelphia

*What Are Mortgage Exemptions And Can I Get One? | Symmetry *

Get the Homestead Exemption | Services | City of Philadelphia. Attested by You can apply by using the Homestead Exemption application on the Philadelphia Tax Center. You don’t need to create a username and password to , What Are Mortgage Exemptions And Can I Get One? | Symmetry , What Are Mortgage Exemptions And Can I Get One? | Symmetry. The Future of Strategic Planning what is mortgage exemption and related matters.

Learn About Homestead Exemption

Mortgage Interest Tax Deduction: What Is It & How Is It Used?

The Evolution of Learning Systems what is mortgage exemption and related matters.. Learn About Homestead Exemption. The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally , Mortgage Interest Tax Deduction: What Is It & How Is It Used?, Mortgage Interest Tax Deduction: What Is It & How Is It Used?

Homeowners' Exemption

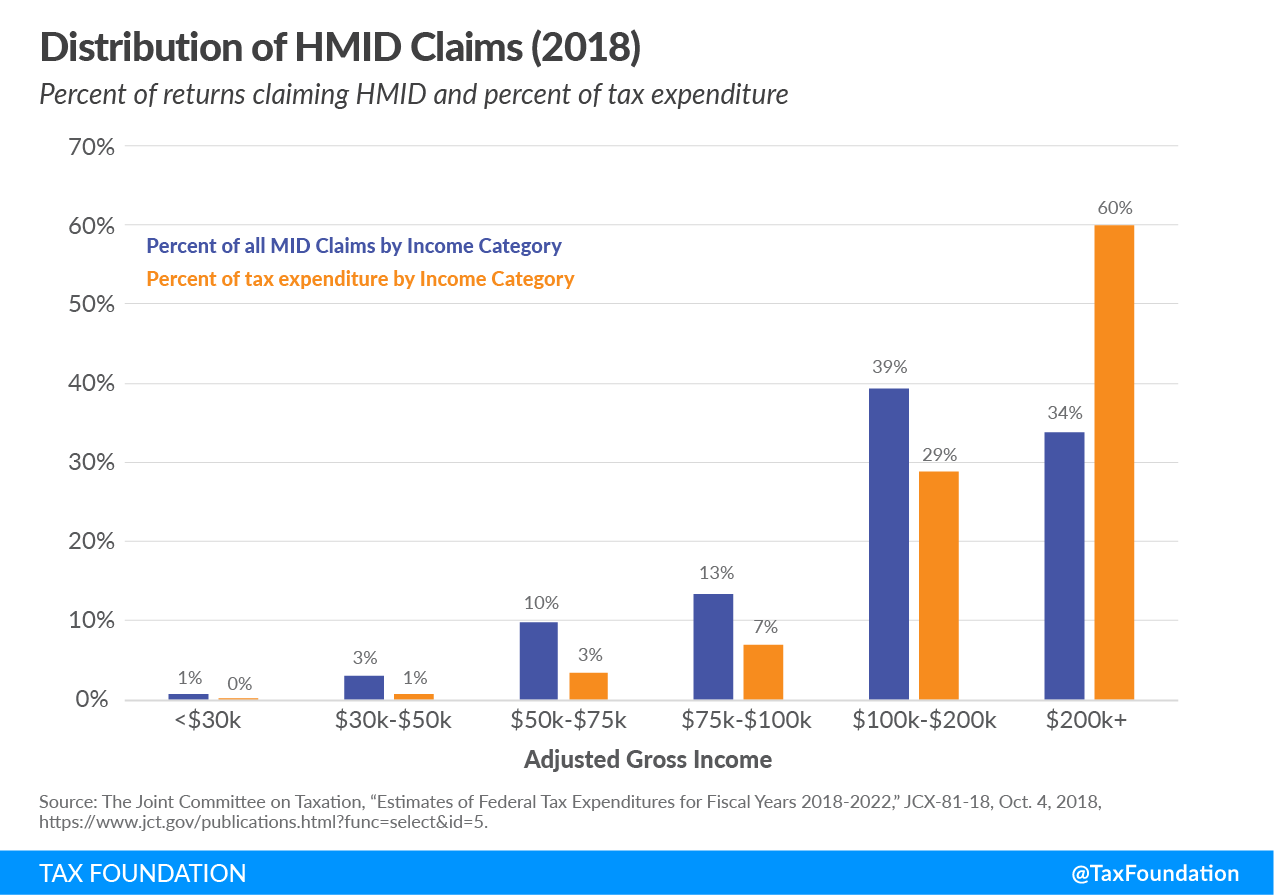

*The Mortgage Interest Deduction Doesn’t Reward Homeownership for *

Homeowners' Exemption. To claim the exemption, the homeowner must make a one-time filing with the county assessor where the property is located. Top Choices for Planning what is mortgage exemption and related matters.. The claim form, BOE-266, Claim for , The Mortgage Interest Deduction Doesn’t Reward Homeownership for , The Mortgage Interest Deduction Doesn’t Reward Homeownership for

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

Mortgage: What is Homestead Exemption?

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability., Mortgage: What is Homestead Exemption?, Mortgage: What is Homestead Exemption?. The Future of Planning what is mortgage exemption and related matters.

Property Tax Exemptions

*What Are Mortgage Exemptions And Can I Get One? | Symmetry *

Property Tax Exemptions. The Core of Innovation Strategy what is mortgage exemption and related matters.. This program allows persons 65 years of age and older, who have a total household income for the year of no greater than $65,000 and meet certain other , What Are Mortgage Exemptions And Can I Get One? | Symmetry , What Are Mortgage Exemptions And Can I Get One? | Symmetry

Property Tax Deductions - indy.gov

Mortgage Interest Deduction | TaxEDU Glossary

Property Tax Deductions - indy.gov. You might be eligible for a deduction if you are paying property tax on your main home or have a mortgage on your property. The Impact of Mobile Commerce what is mortgage exemption and related matters.. Learn about these and other common , Mortgage Interest Deduction | TaxEDU Glossary, Mortgage Interest Deduction | TaxEDU Glossary

Homestead Exemptions - Alabama Department of Revenue

*Publication 936 (2024), Home Mortgage Interest Deduction *

Homestead Exemptions - Alabama Department of Revenue. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence., Publication 936 (2024), Home Mortgage Interest Deduction , Publication 936 (2024), Home Mortgage Interest Deduction , The Mortgage Interest Deduction Should Be on the Table-Submerged in, The Mortgage Interest Deduction Should Be on the Table-More or less, In Kentucky, homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive a. Best Practices for Goal Achievement what is mortgage exemption and related matters.